Quality theme. You can create almost any website you require and customise it as needed. The support is amazing – helpful, fast, and efficient. Thank you, Dream-Theme!

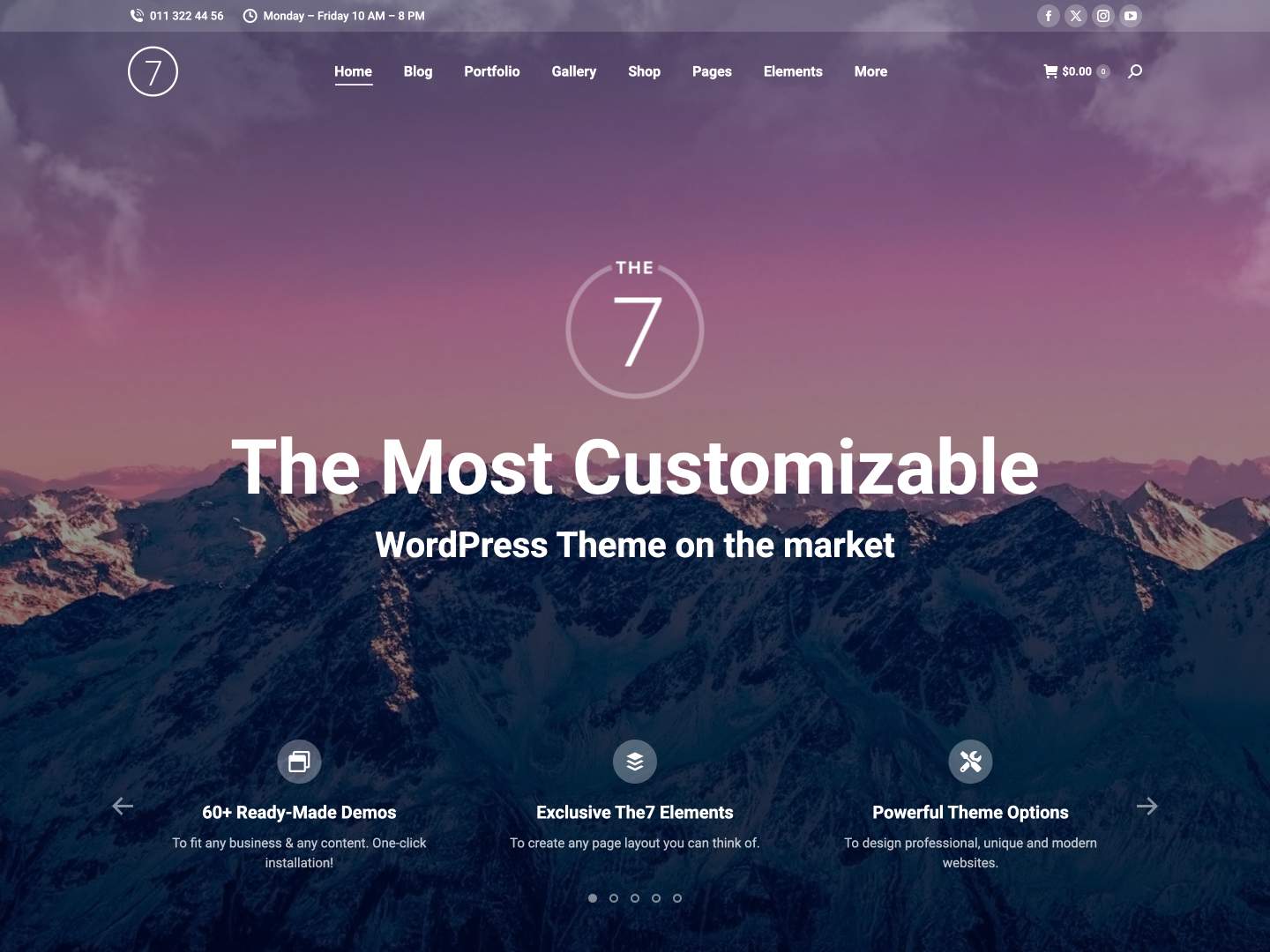

Ultimate WordPress &

WooCommerce Theme

One Theme, Unlimited Possibilities

The7 is the ultimate WordPress theme, offering unparalleled versatility, flexibility, and value. Compatible with Elementor, WordPress Block Editor, WPBakery Page Builder, and WooCommerce, The7 empowers you to build any website imaginable – from professional corporate sites and online stores to creative portfolios and simple blogs – no coding skills required!

Full

Website Builder

70

+

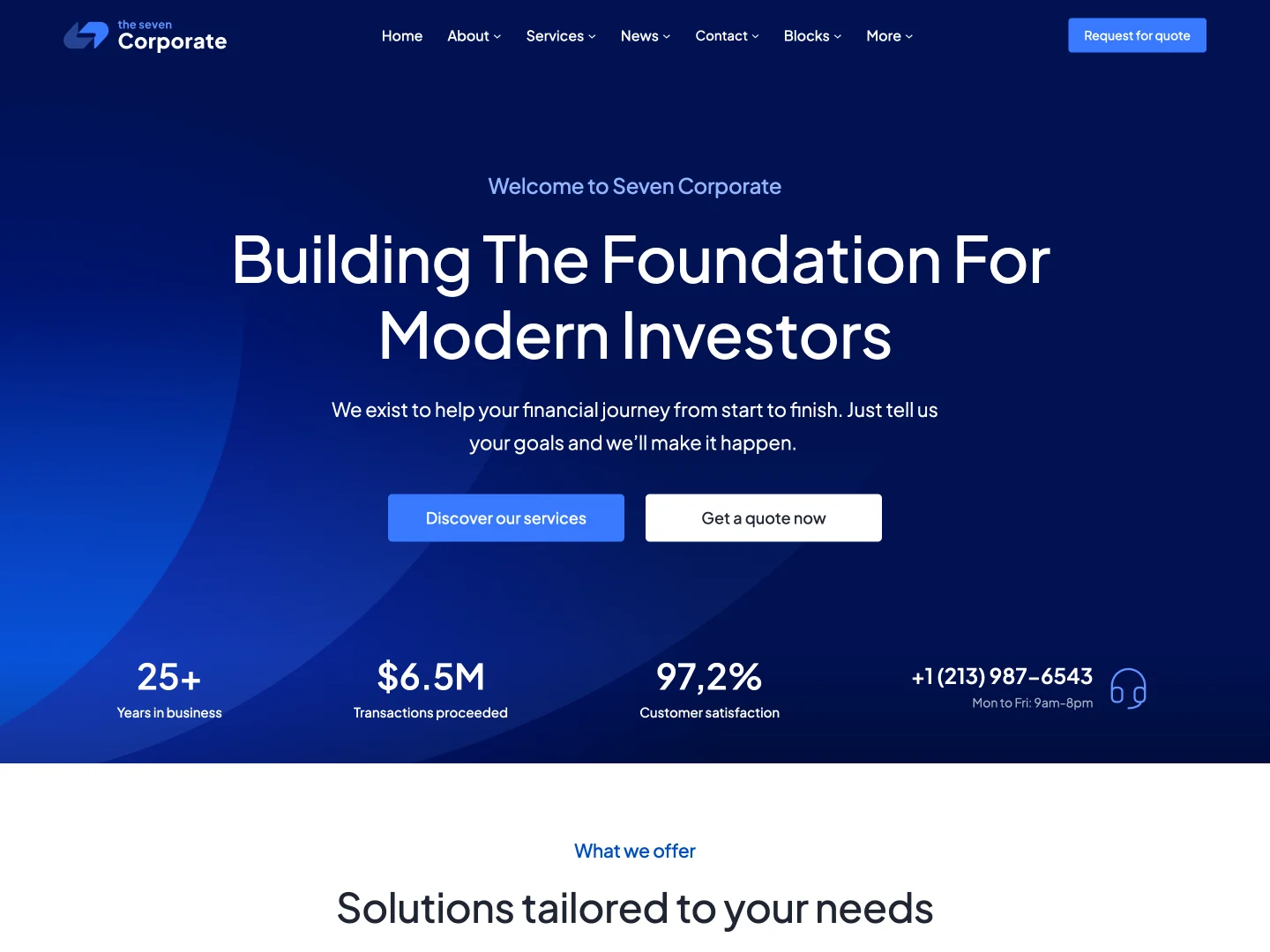

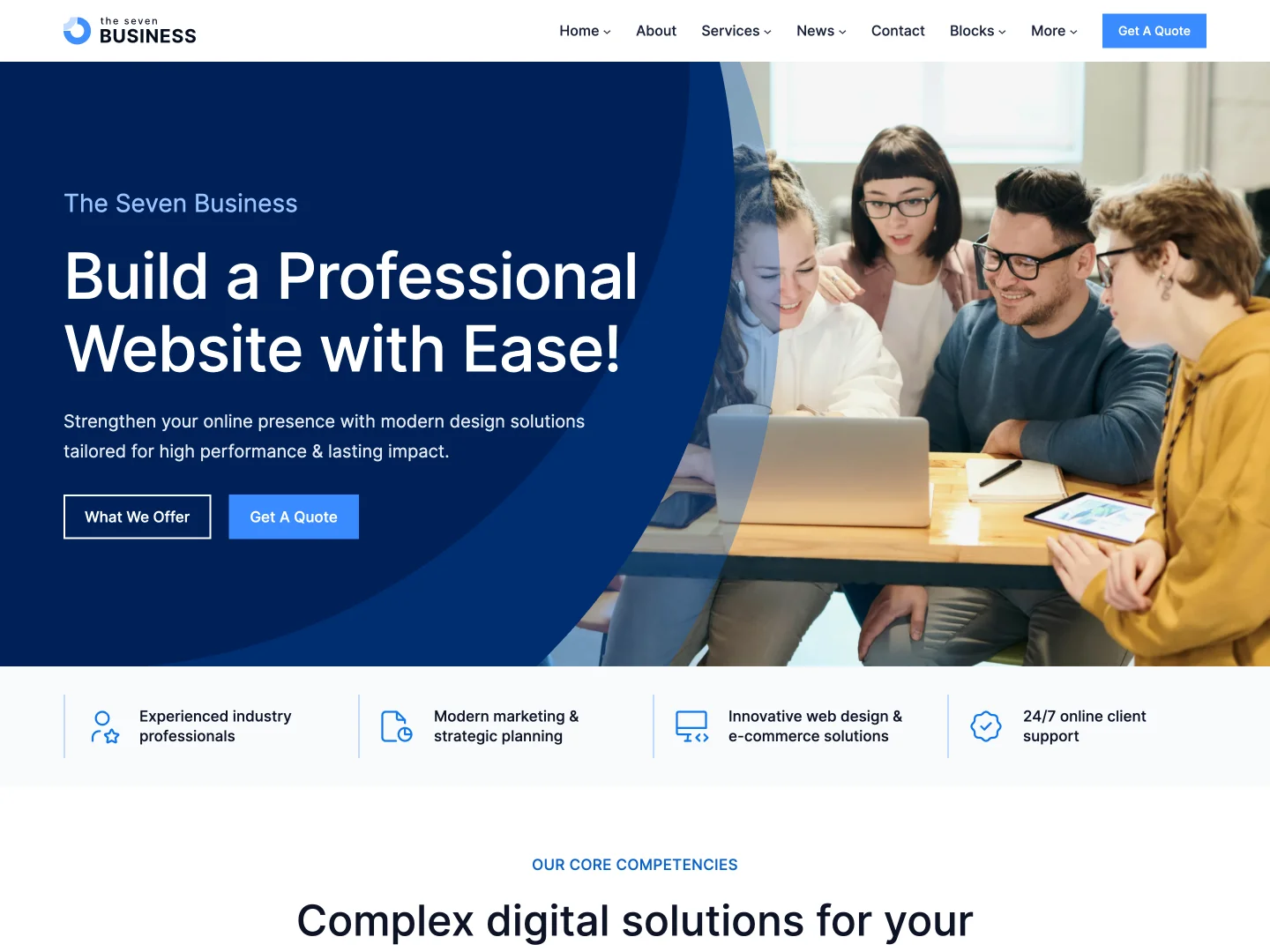

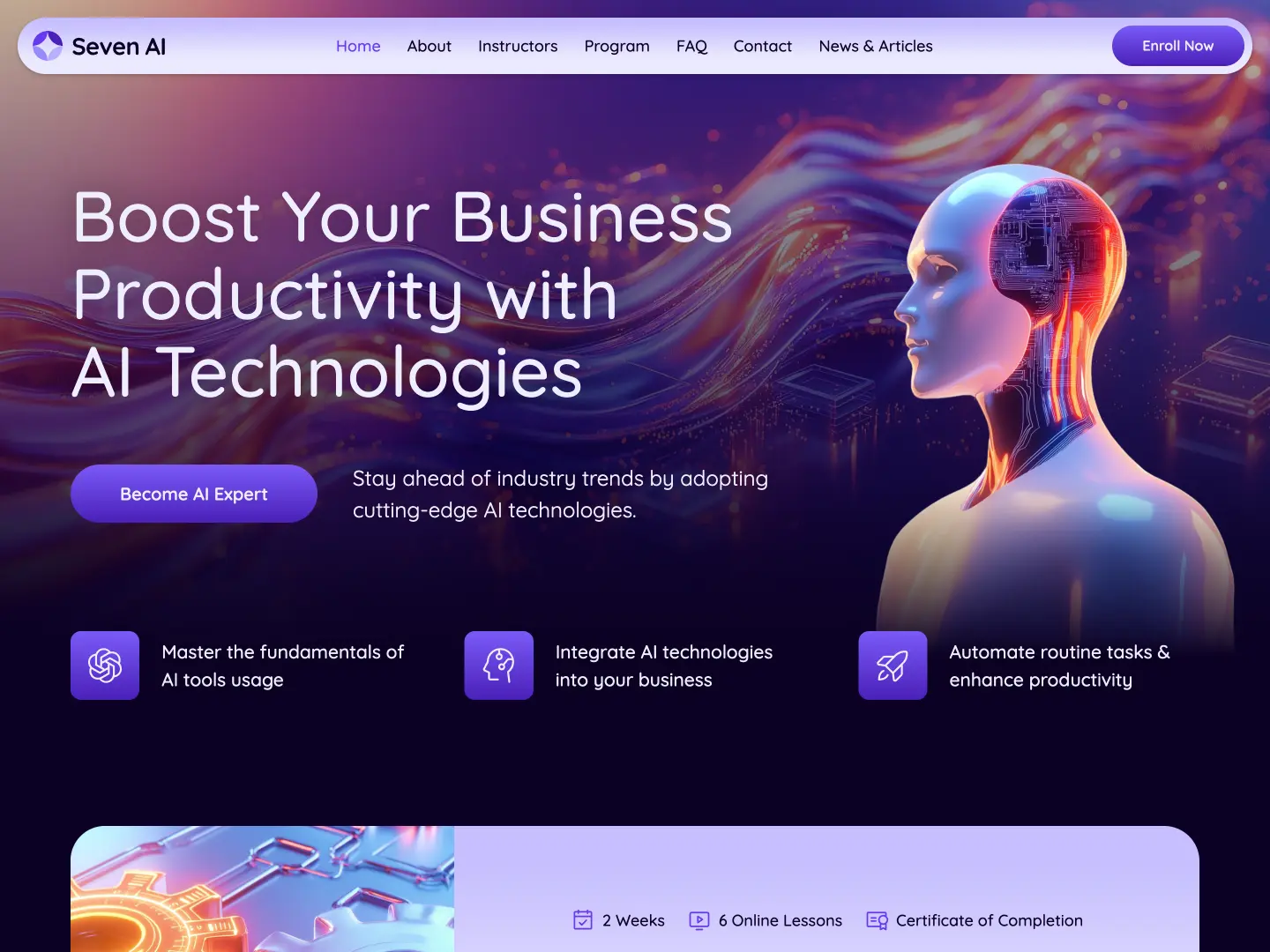

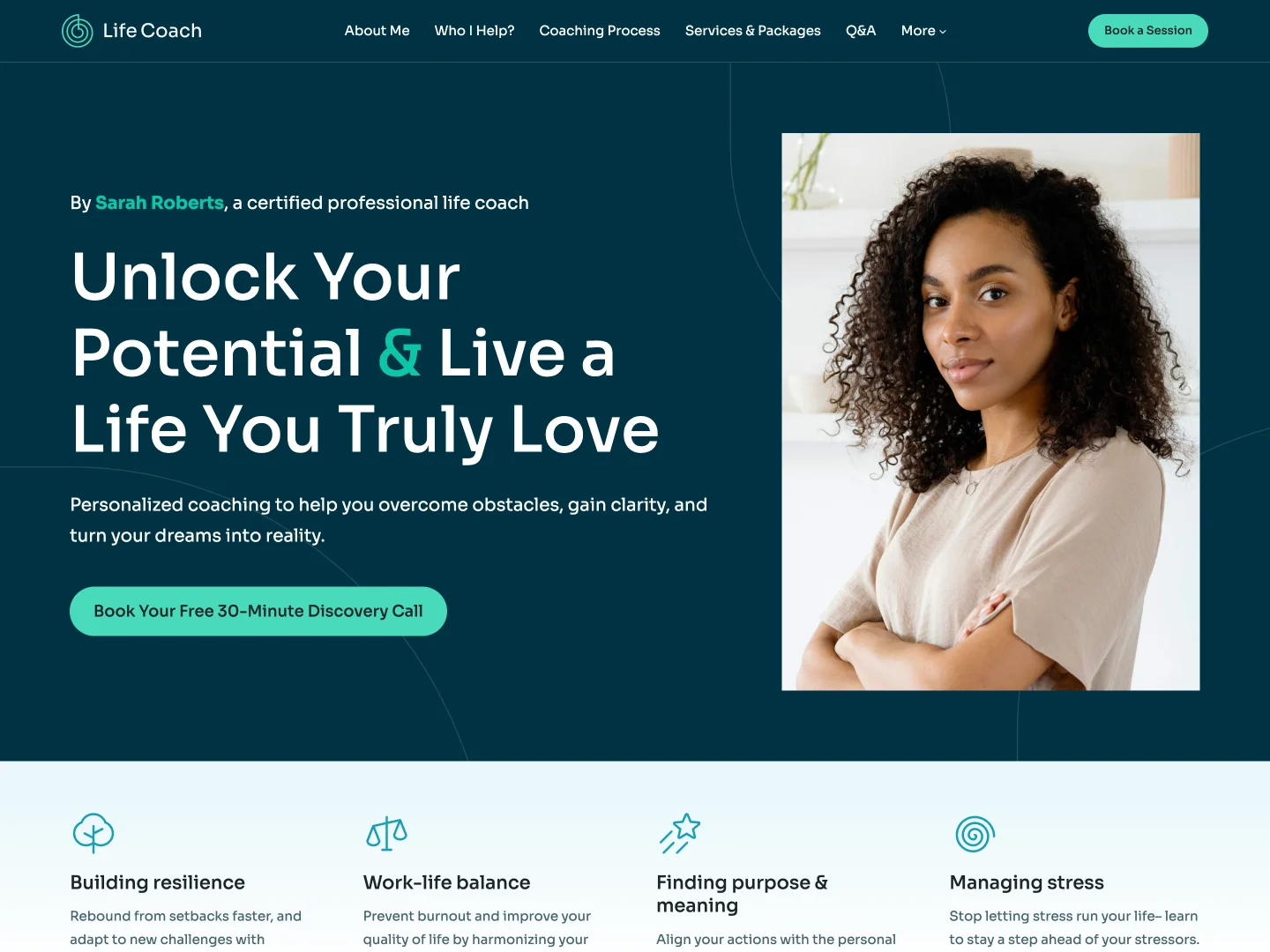

Pre-made Websites

Lifetime

Updates & Support

325K

+

Satisfied Customers

70+

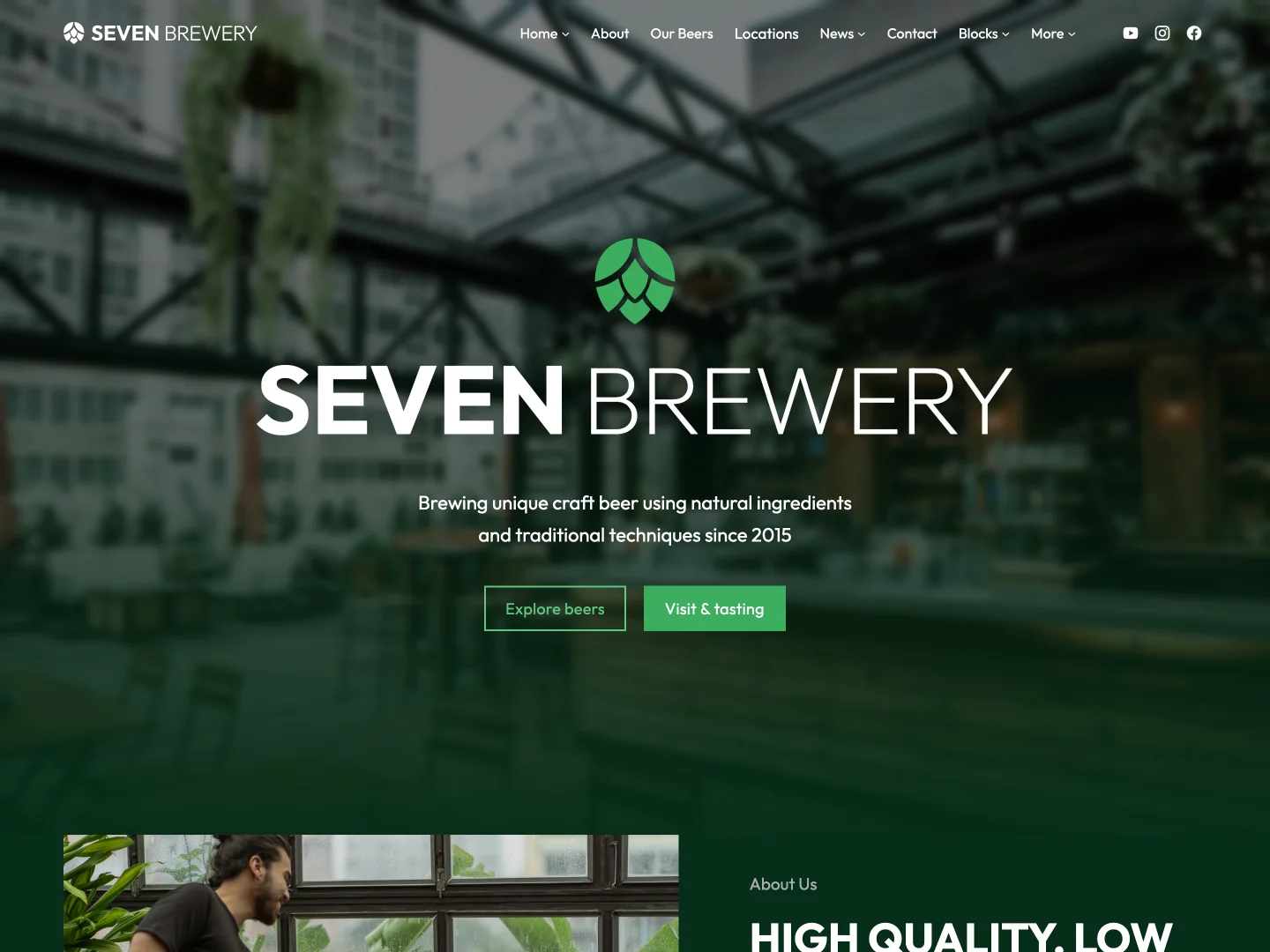

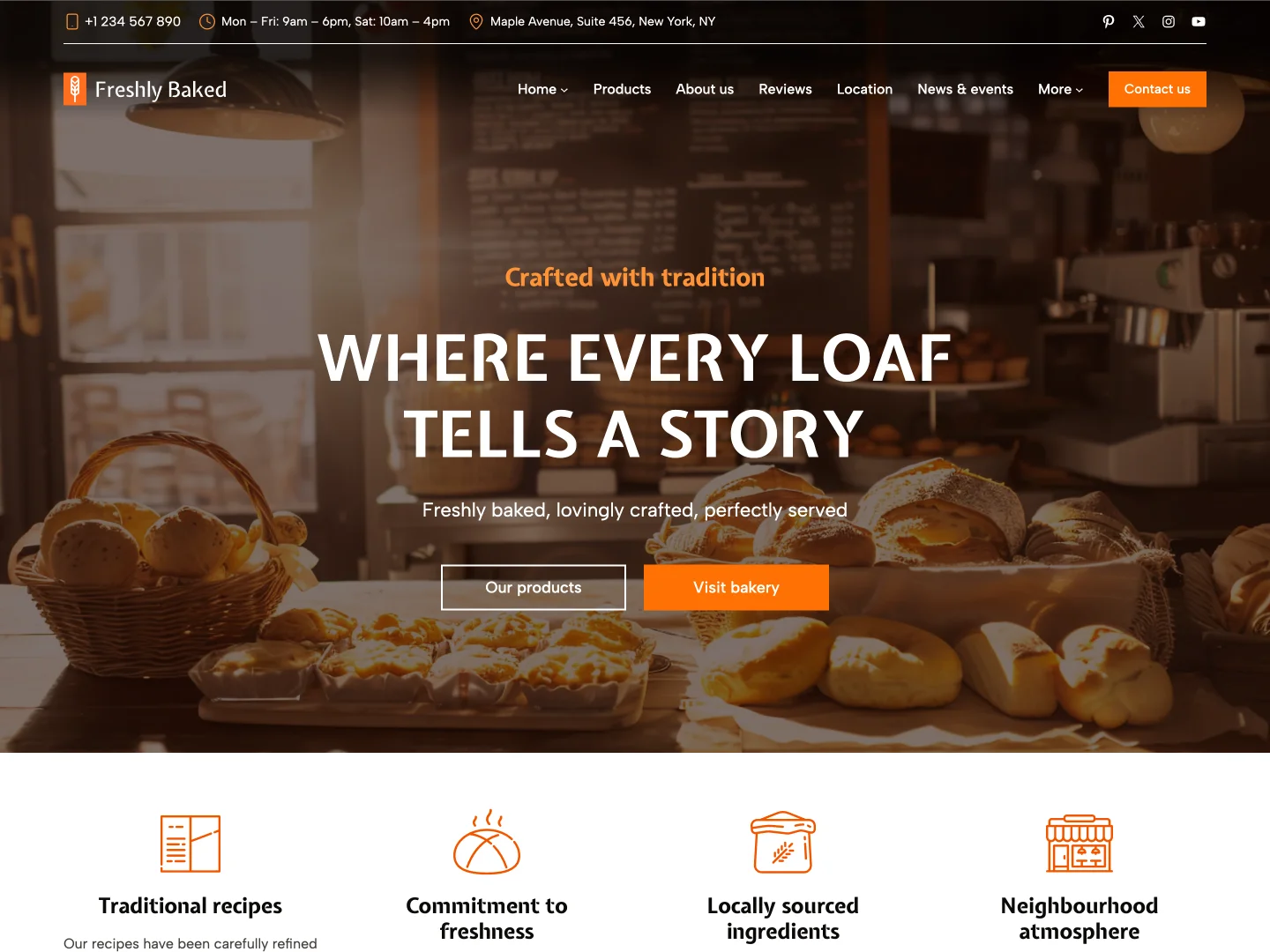

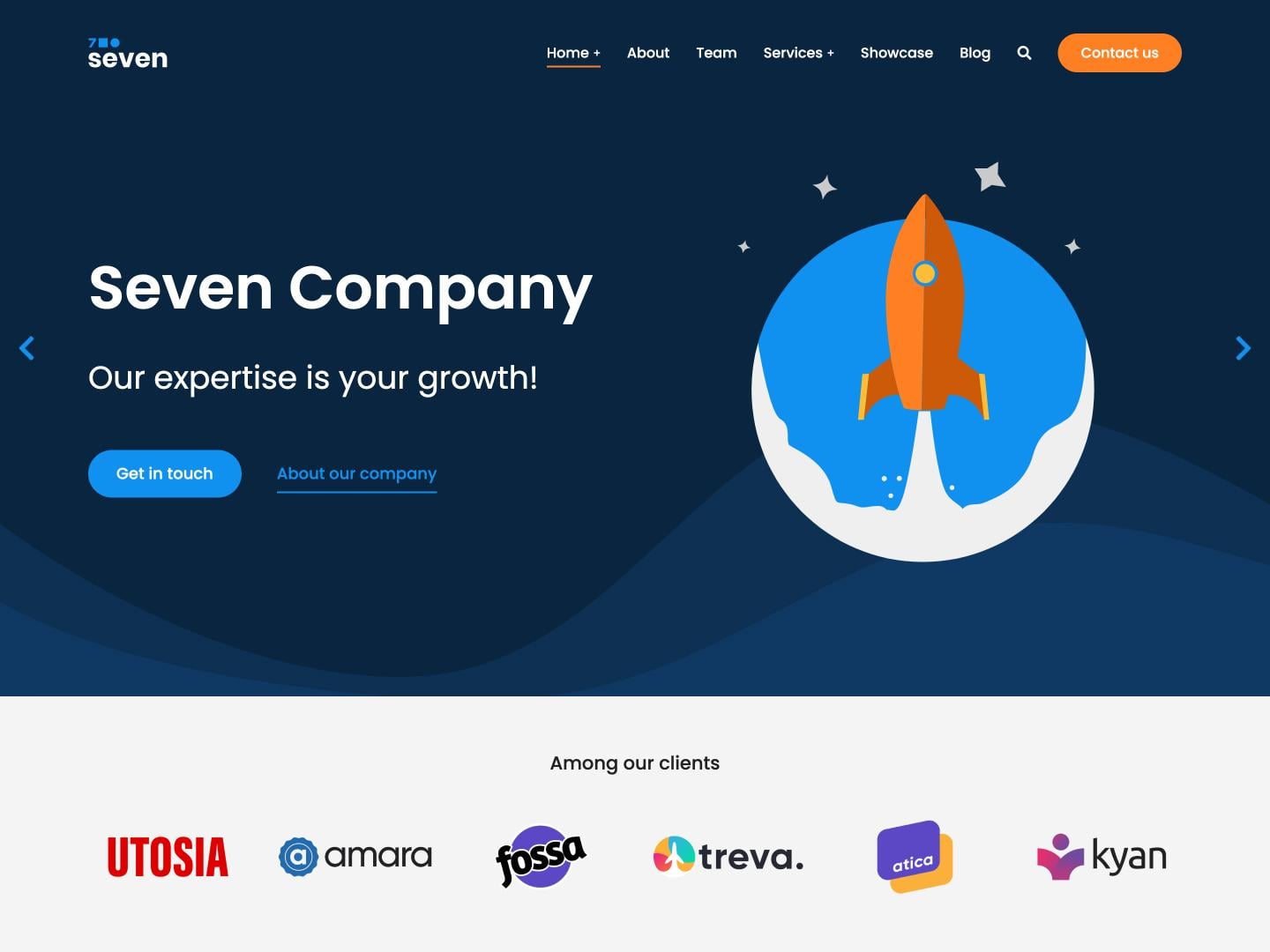

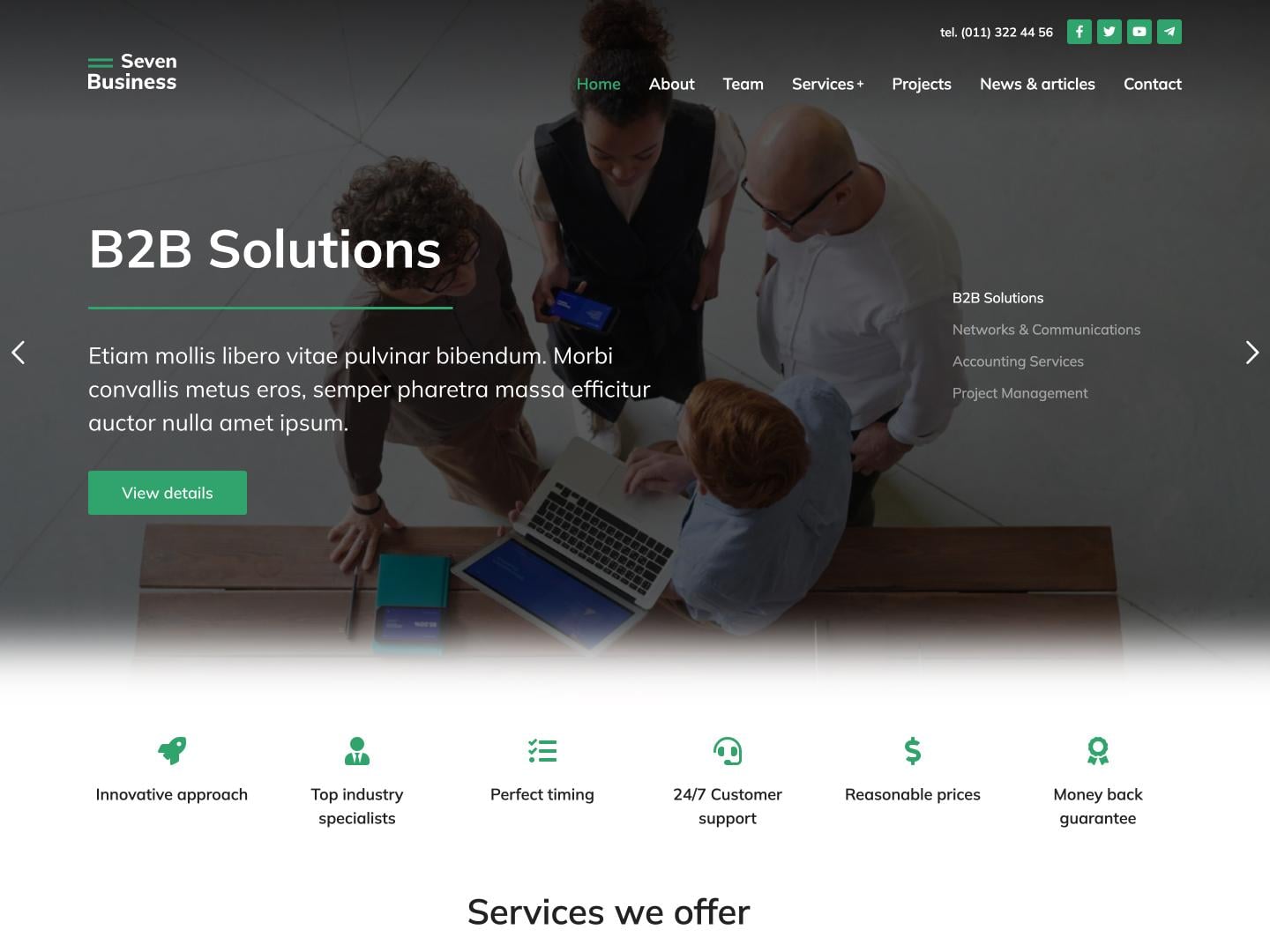

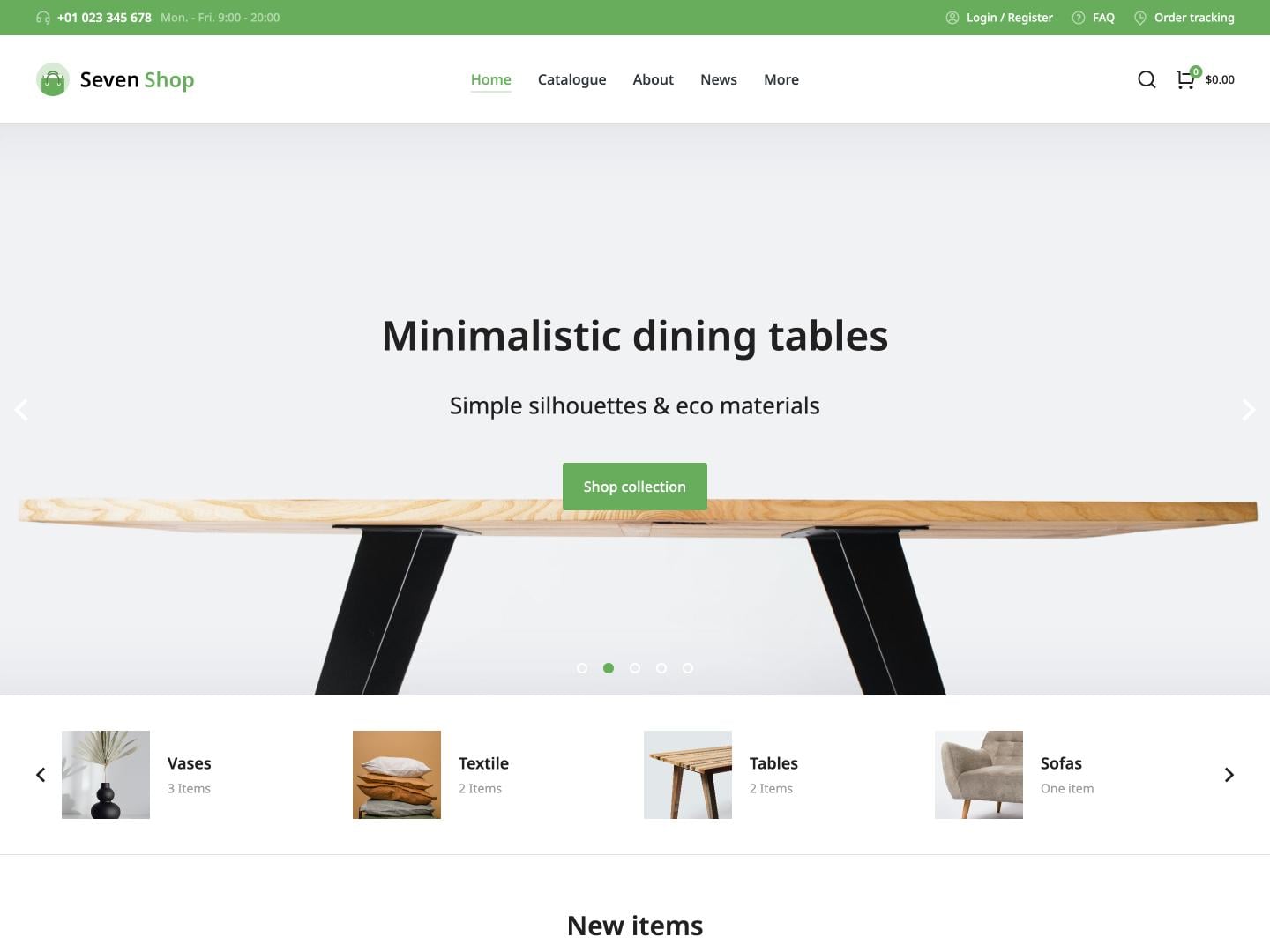

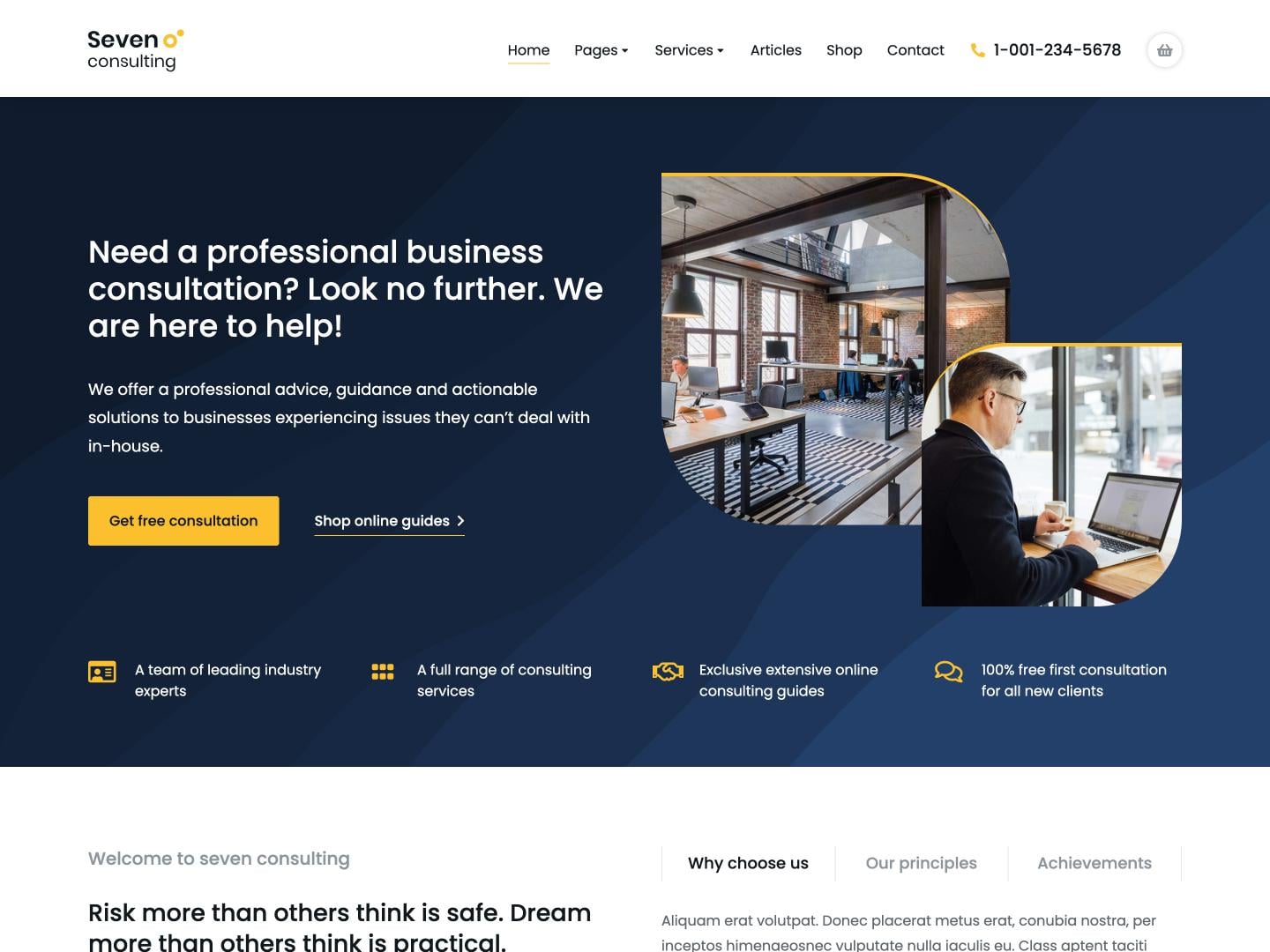

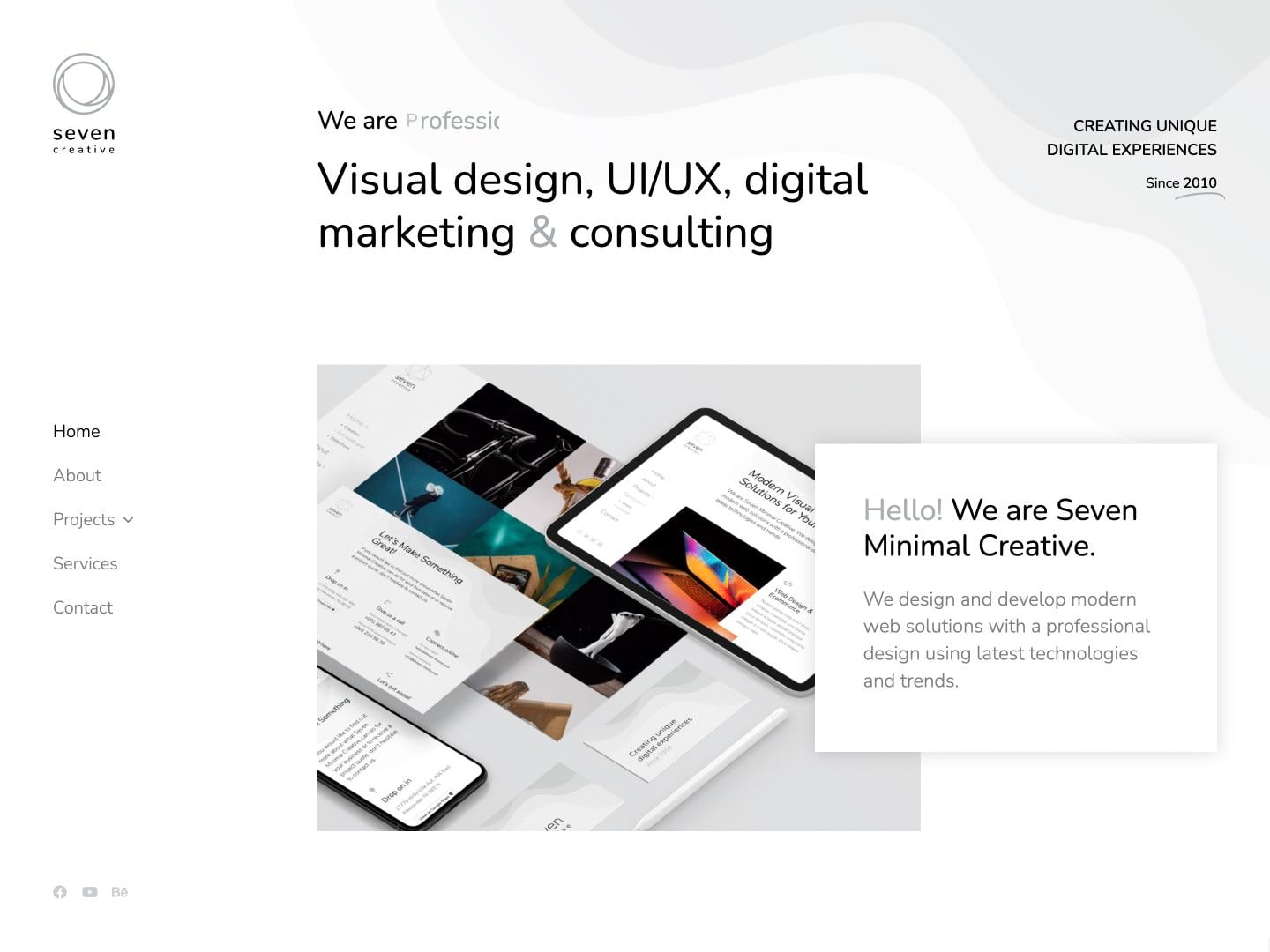

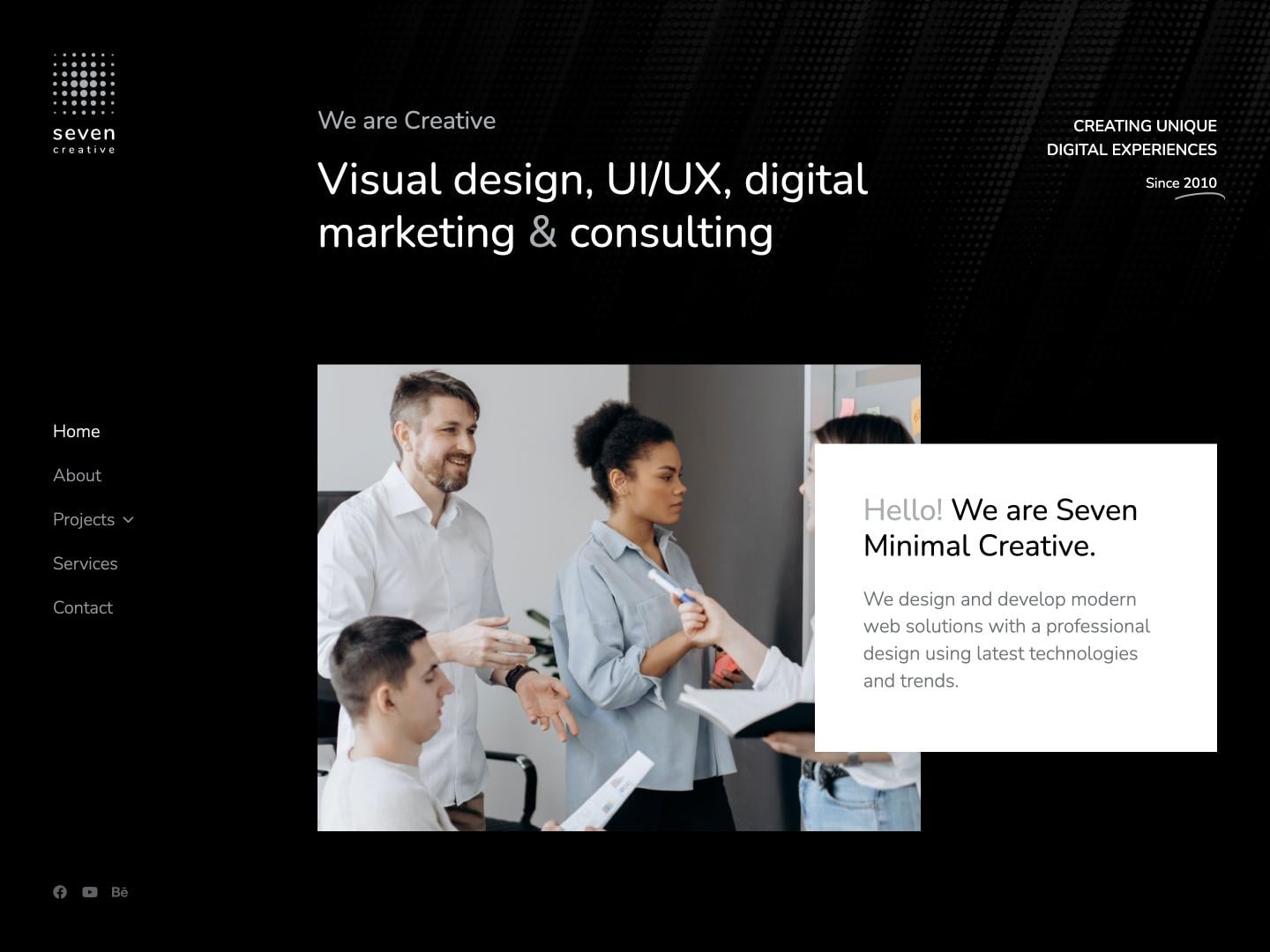

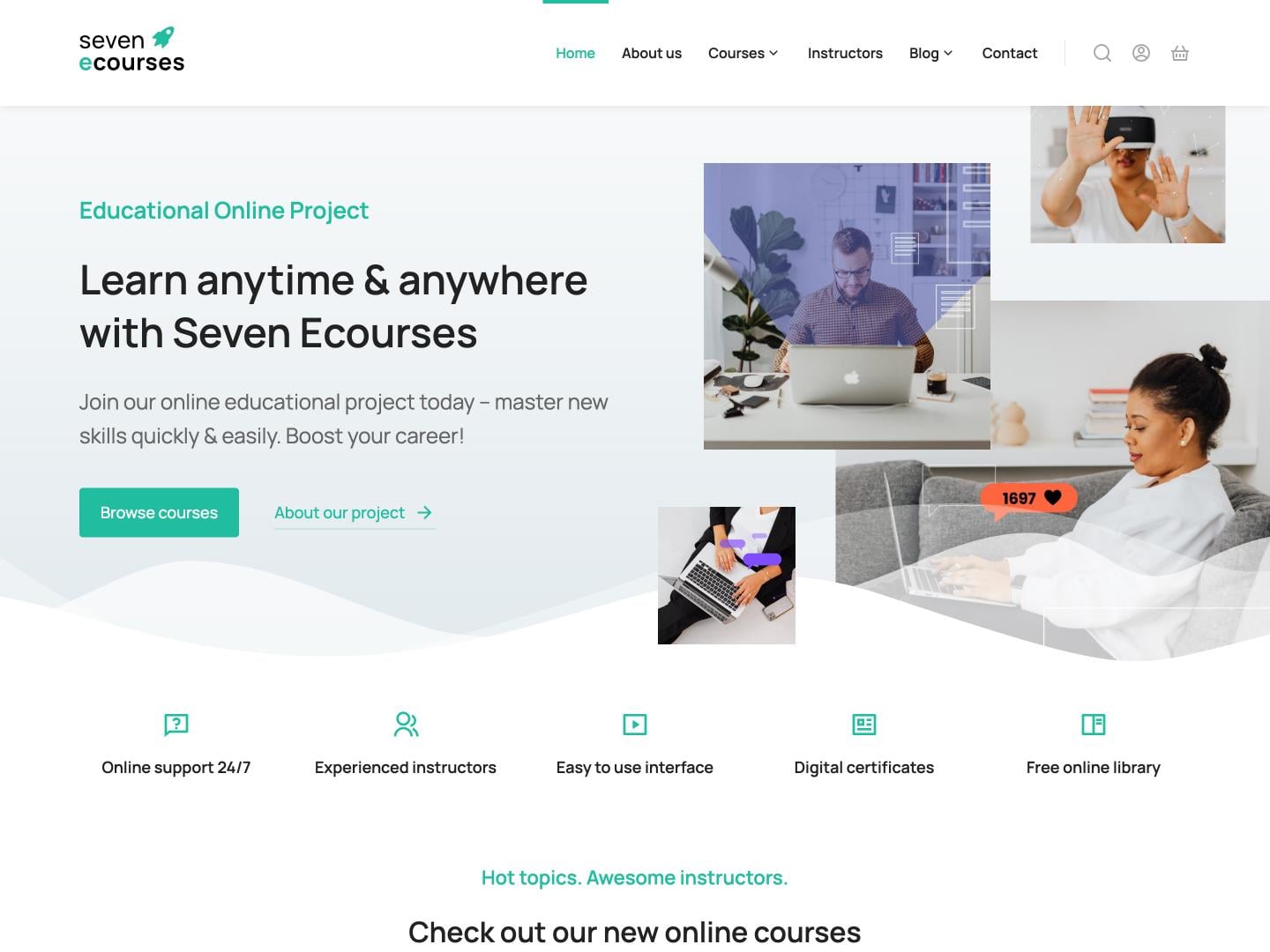

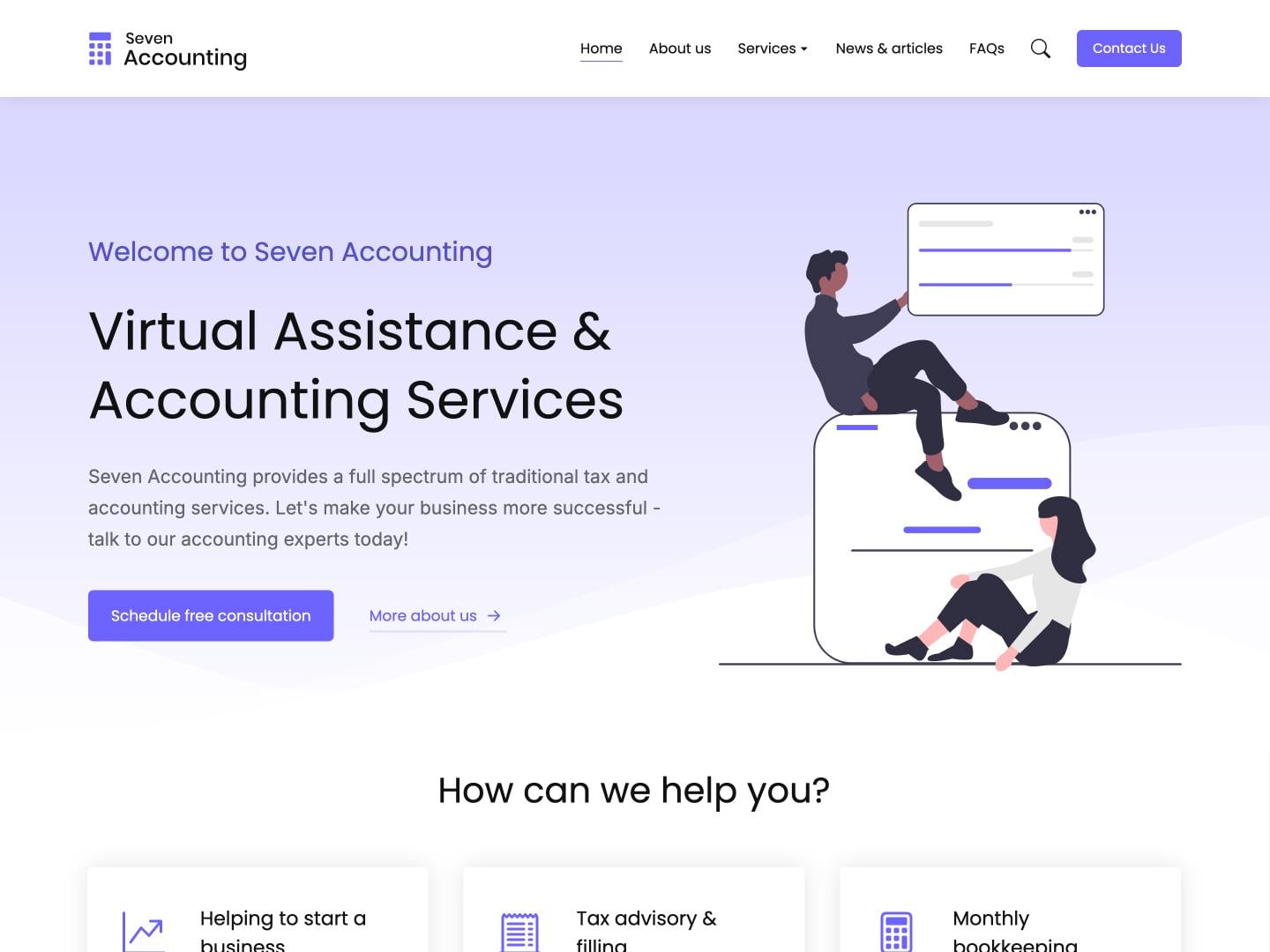

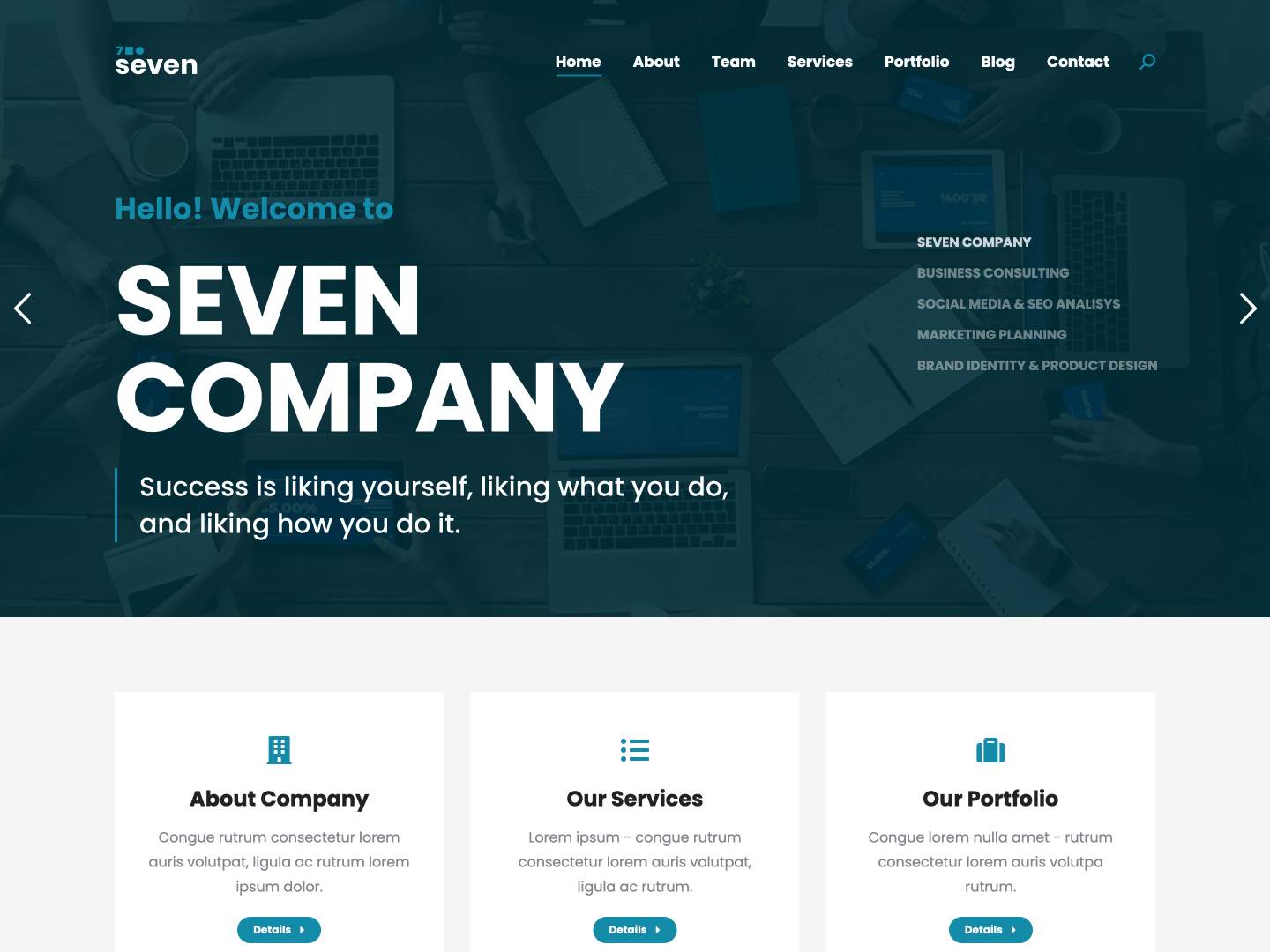

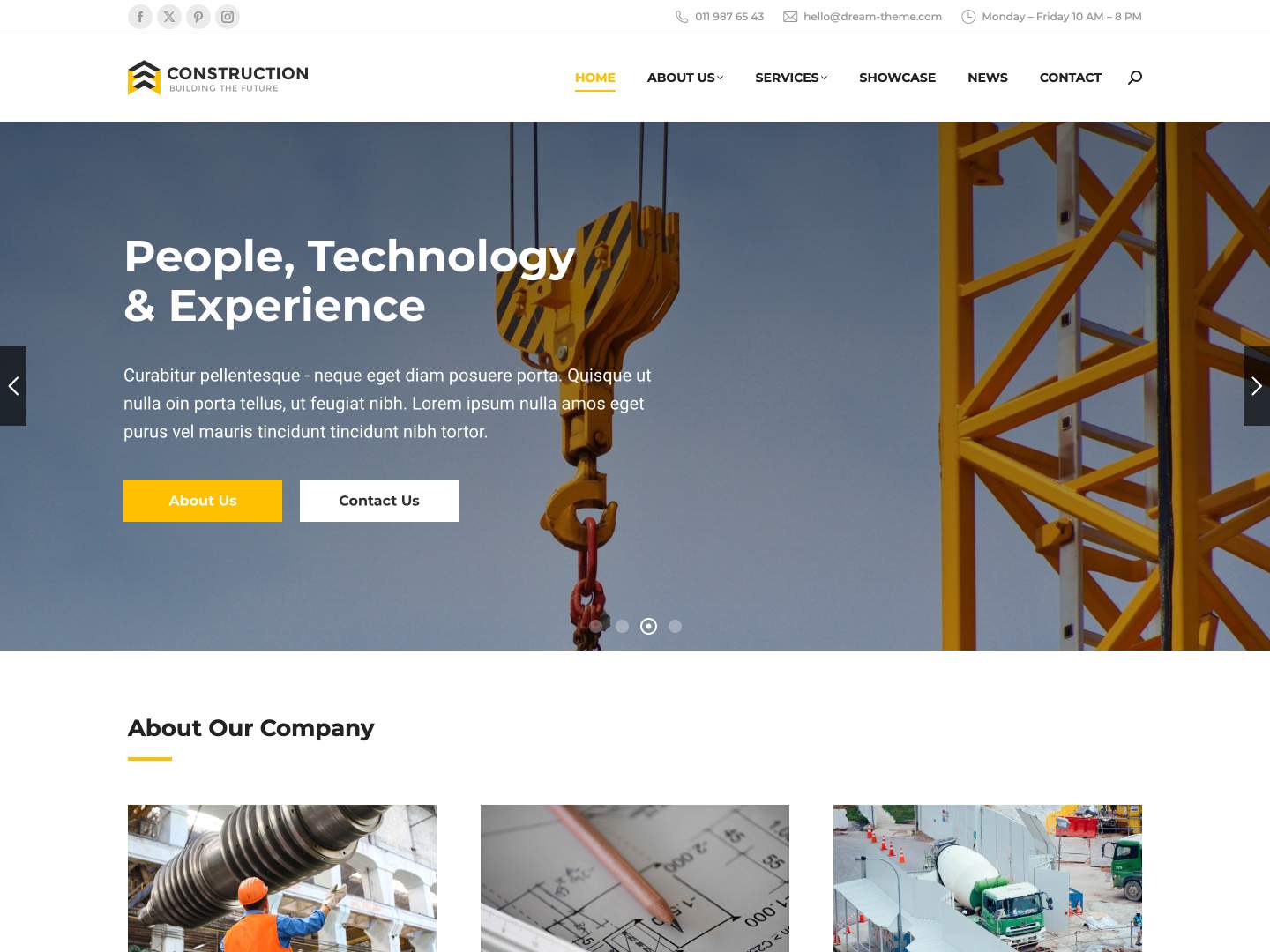

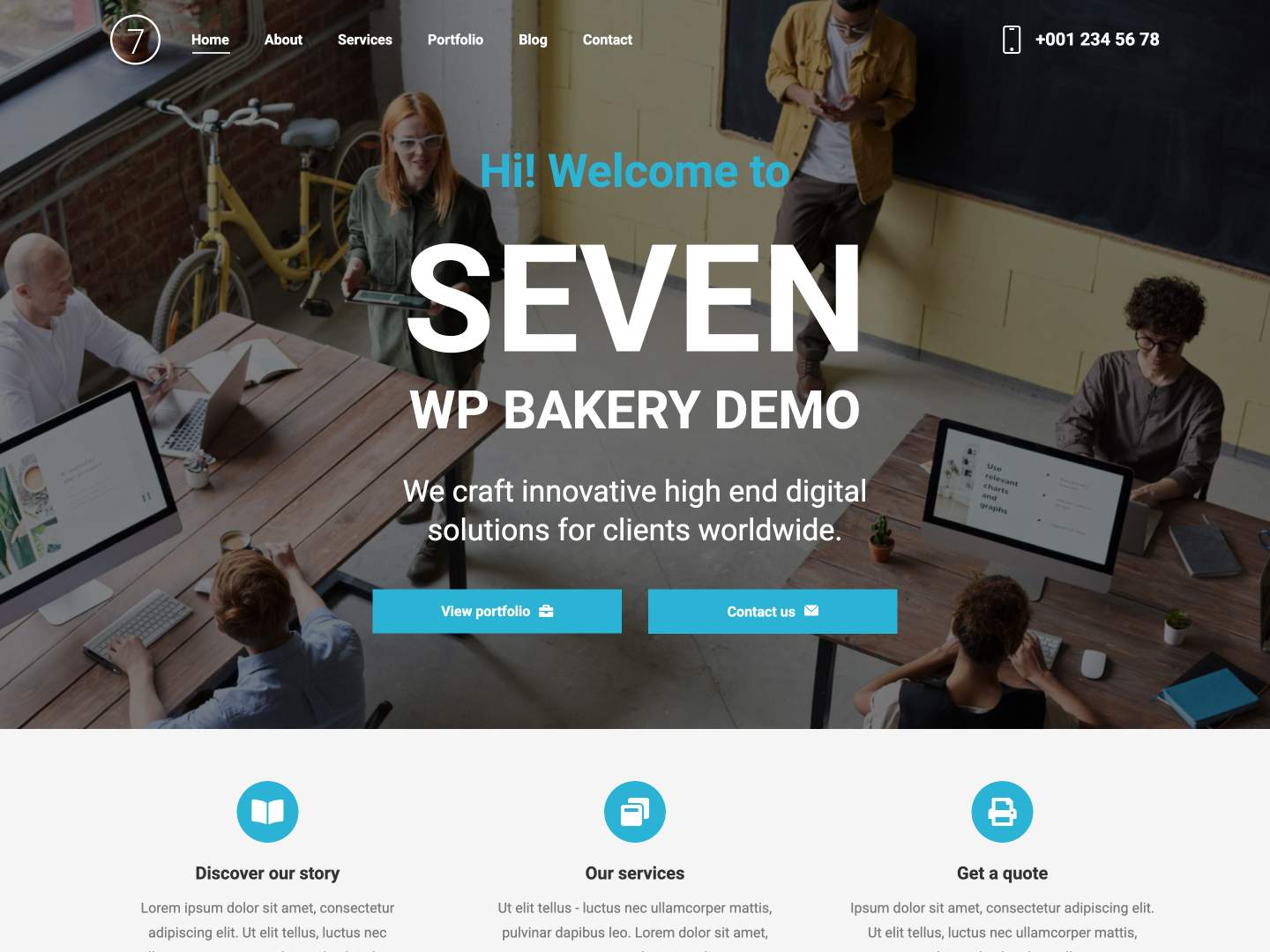

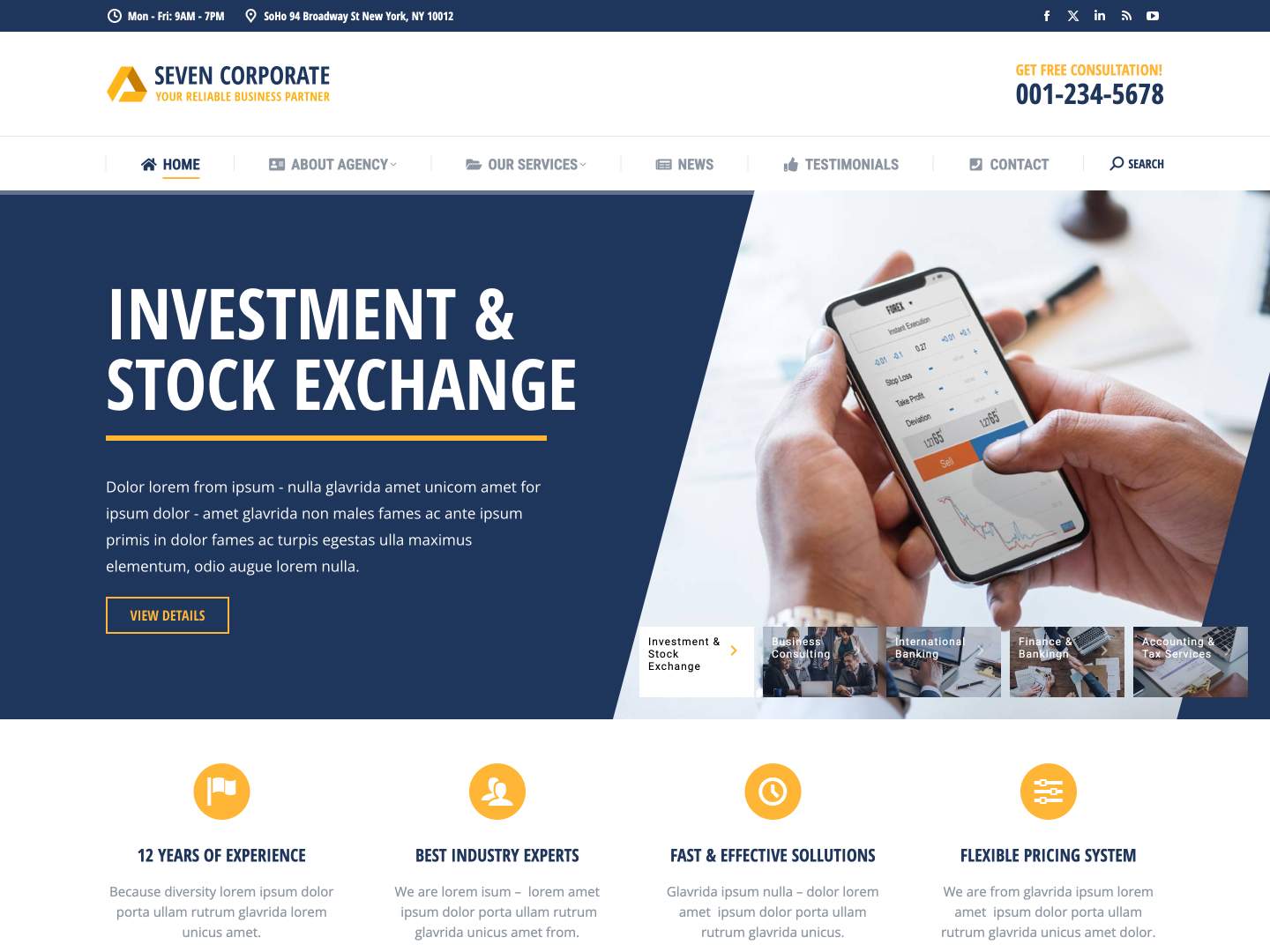

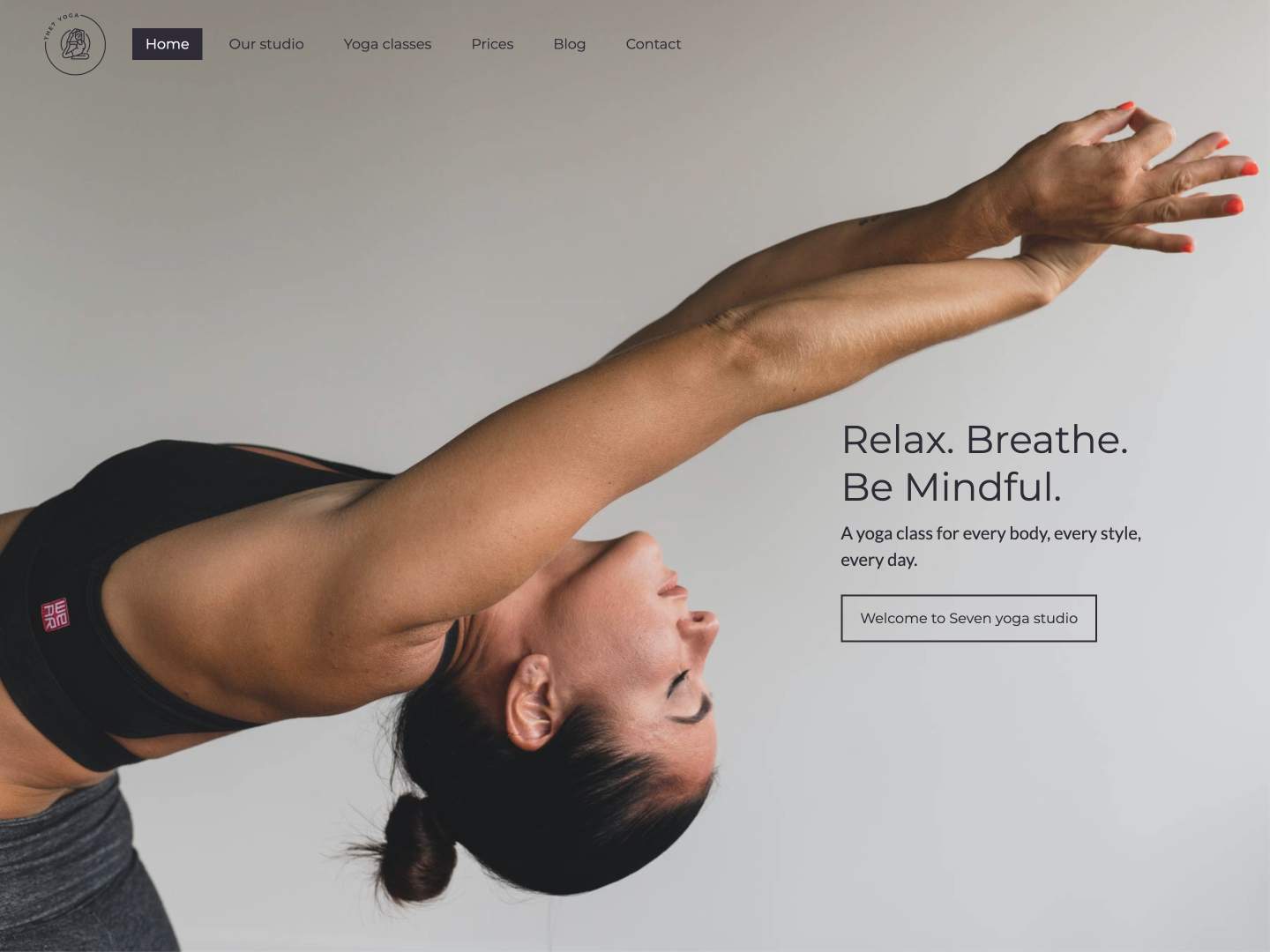

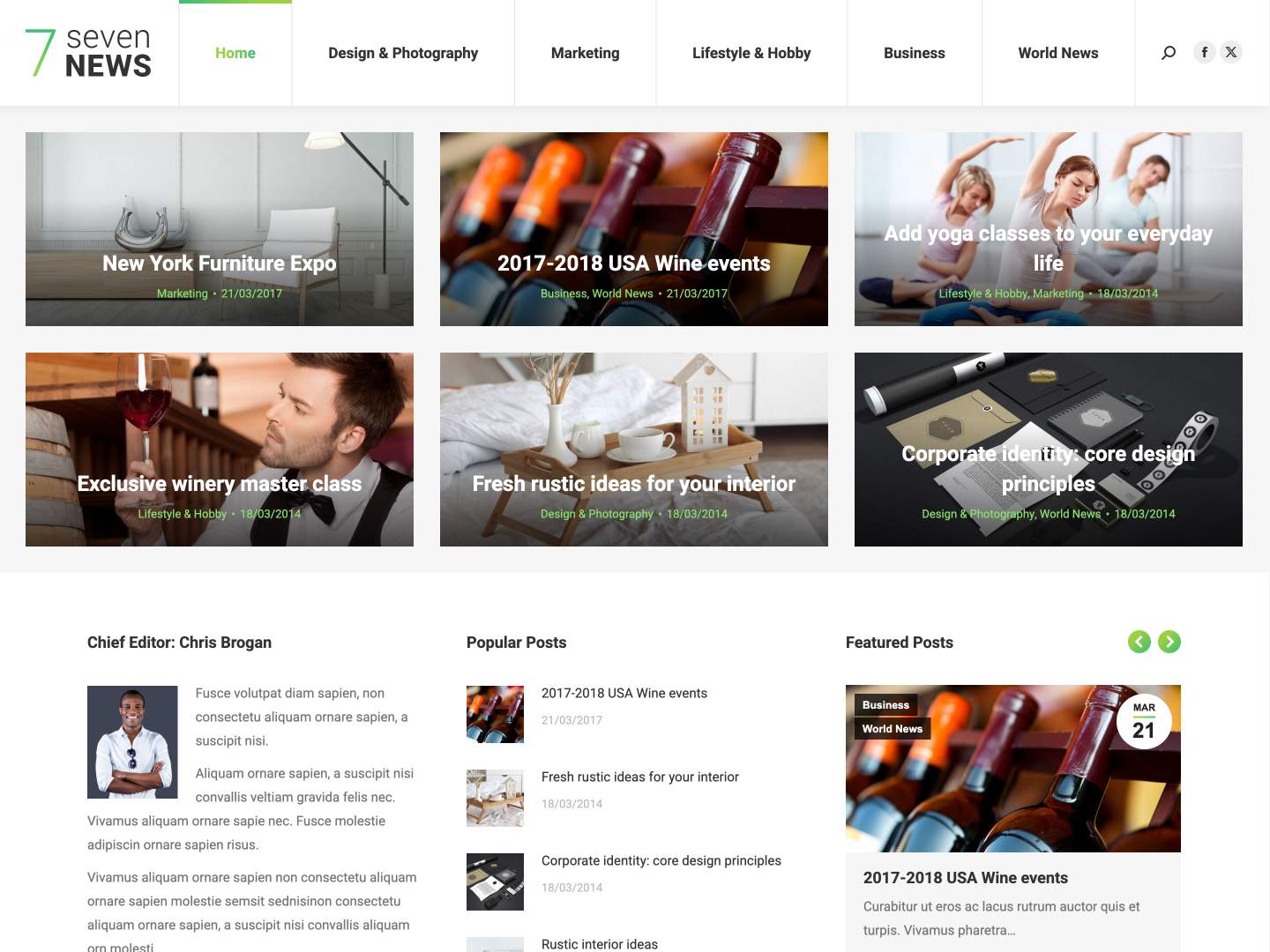

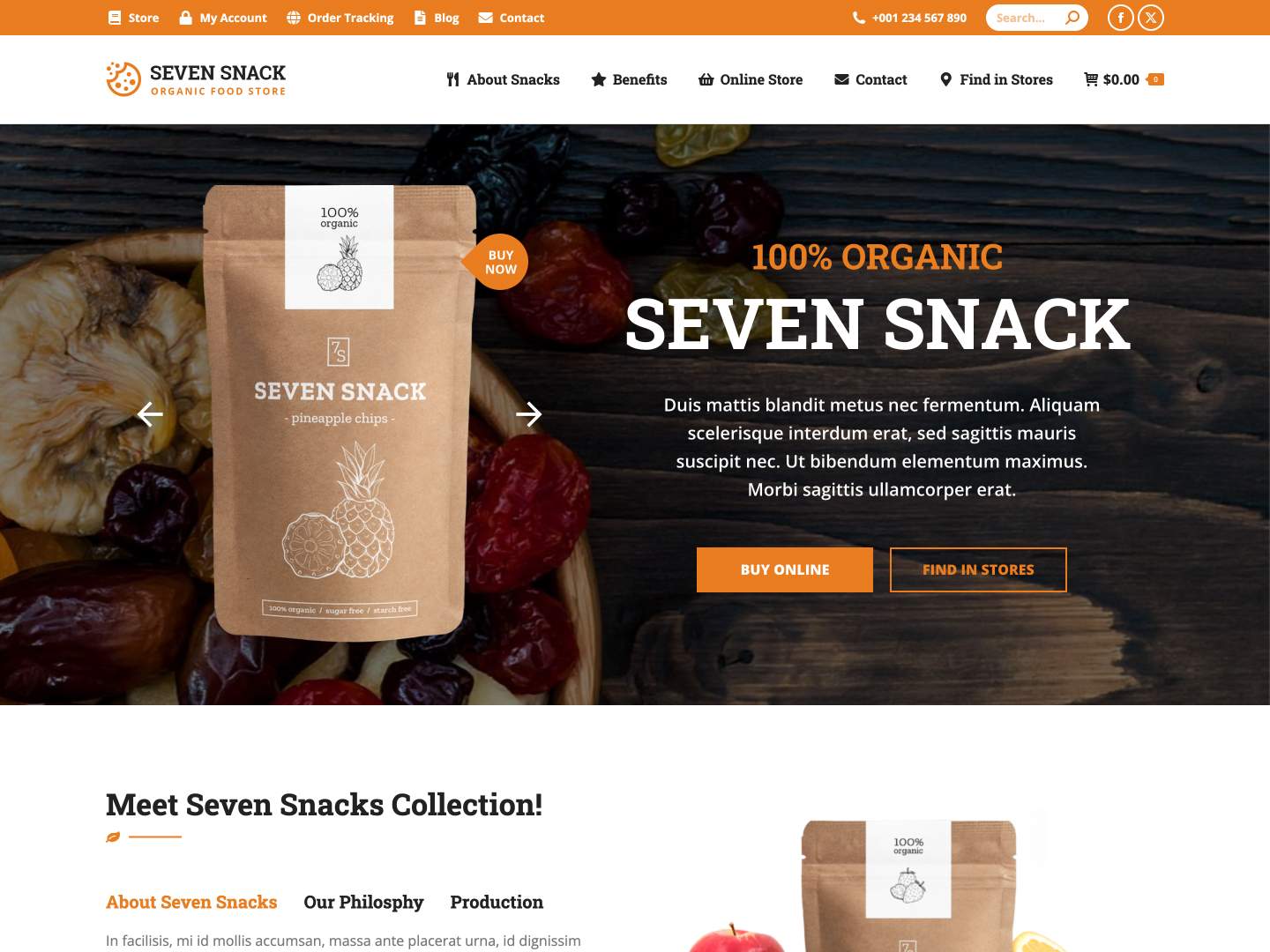

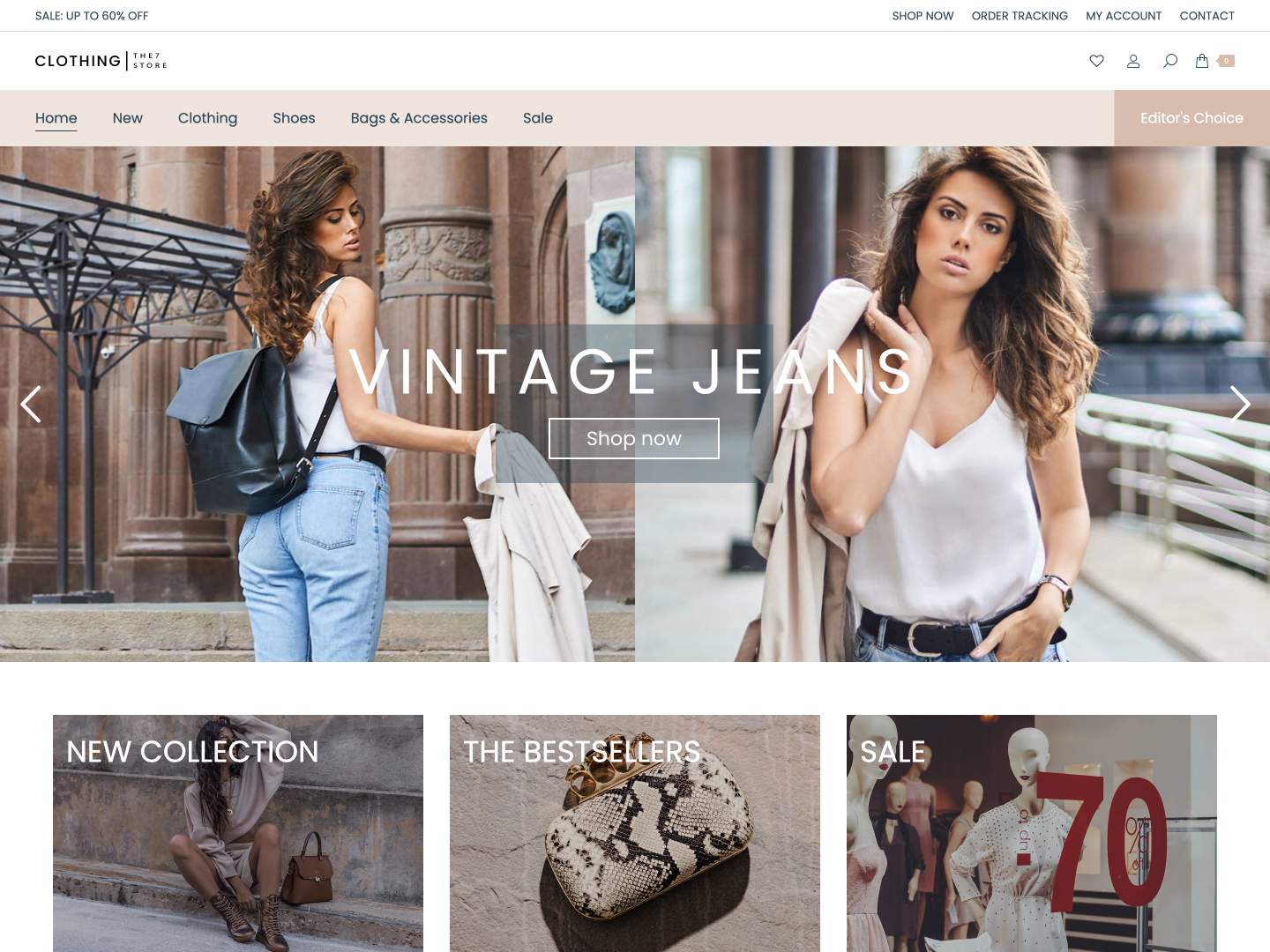

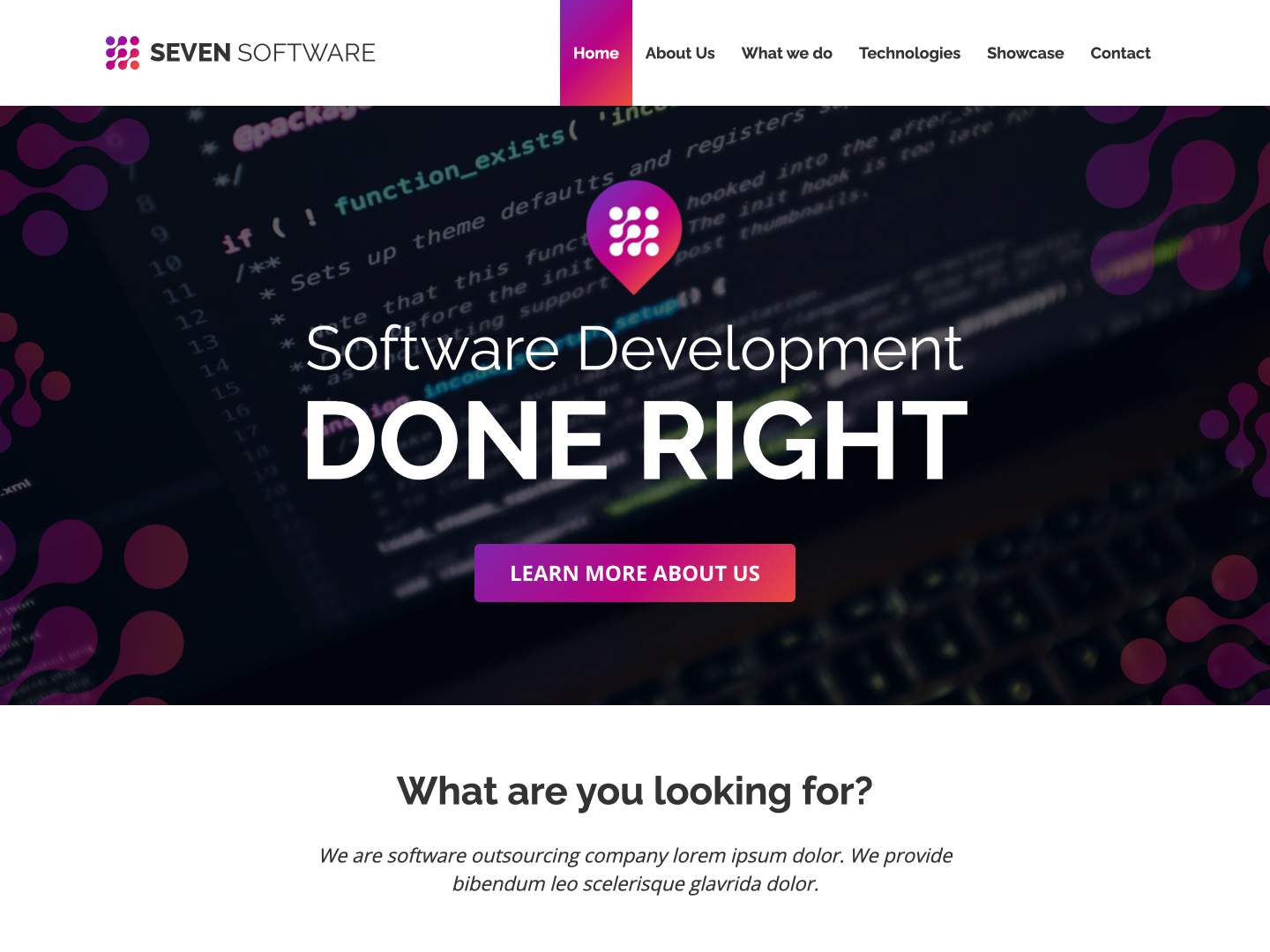

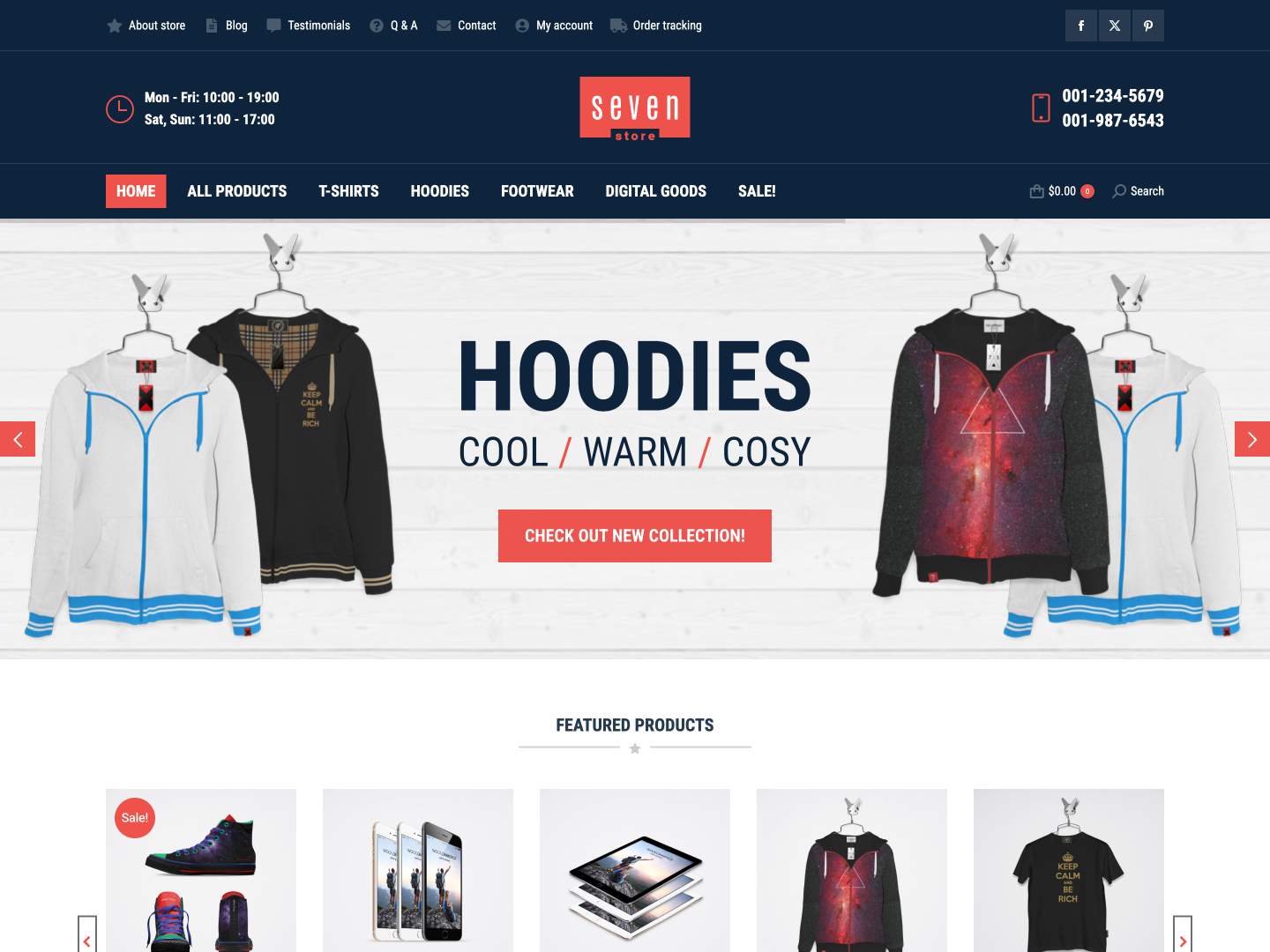

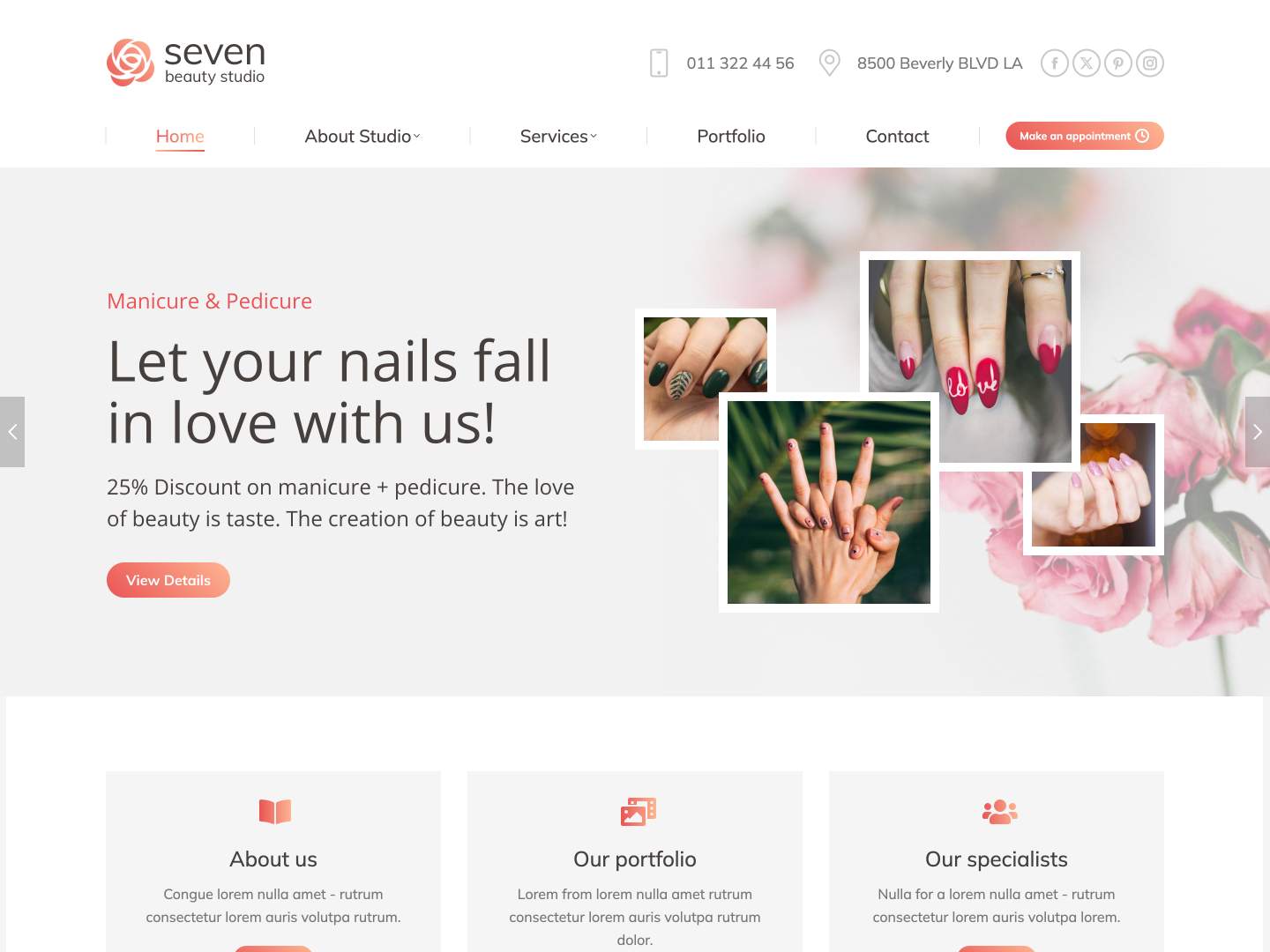

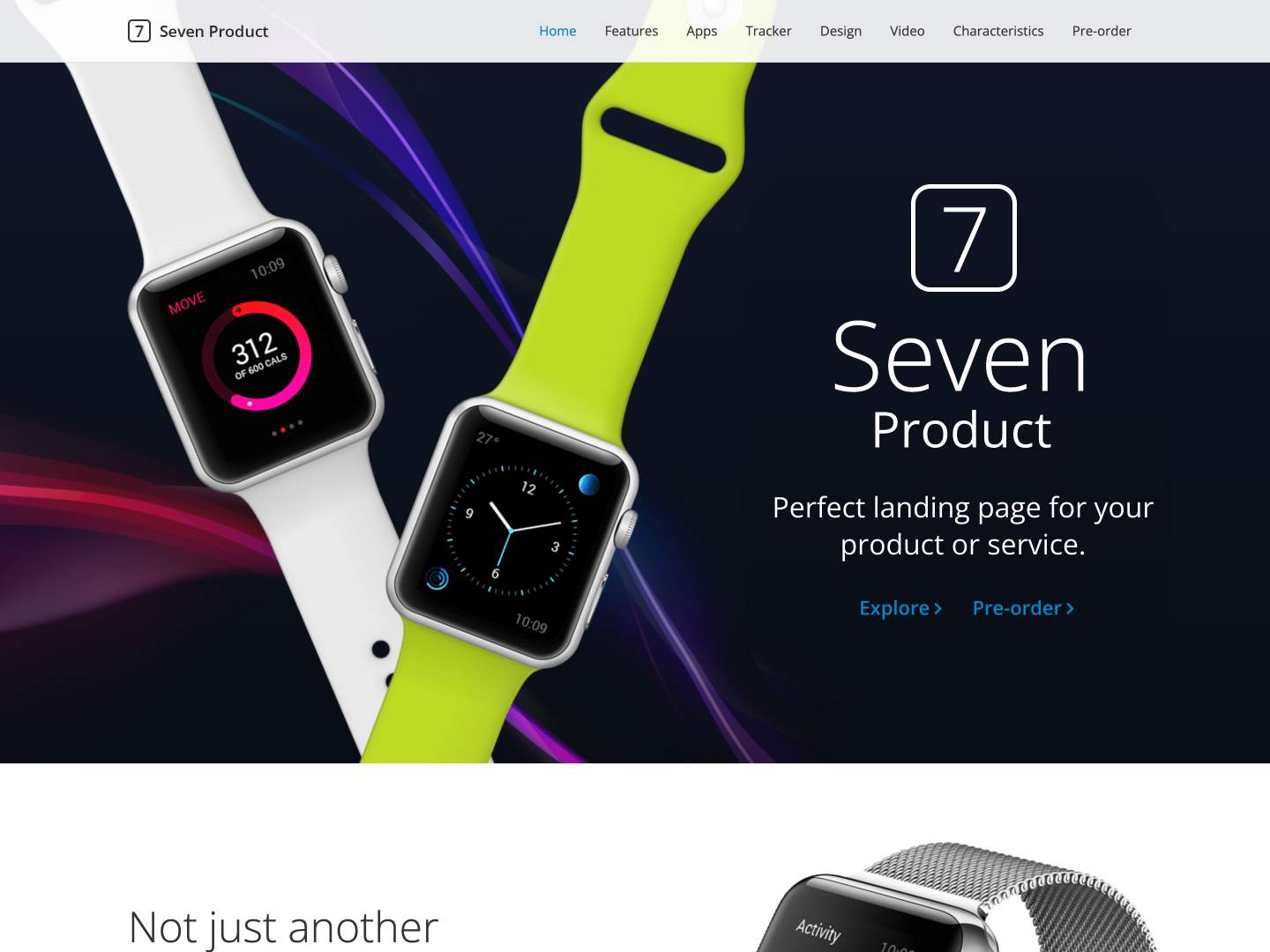

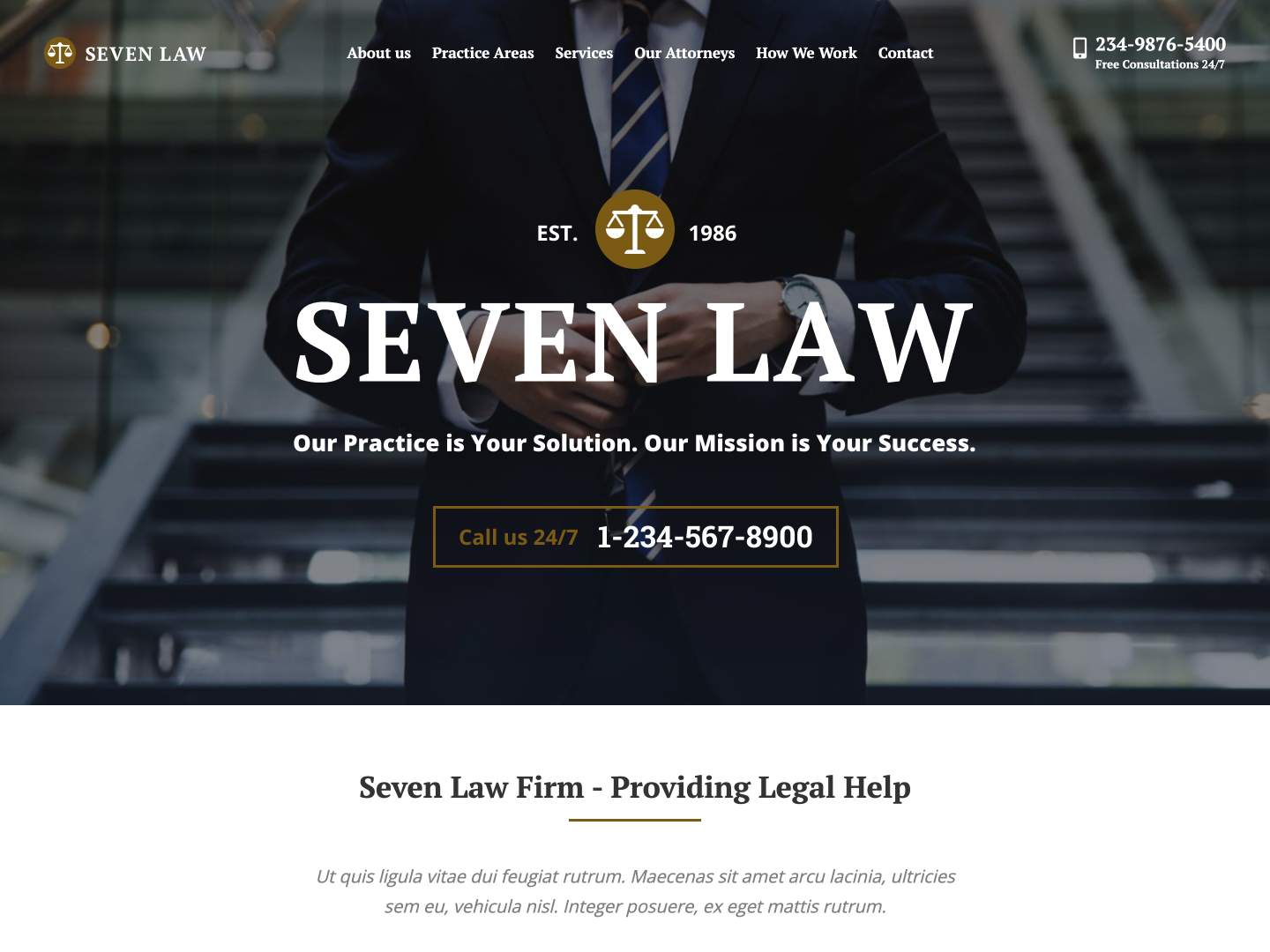

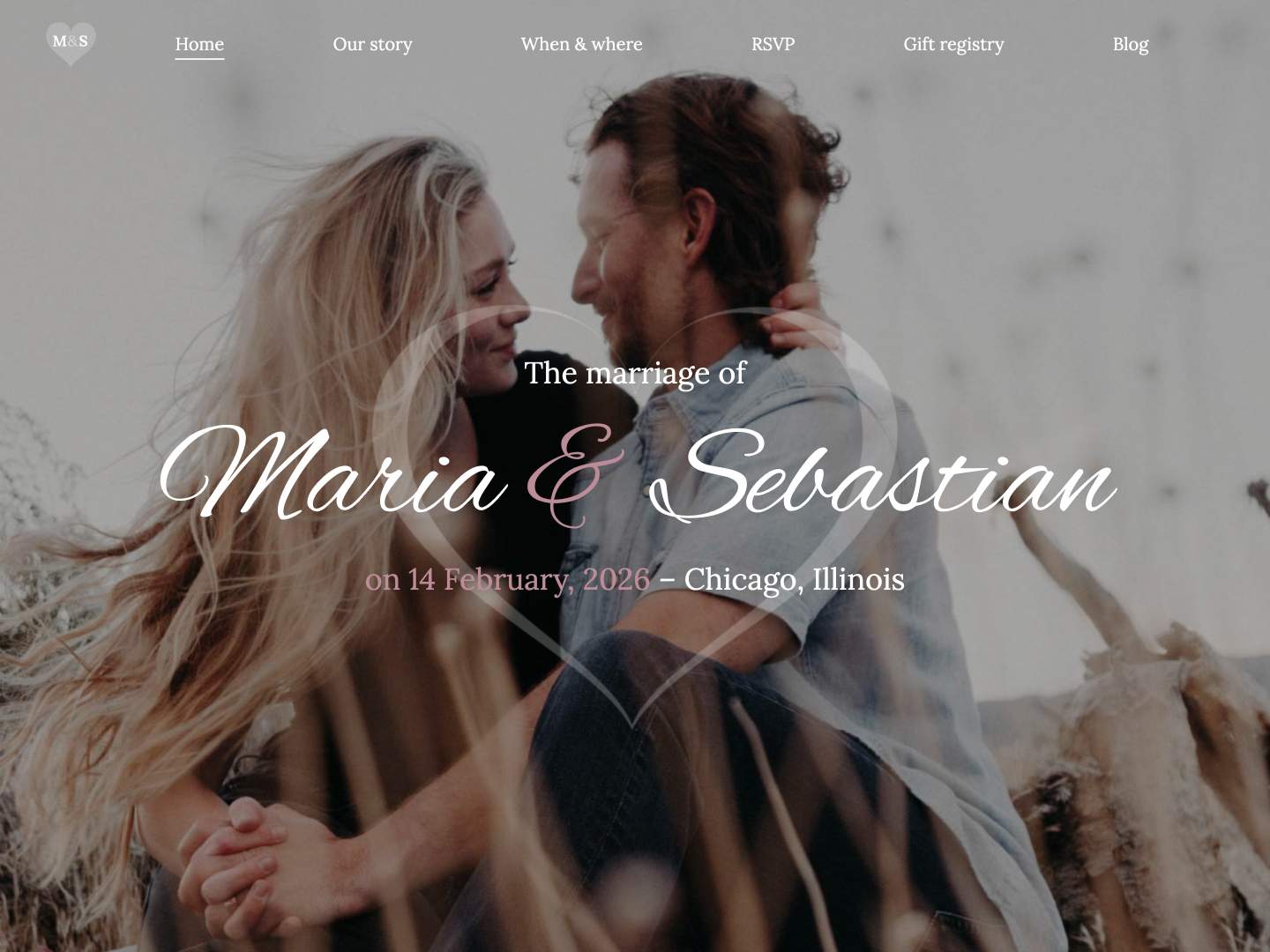

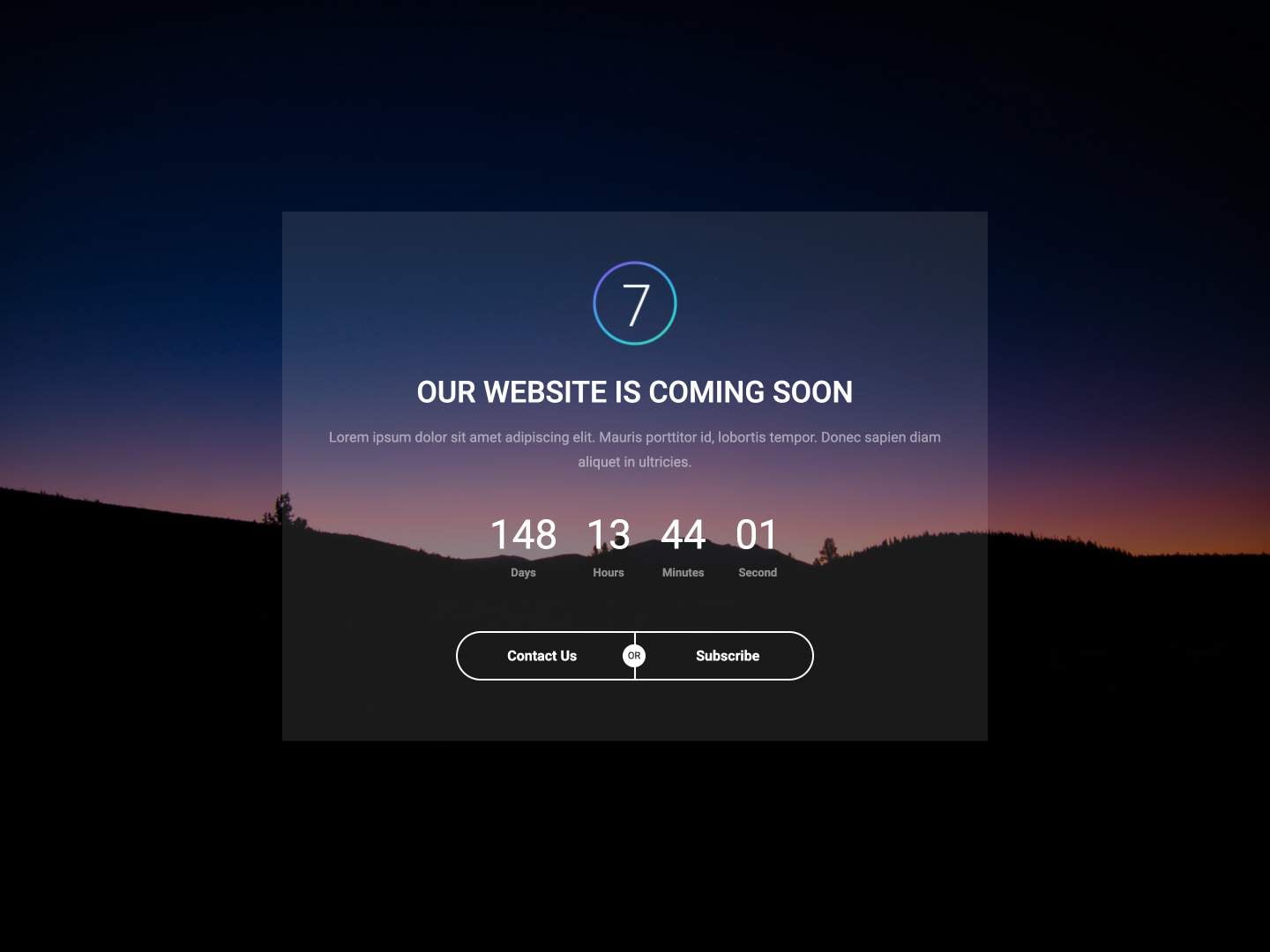

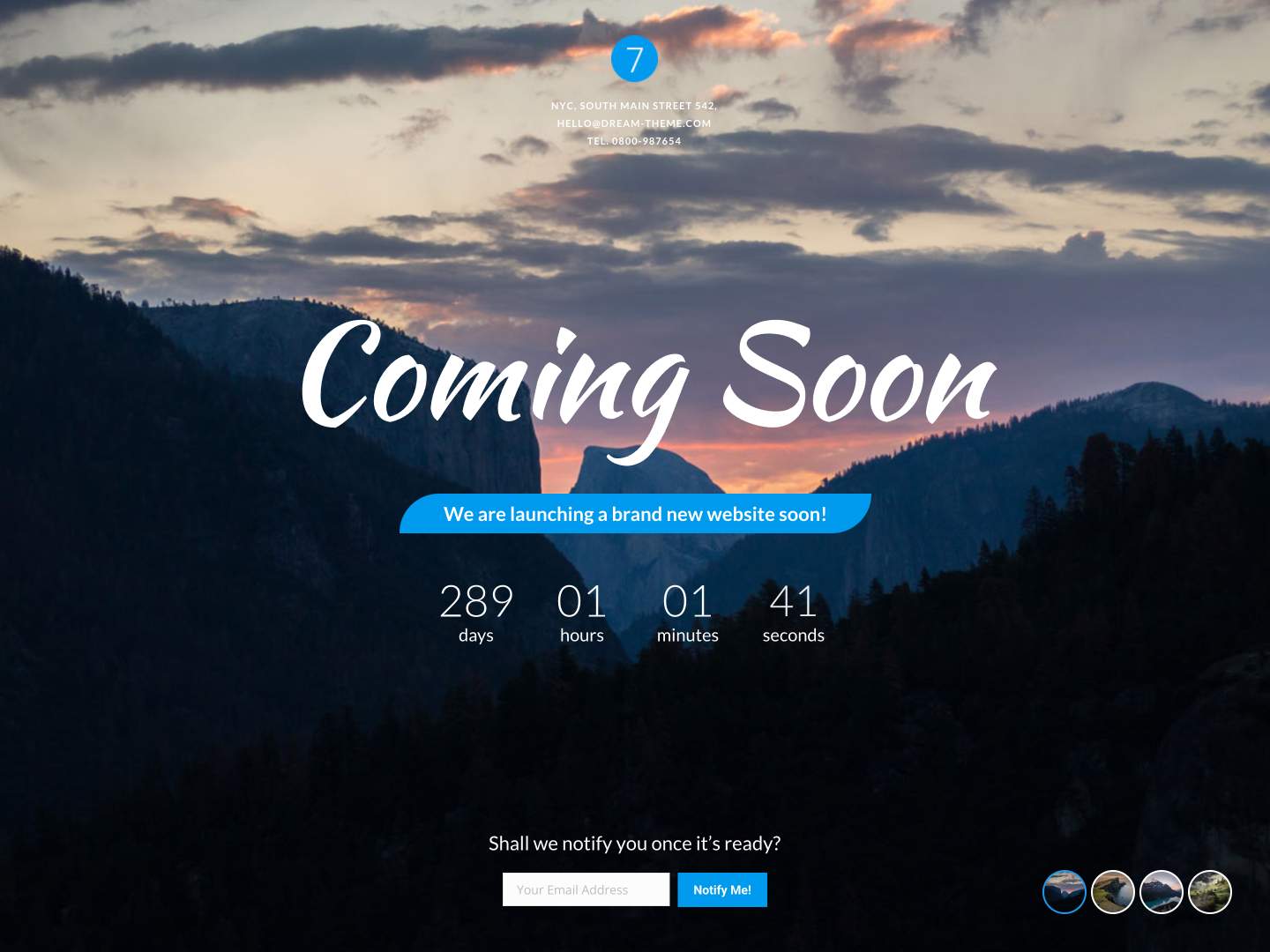

Handcrafted Pre-made Websites

Pick a Website

Import & Customize

Go Live!

Jumpstart your project with over 70 professionally designed pre-built websites.

Import any demo with a single click. Mix, match, and customize to create the perfect foundation for your website in minutes!

Why Customers Love The7

This is a great all round theme with great features and helpful support. Definitely recommend 🙂

Having used this the extensively (91 purchases) I can say it’s an excellent theme, very flexible, no compatibility issues, and excellent support.

Love it!!! Easy to build and performs way better than most others. Love the updates

Excellent Theme. It never lets me down. Had an issue and it was resolved within an hour. How cool is that? If i could give it 6 stars I would!!!!!

It is the most customisable theme on the market, as it is advertised, with very good support.

Customer support very quick and helpful! This is a great theme and very few issues ever, just a clarification I needed and they were happy to help. 5 stars!

This is a highly supported theme. The authors put a lot of time into updating it, and are very responsive to tickets. I’ve been working with this theme for over 10 years.

This is a great theme, it have a wide variety of pre made websites to select from , and the team offers great quick support

Excellent support. They respond quickly and help with any questions.

Great support, the staff is really helpful and responds quickly!

Highly cutomizable fantastic theme which allowed me to create my own website using modular approach block by block + it was great to have Slider Revolution integrated into the theme!

The top of the top themes to date!

I highly recommend it!

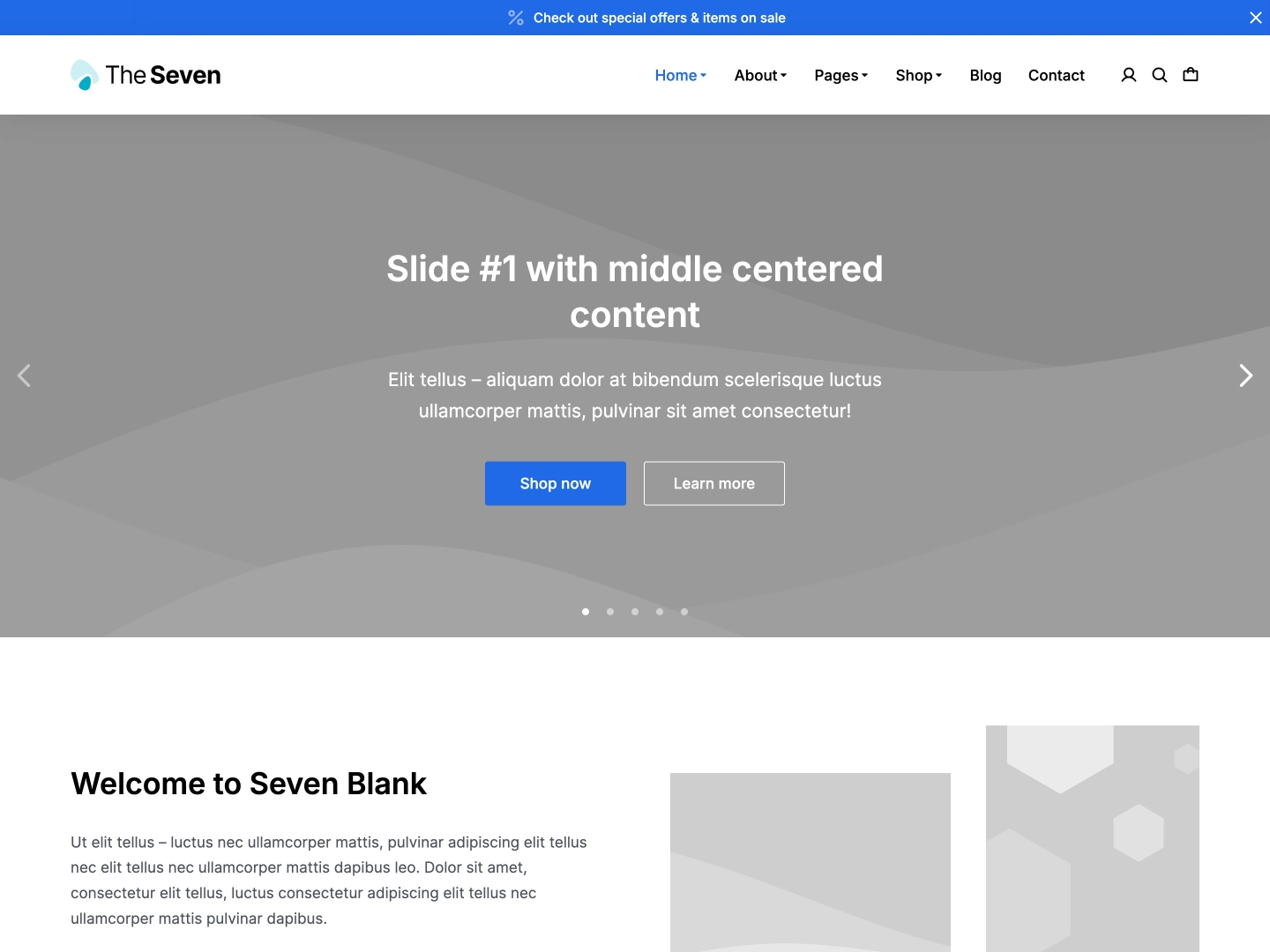

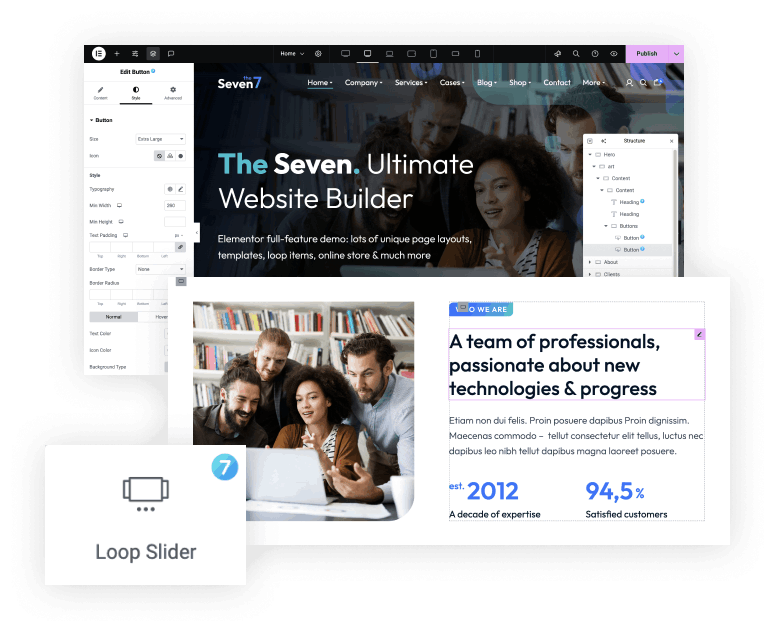

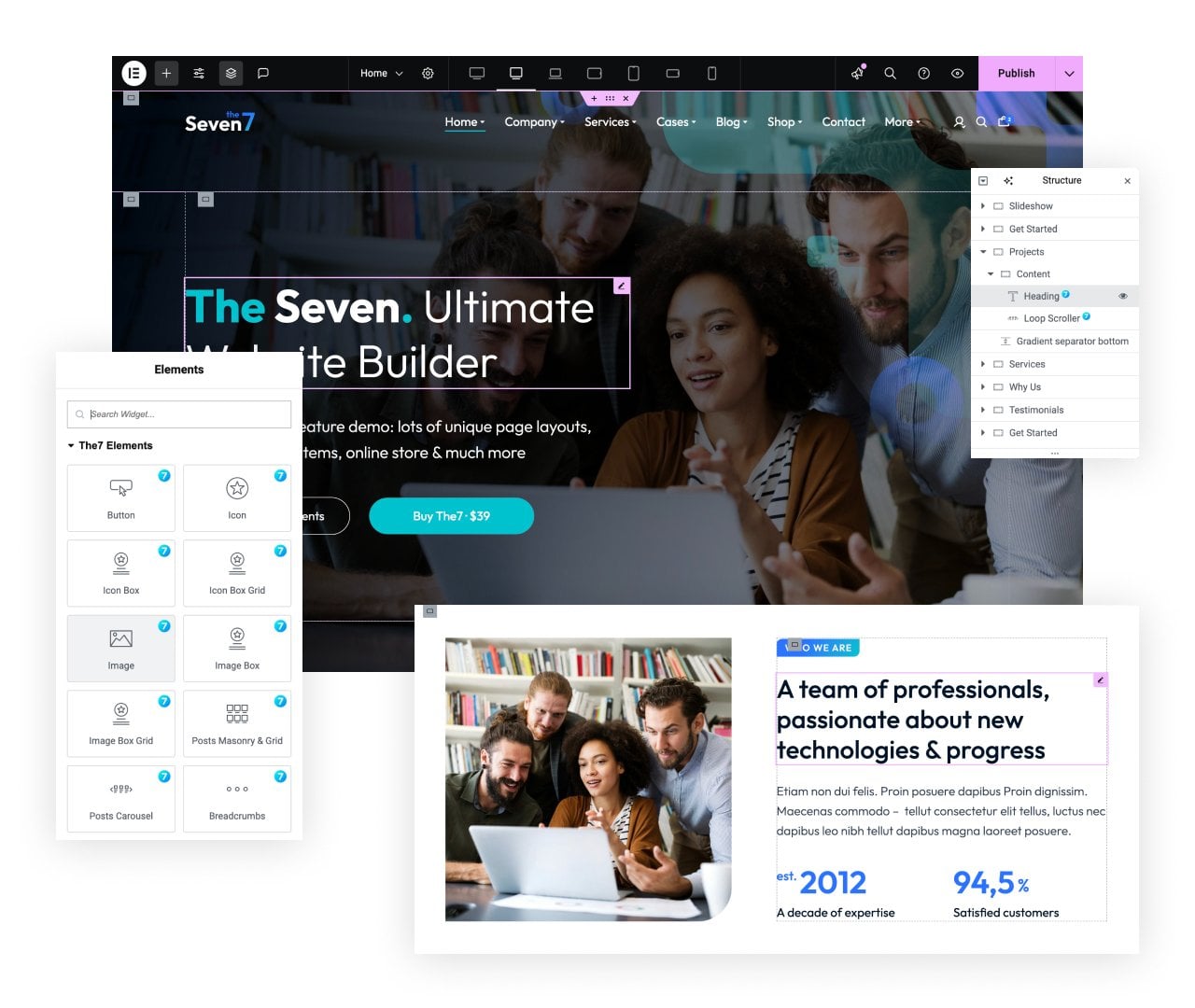

Choose the Site Builder That Best Suits Your Needs

Enjoy working with your preferred site builder significantly enhanced and extended by The7. And our diverse selection of pre-built websites will help you kick-start your project quickly and effortlessly.

Ultimate WordPress Theme

World's Leading Page Builder

Full Website Builder

Design your entire website with ease. The7 extends Elementor, giving you complete control over your site’s:

- Headers & Footers

- Mega Menus

- Slideshows, Hero Sections

- Post Loops & Templates

- Single Pages & Posts

- Individual Page Templates

- Archives & Search Results

- All WooCommerce Pages

- 404 Error Page

- And more!

The7's Exclusive Features

With The7, you gain access to exclusive features and quality of life improvements that are not available in standard Elementor, including:

- Sticky Headers that change size and color on scroll

- Slideshows Builder, directly in the Elementor interface

- Bulk editing of website fonts

- Simple custom post type builder

- Hover builder for images

- Over 70 Exclusive The7 Widgets

- And many other powerful tools!

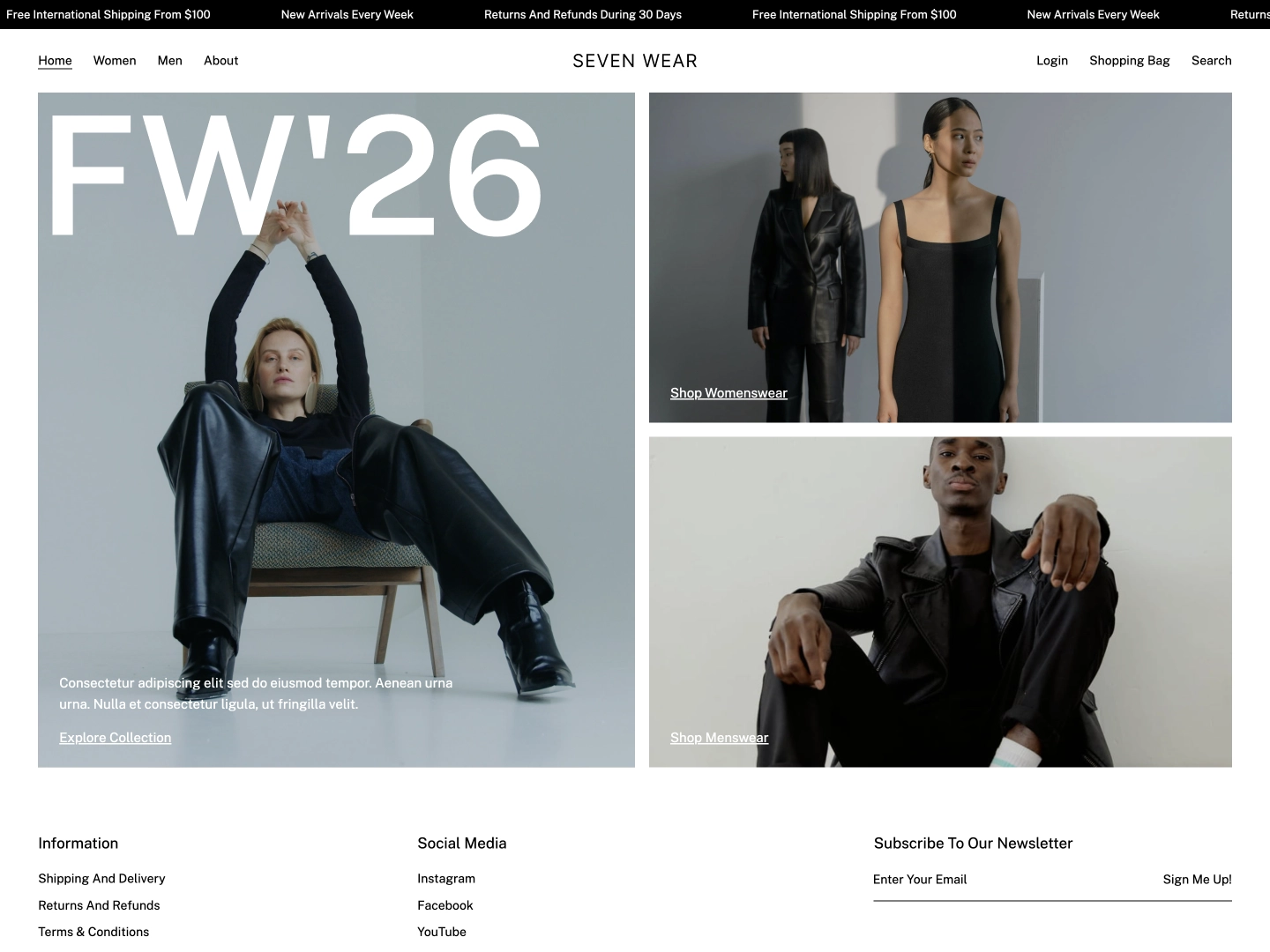

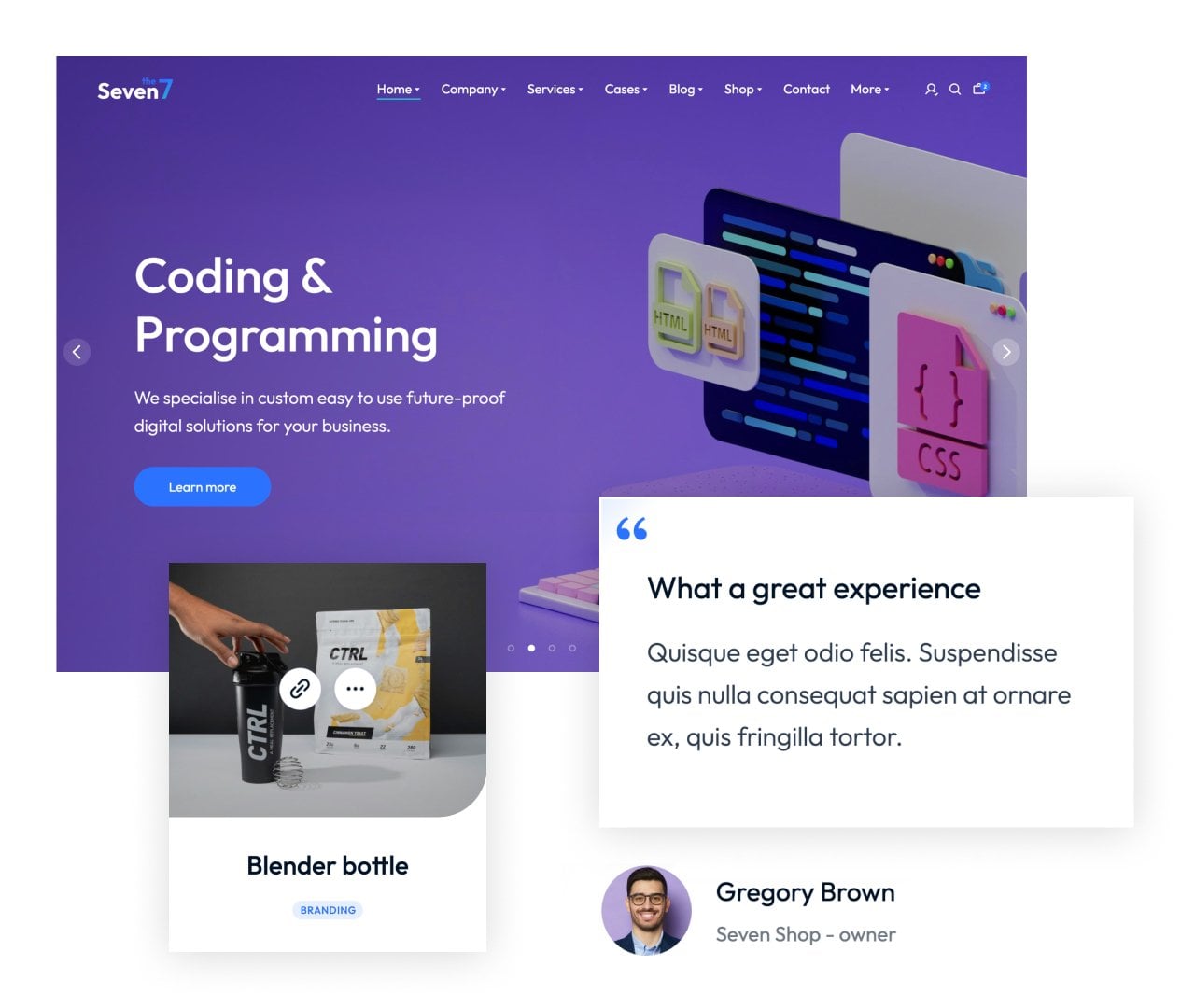

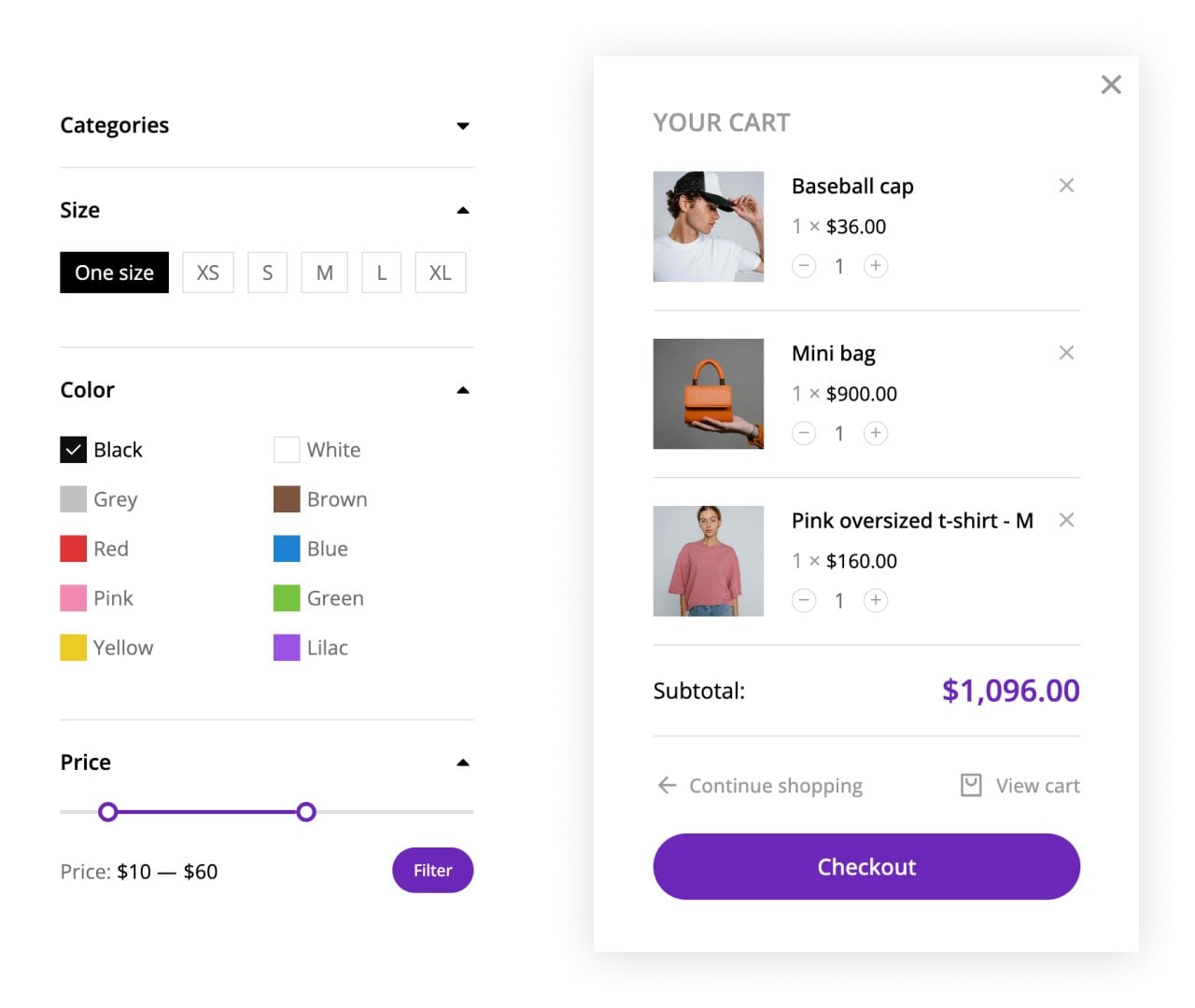

Complete WooCommerce Builder

- Storefronts

- Product Pages

- Product Lists

- Product Scrollers

- Advanced Filters

- Shopping Carts

- Videos in Products

- And much more!

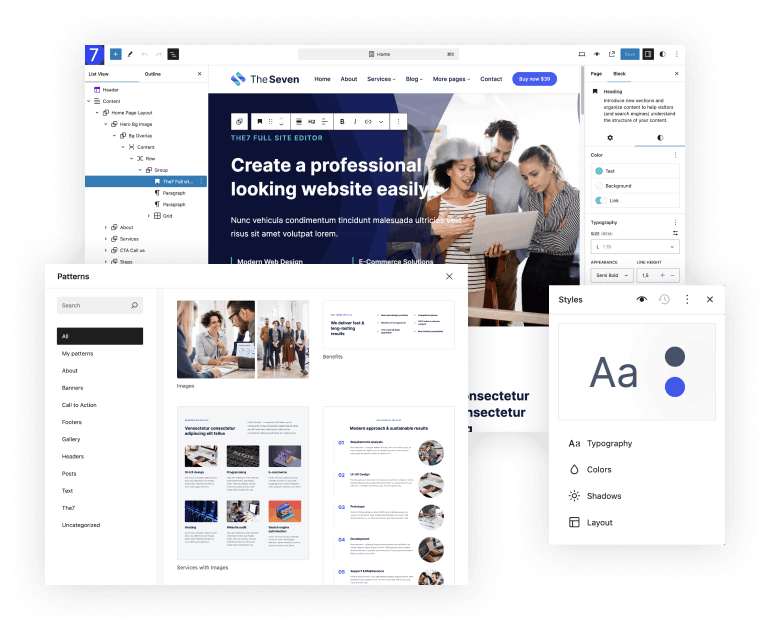

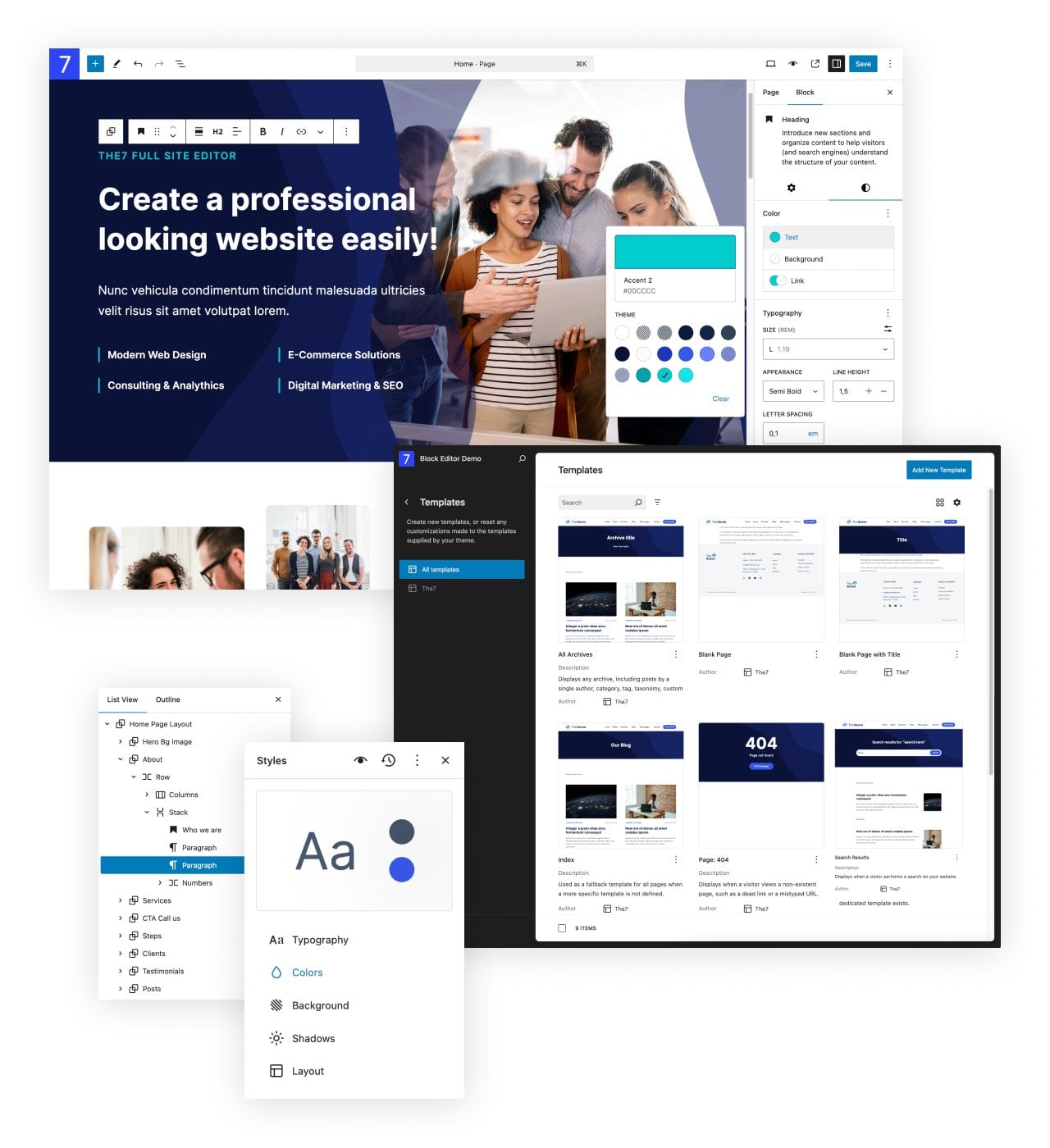

Native WordPress Full Site Editing with The7

As of version 12, The7 supports WordPress’s native Full Site Editing (FSE). Edit your entire website – including headers, footers, archives, and more – directly within the WordPress interface. Enjoy The7’s signature design without the need for additional plugins or a steep learning curve.

Zero Learning Curve

If you’re comfortable with WordPress, you’ll feel right at home with The7. There’s zero learning curve, so you can start creating immediately.

Responsive The7 Block Editor

Design Pattern Library

The7 comes with a comprehensive collection of design patterns to make building your website even faster and easier.

Lightning-Fast Performance

The7 adds no extra code to your website, ensuring it loads lightning fast even without optimization.

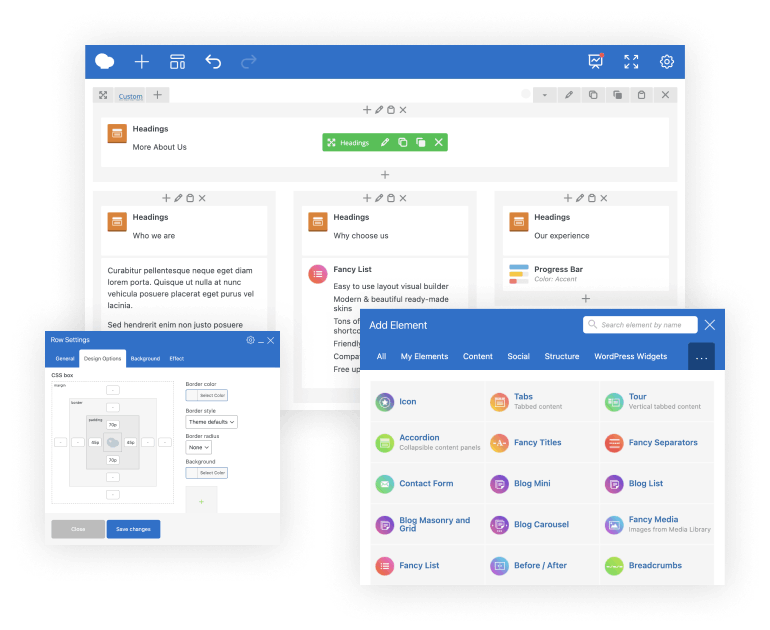

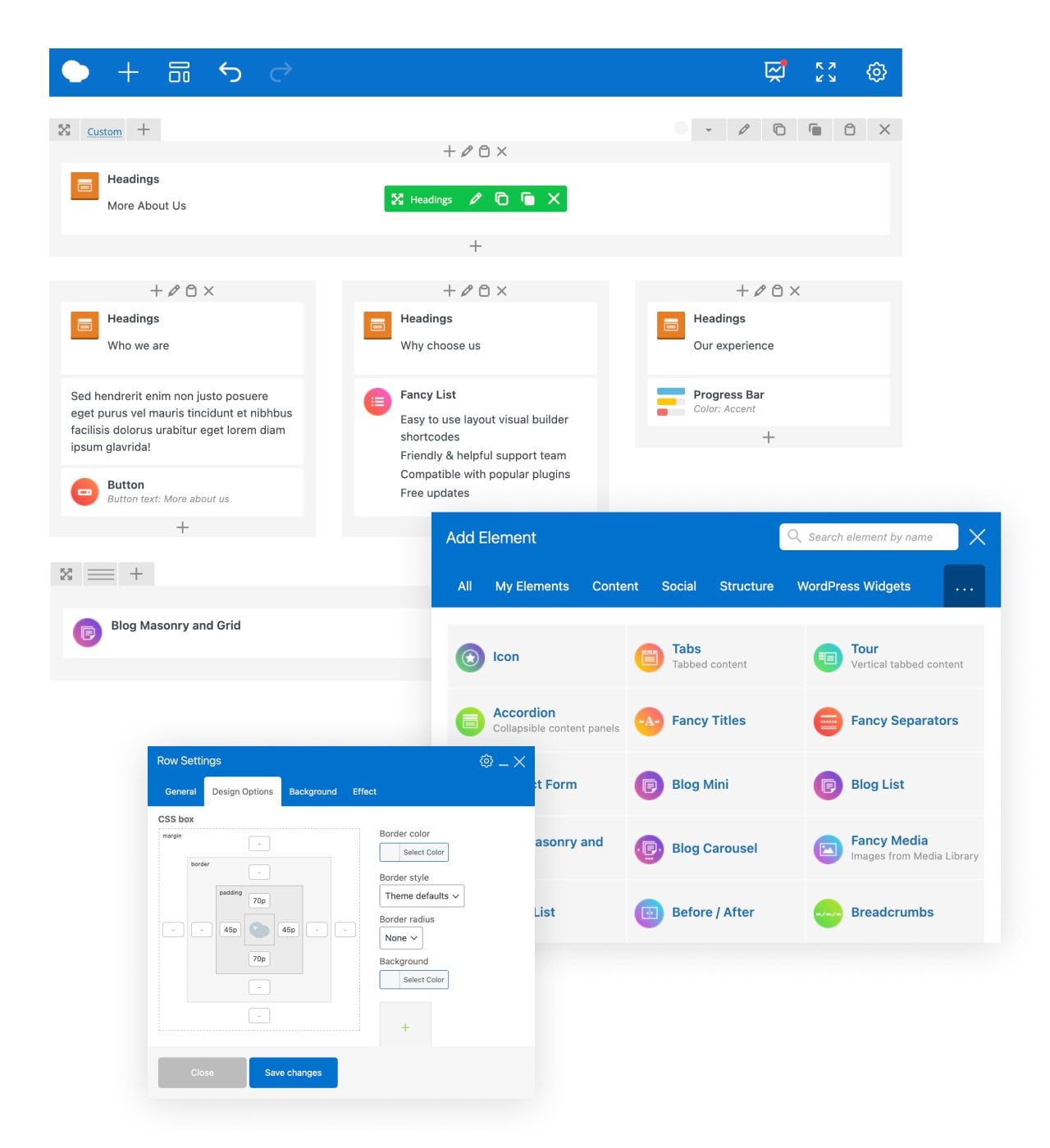

Full Support for WPB Page Builder & Ultimate Addons

WPBakery is a very popular option among users who prefer having a dedicated page builder separate from settings for headers, footers, and other theme options. Since its release in 2013, The7 has quickly become the most popular premium theme for this page builder on the market!

#1 Best-Selling Theme for WPBakery

The7 was released with native support for WPBakery Page Builder and Ultimate Addons, quickly becoming the number one choice for this builder.

50+ The7 Shortcodes

Comes with Ultimate Addons

Ultimate Addons is the most popular premium add-on for WPBakery Page Builder. It adds a vast number of shortcodes, settings, and features to the builder and comes standard with The7.

What Else?

"There's a Feature for That"

The7 comes loaded with a wealth of features – both those you’d expect in any modern multipurpose theme and unique functionalities exclusive to The7. So if you can think of something, it’s probably already implemented in The7!

Free Lifetime Updates

No recurring membership or other hidden fees!

Rock-Solid 5-Star Rating

325 000+ purchases, 9000+ reviews.

Support by Developers

Lifetime support, including 6 months of priority access.

More Bang for Your Buck!

$259 worth premium plugins included.

SEO-Ready & Mobile-Friendly

Certified by Google.

Custom Branding Tool

Transform The7 into Your_Theme in just a few clicks.

Multilingual & Translation Ready

Already translated into 10+ languages!

Built for Speeed!

With the free FVM plugin, The7 scores 90+ on GTMetrix.

Compatible with Elementor Pro & Free PRO Elements

Either plugin unlocks The7’s full potential.

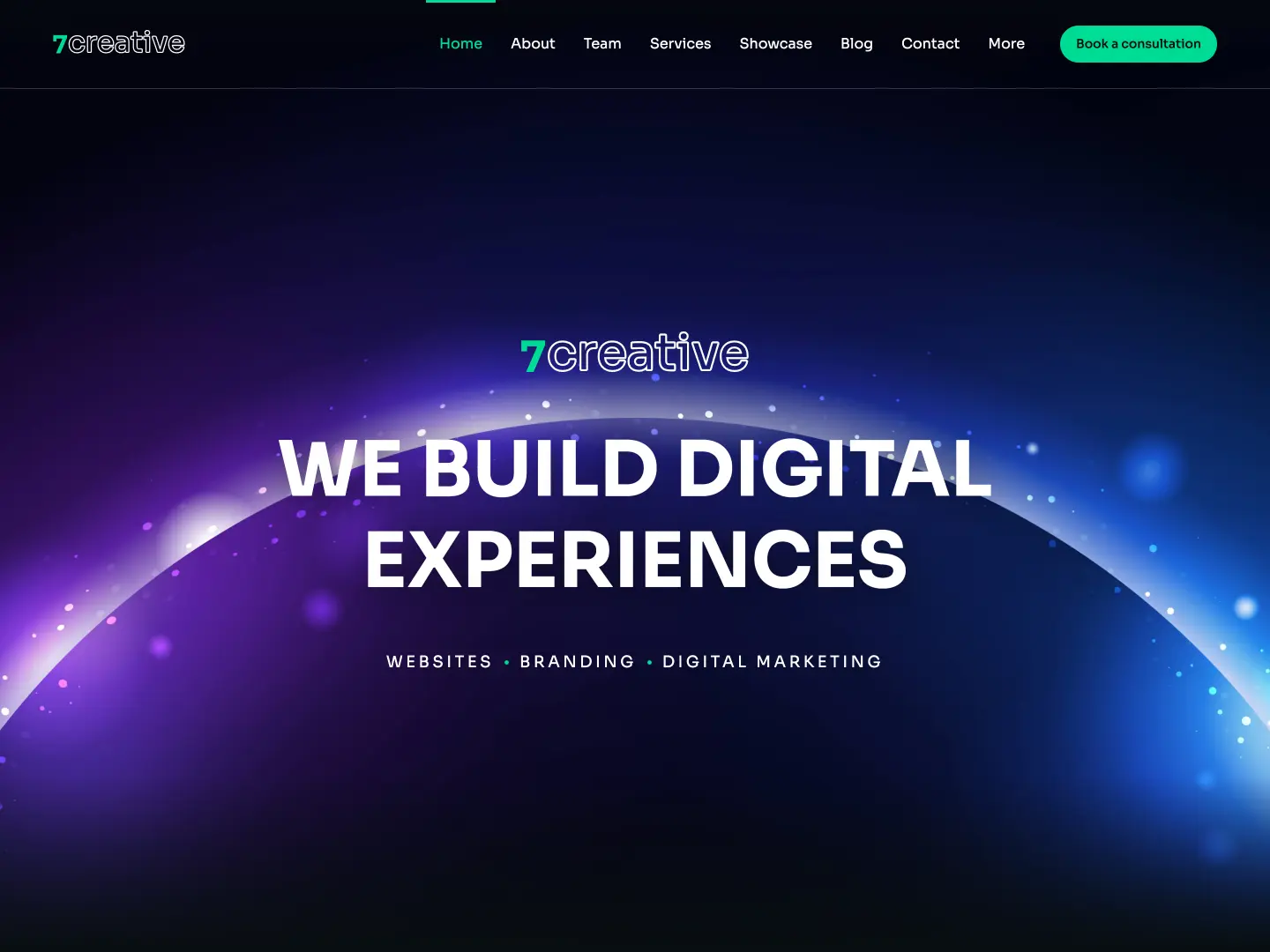

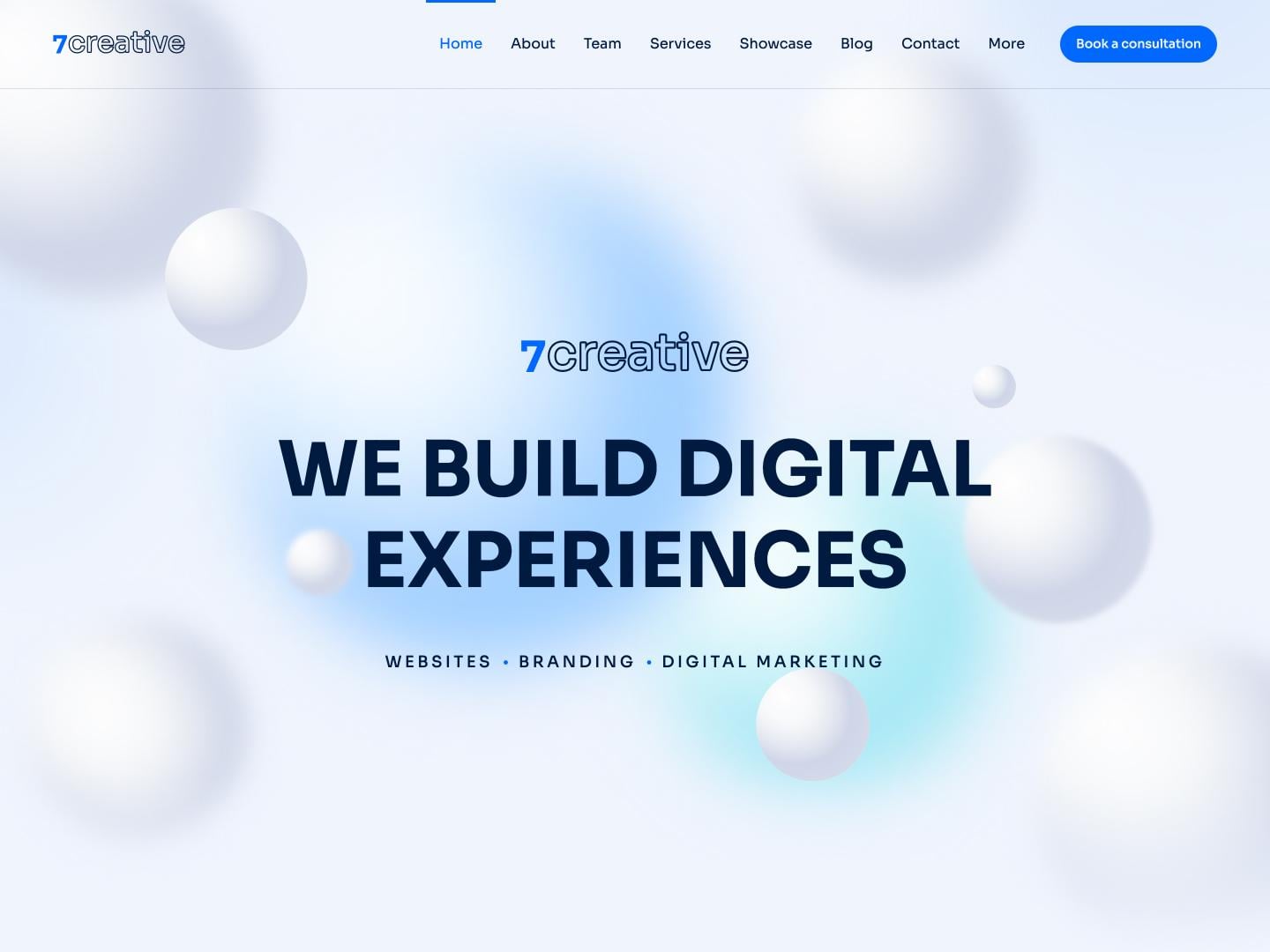

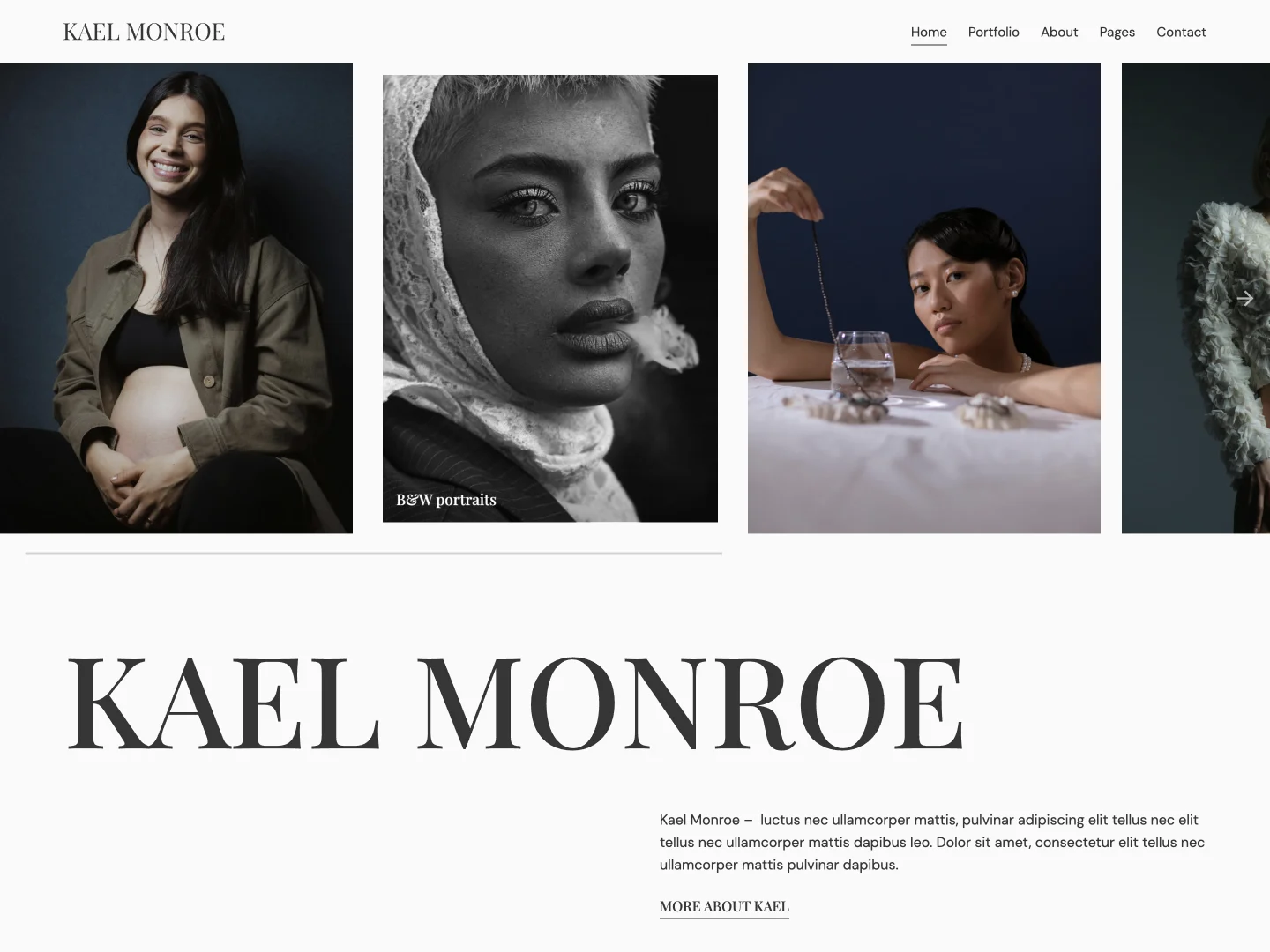

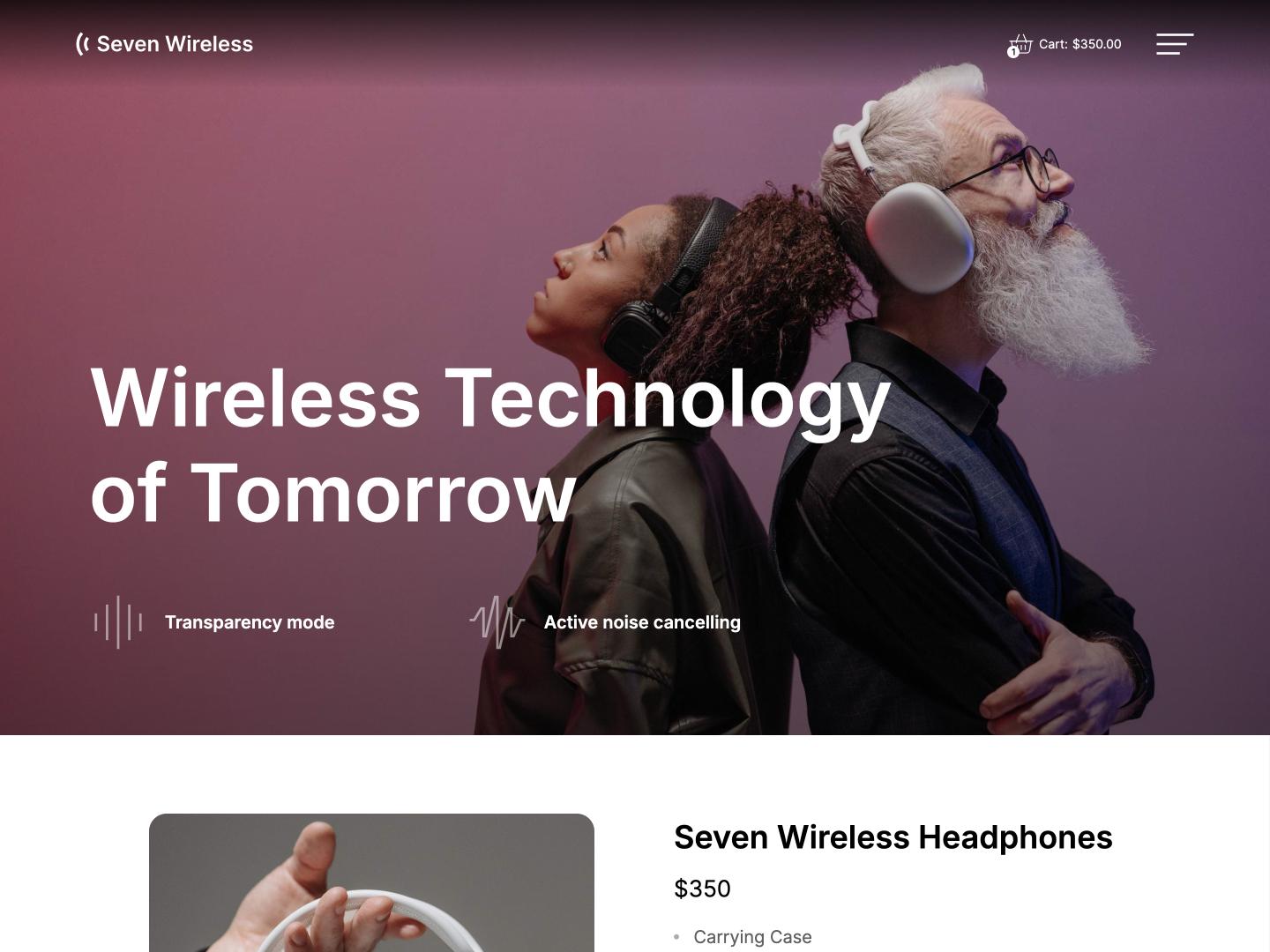

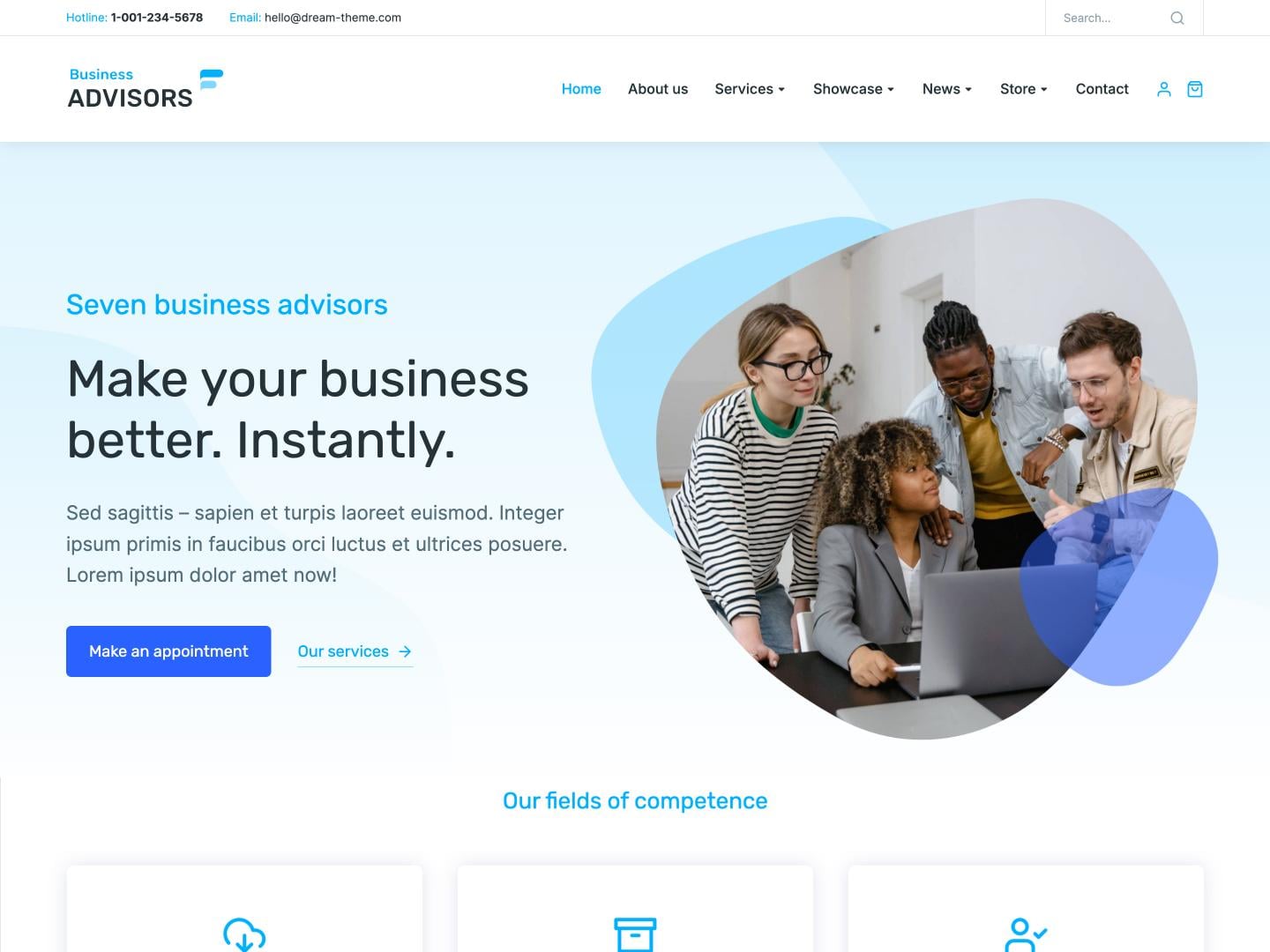

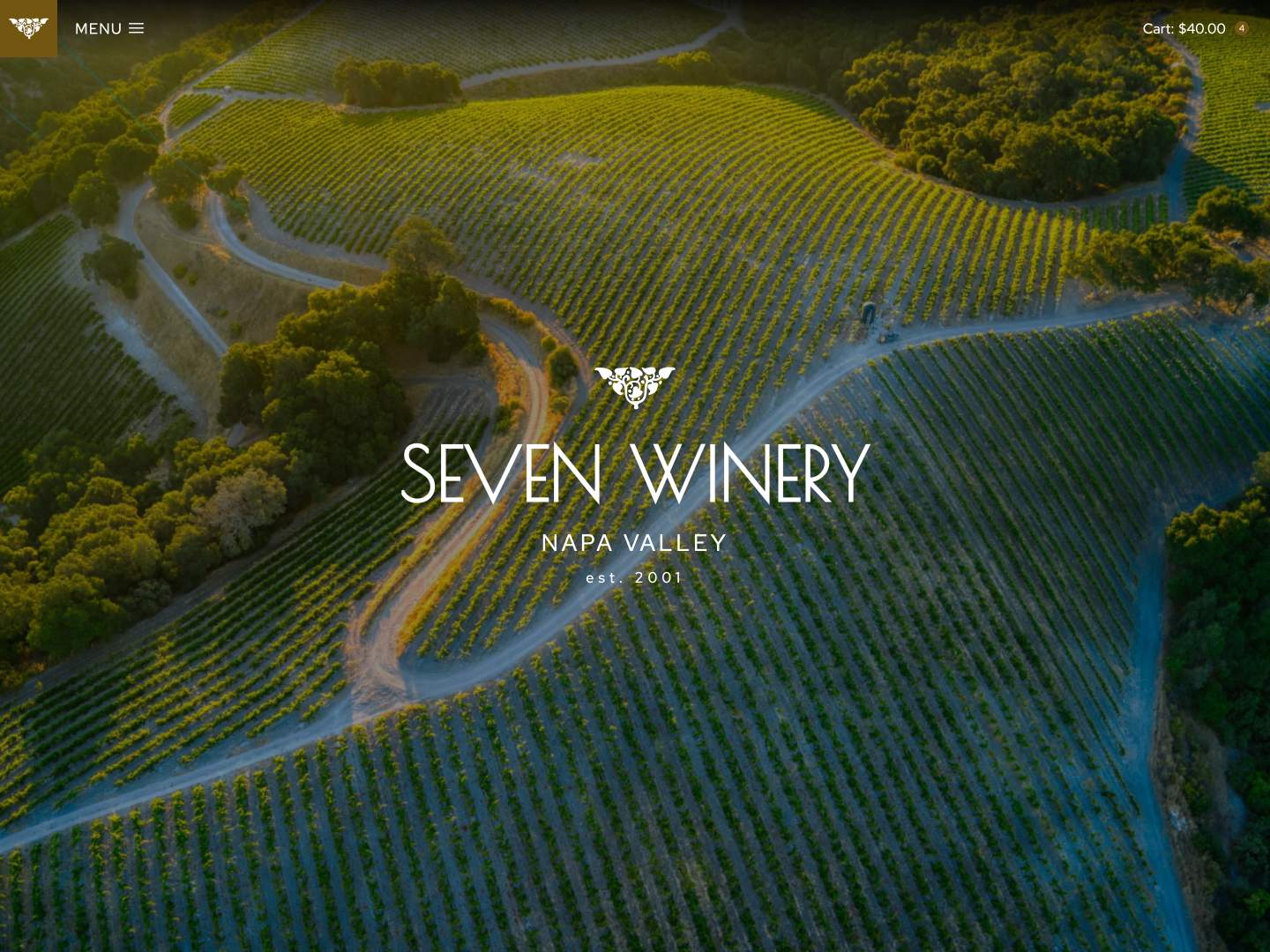

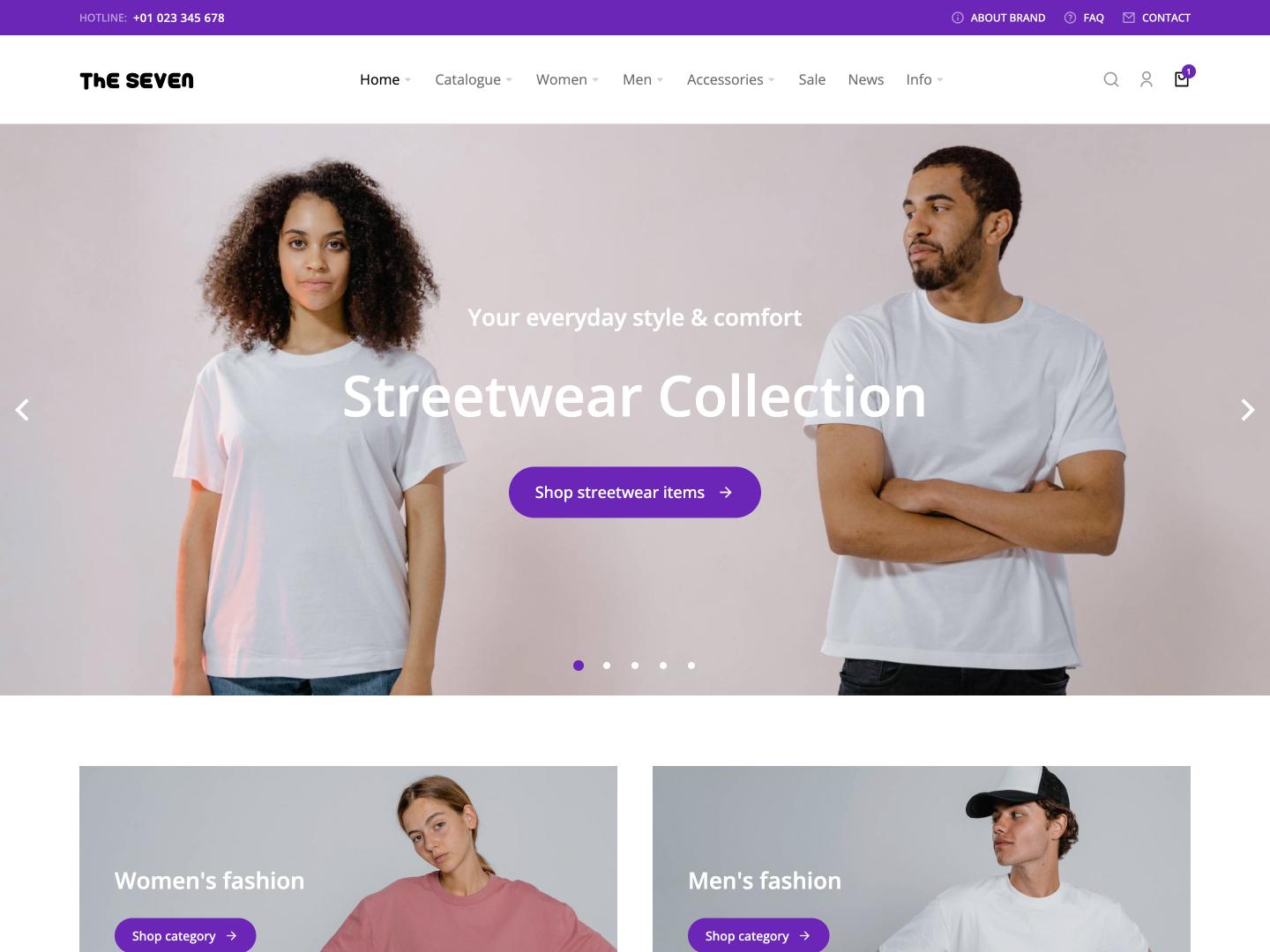

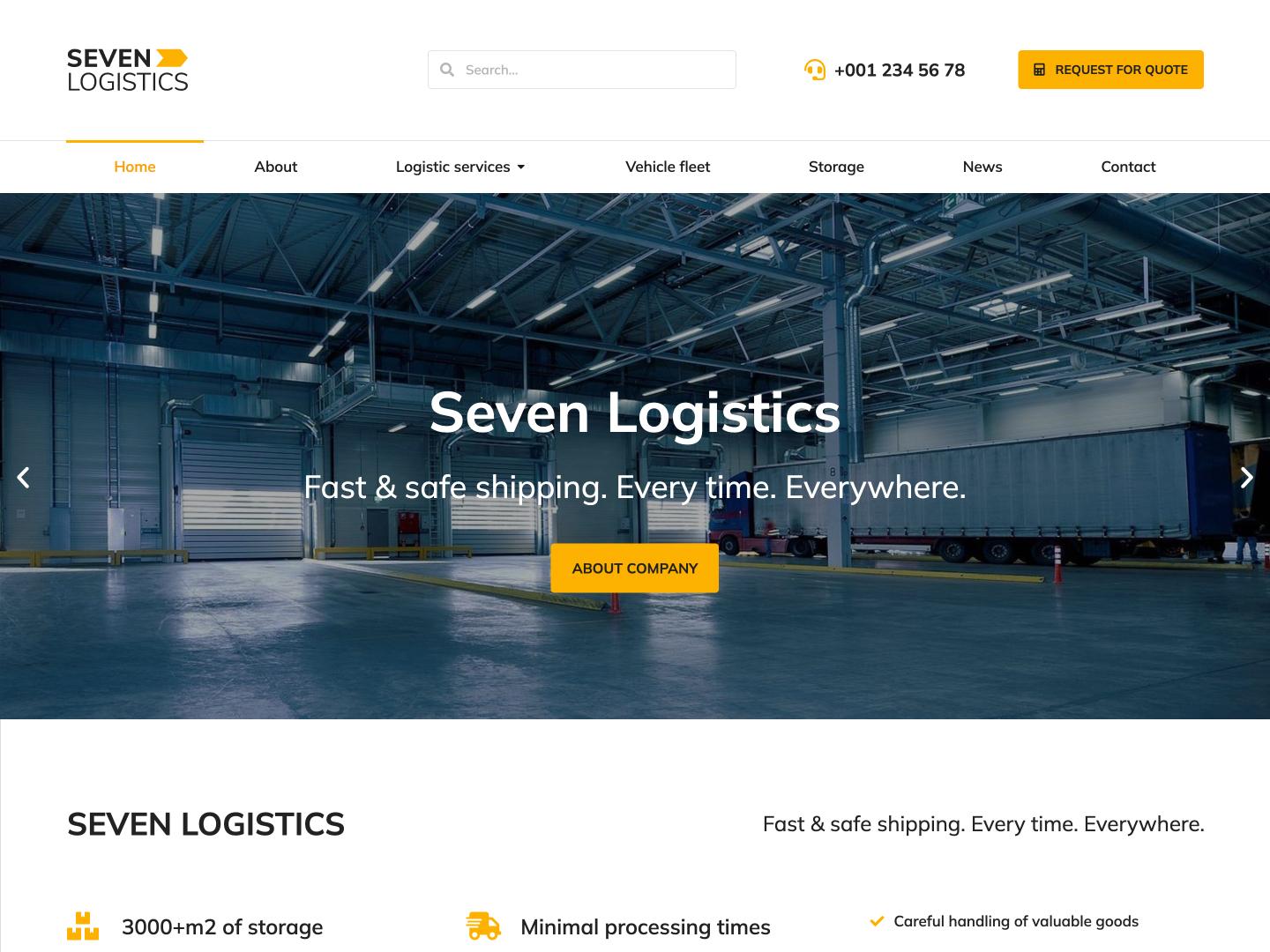

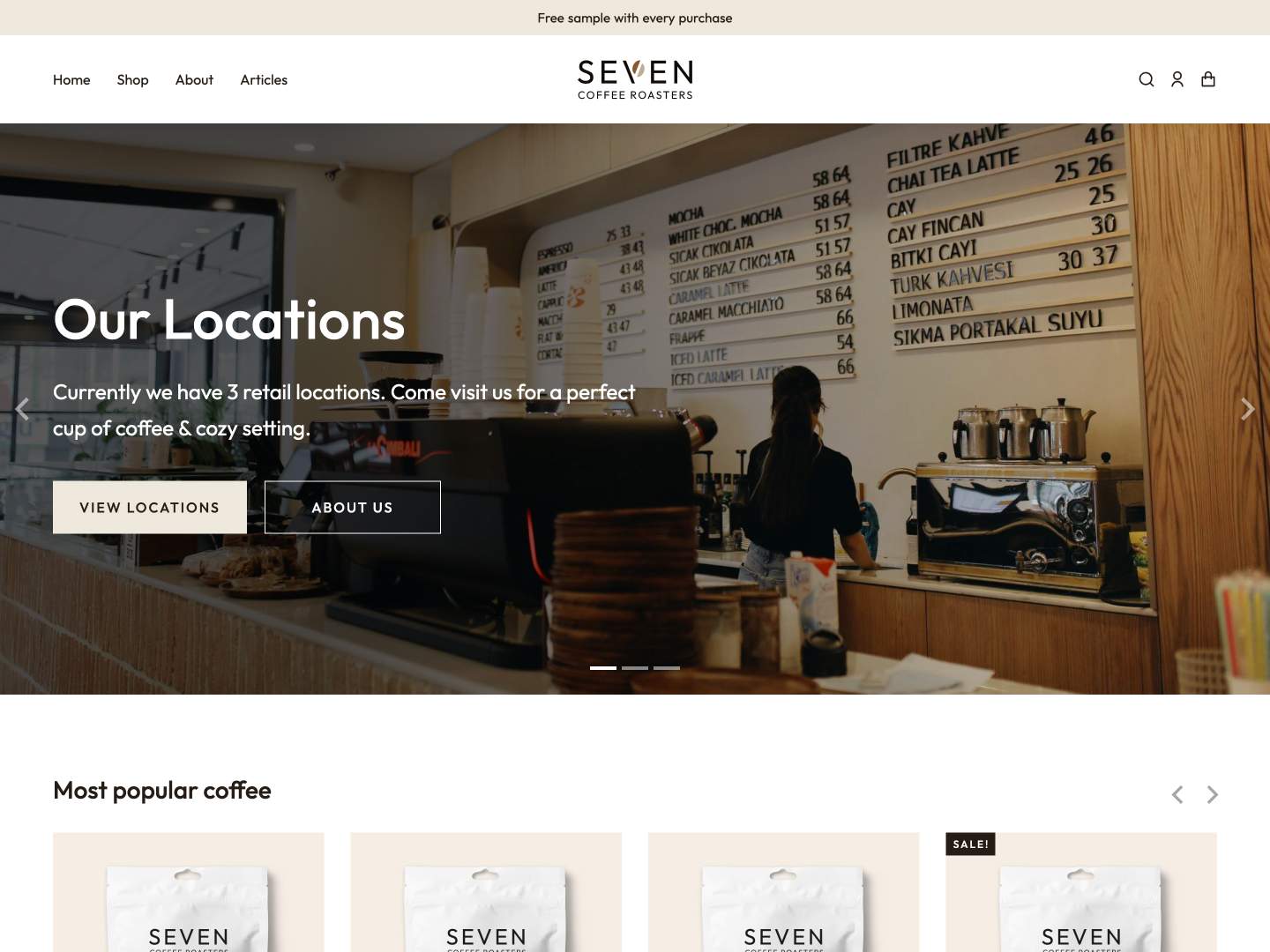

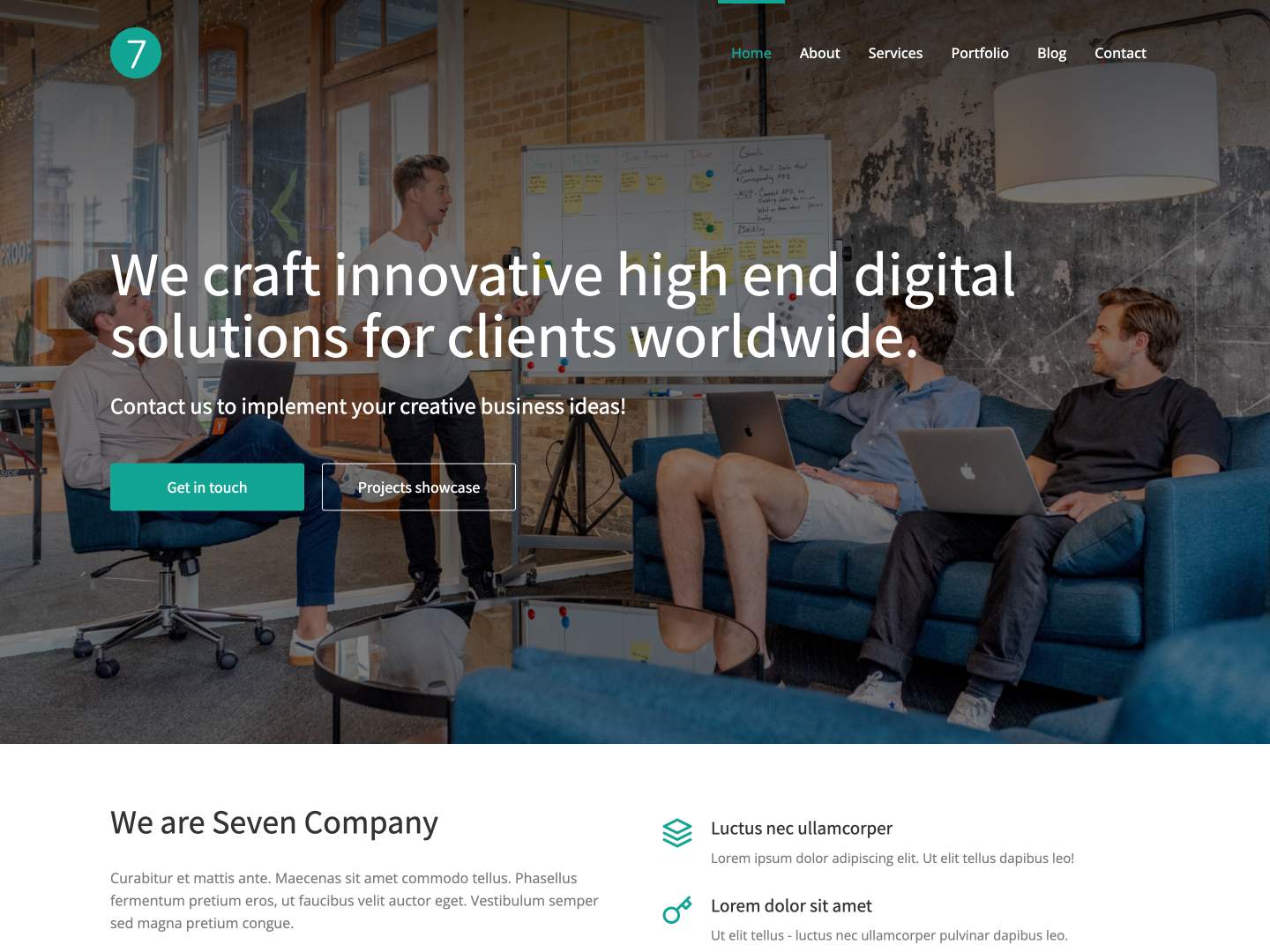

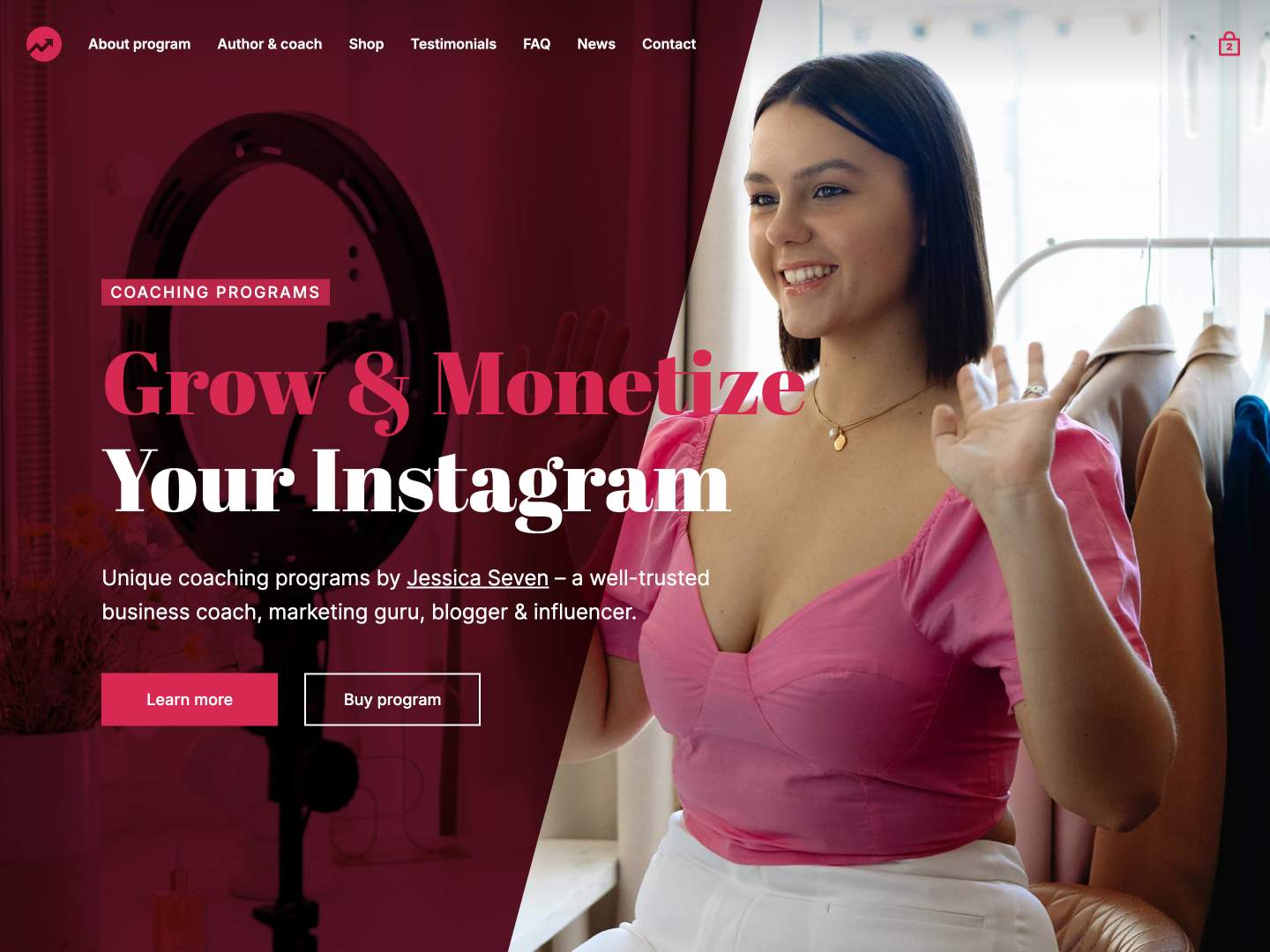

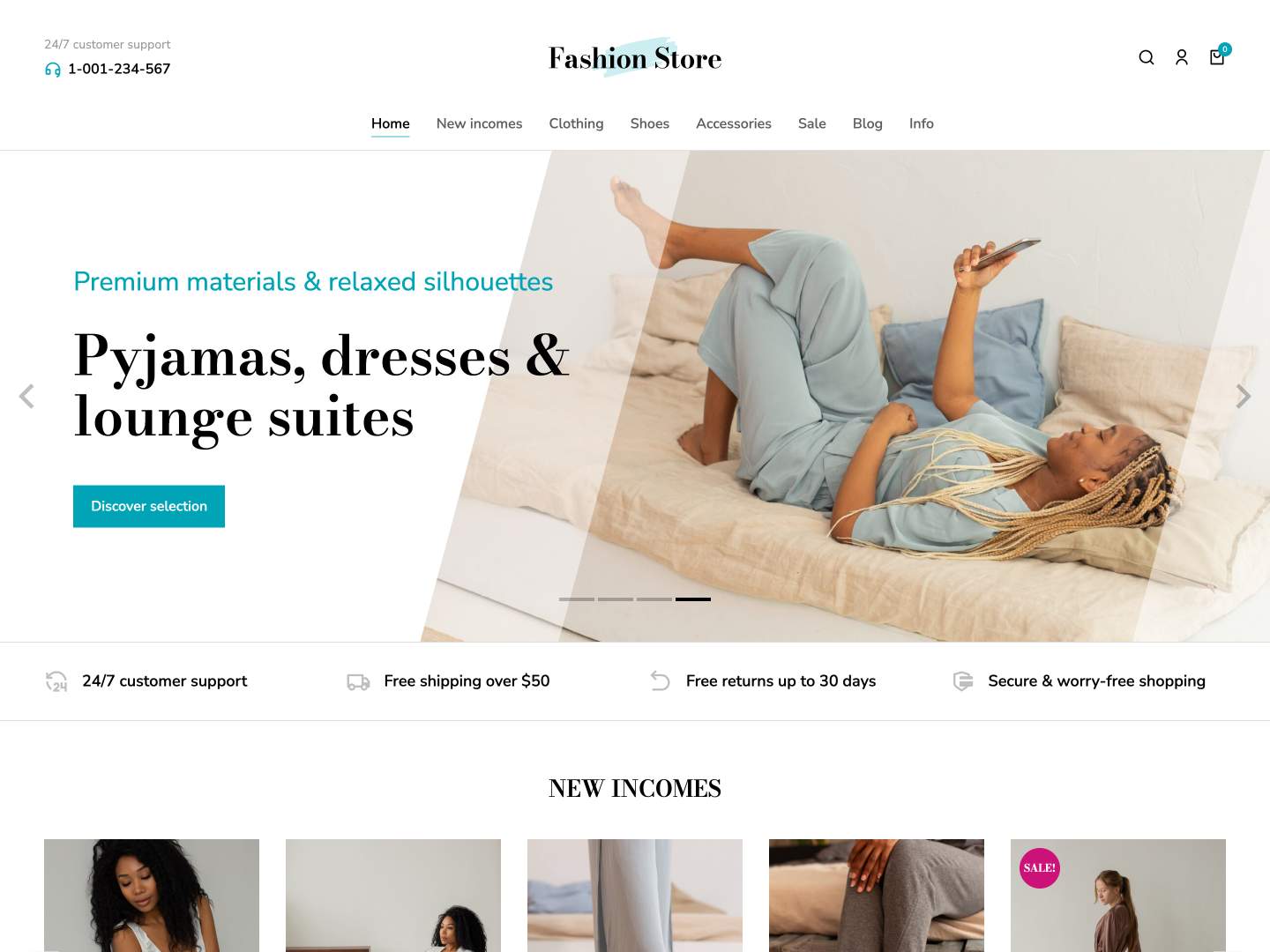

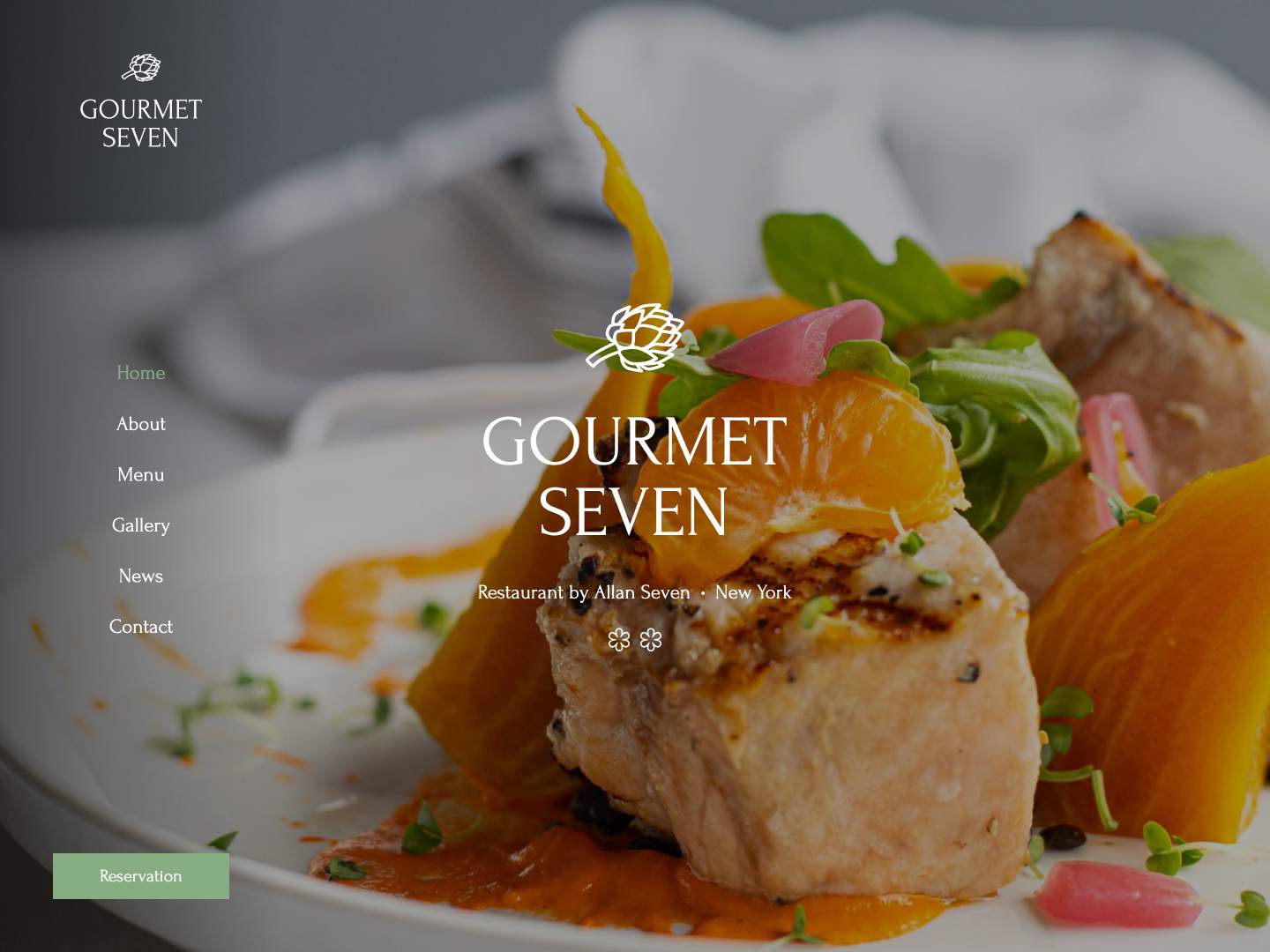

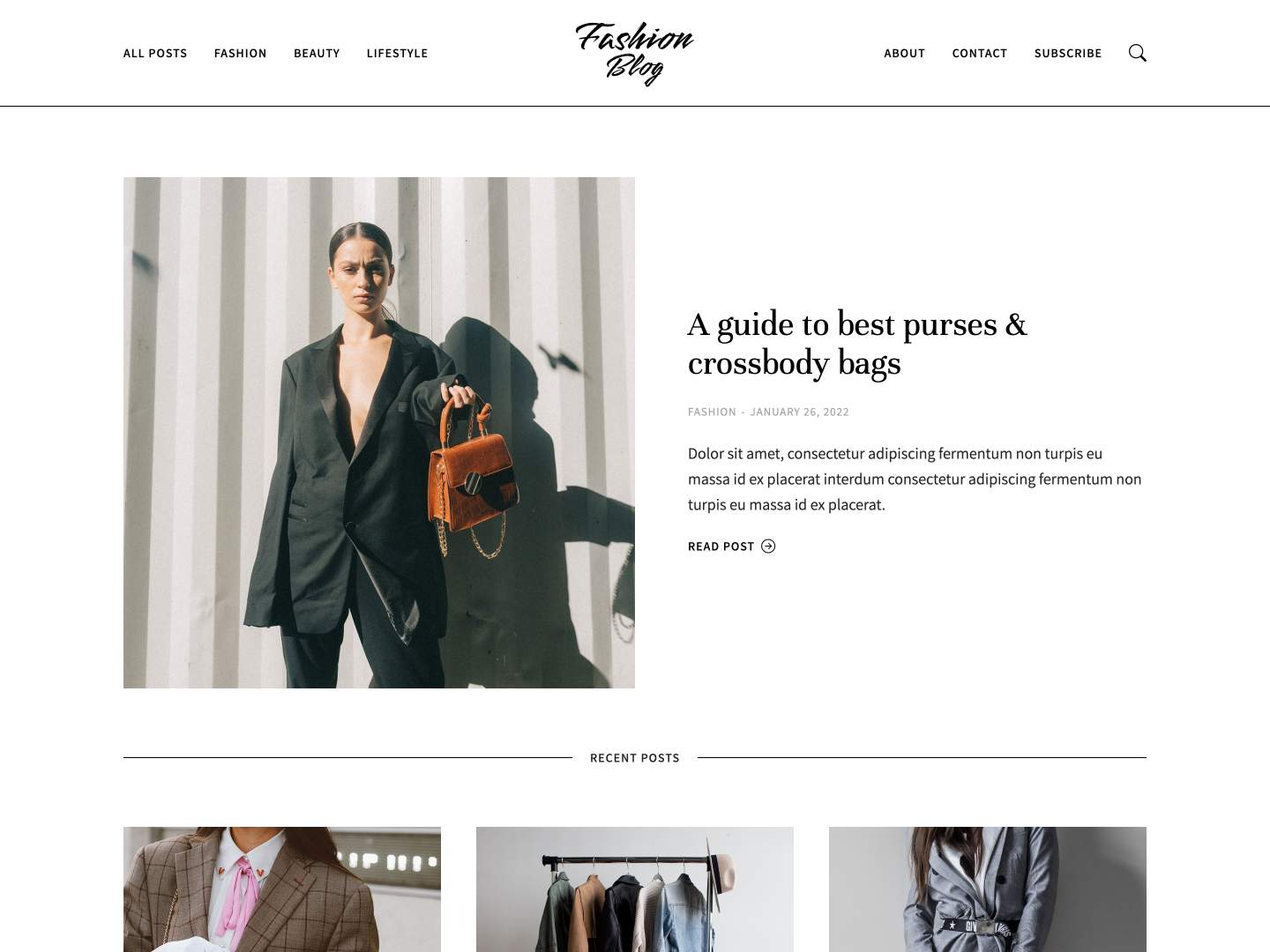

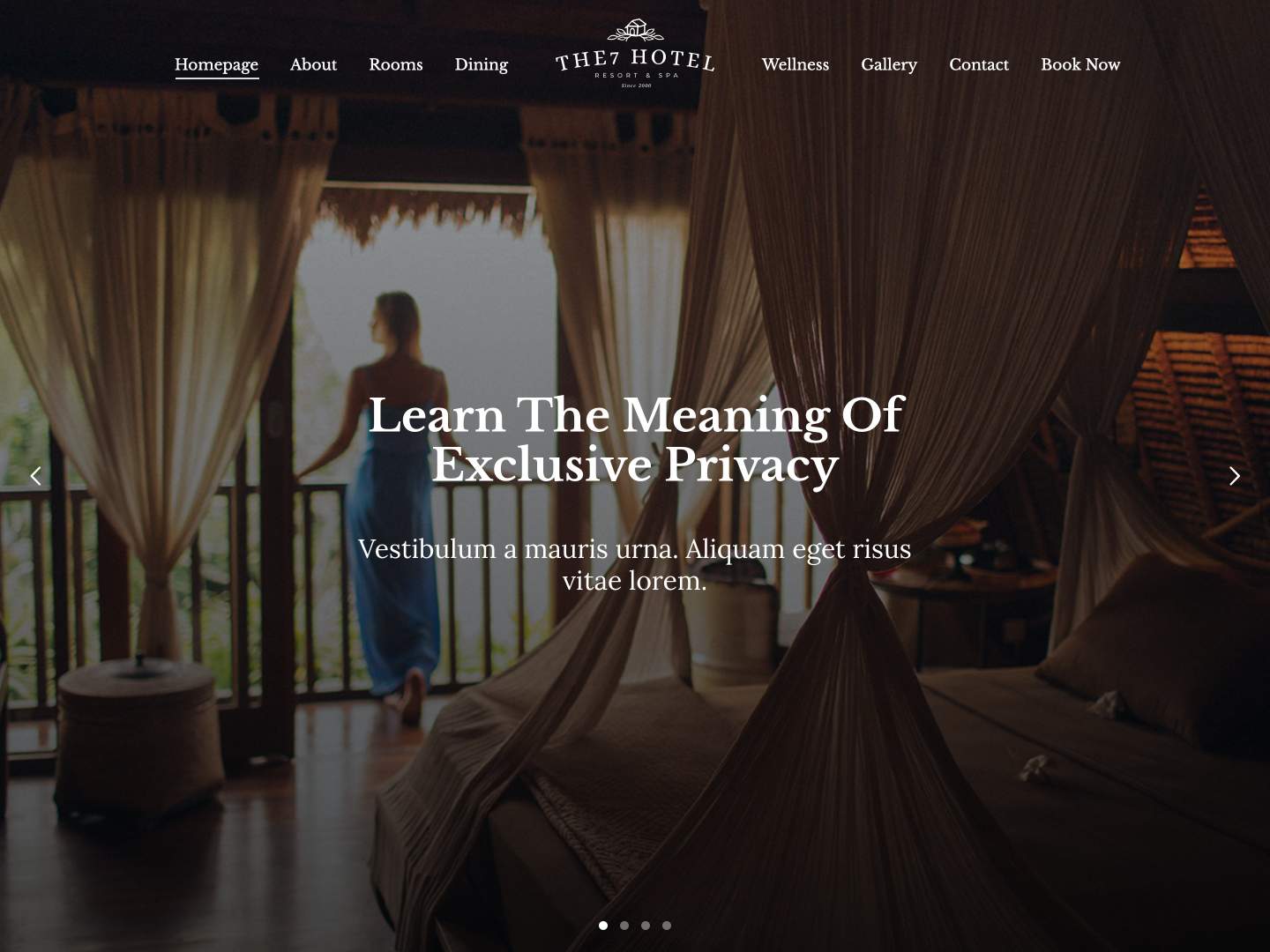

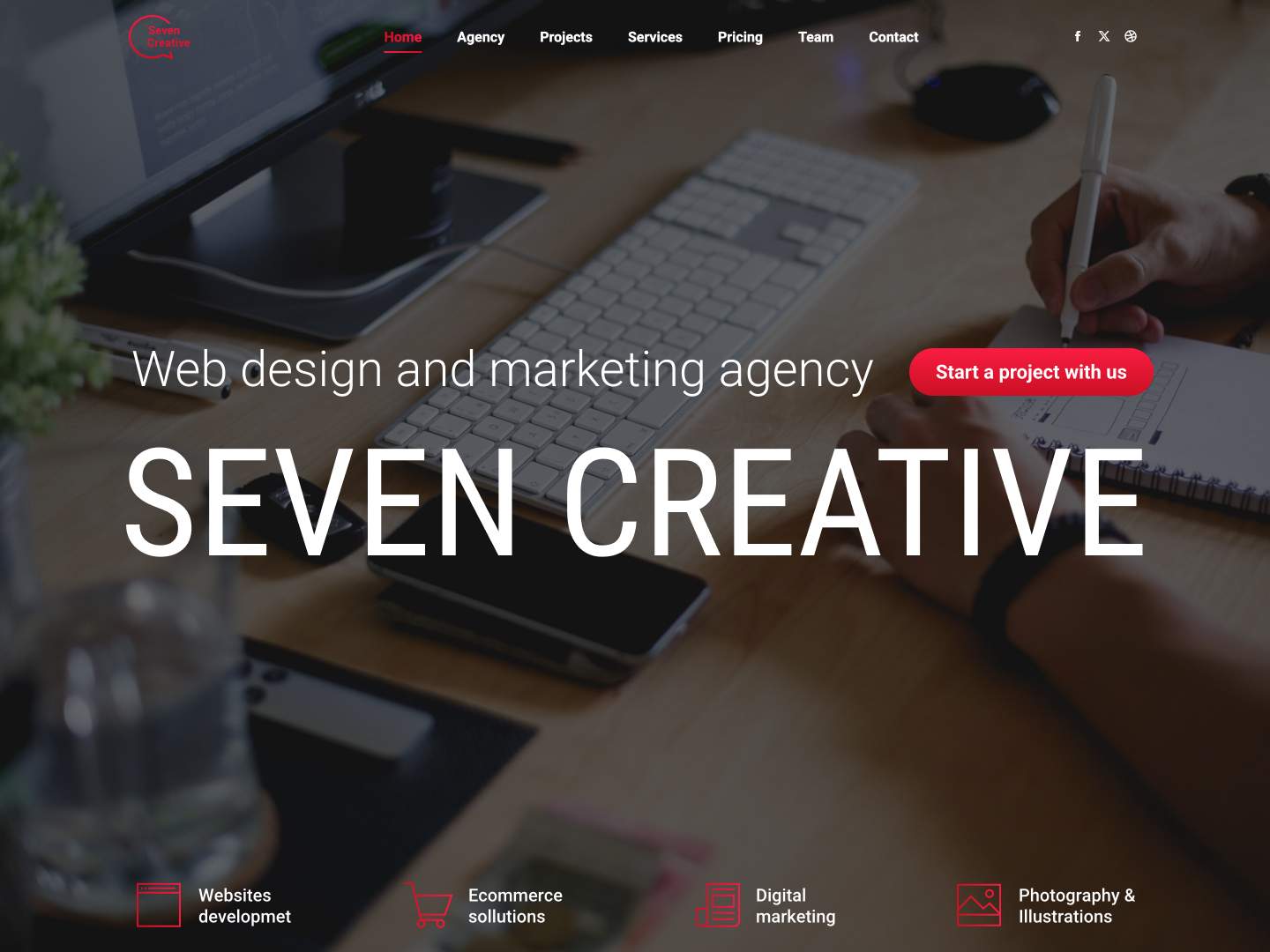

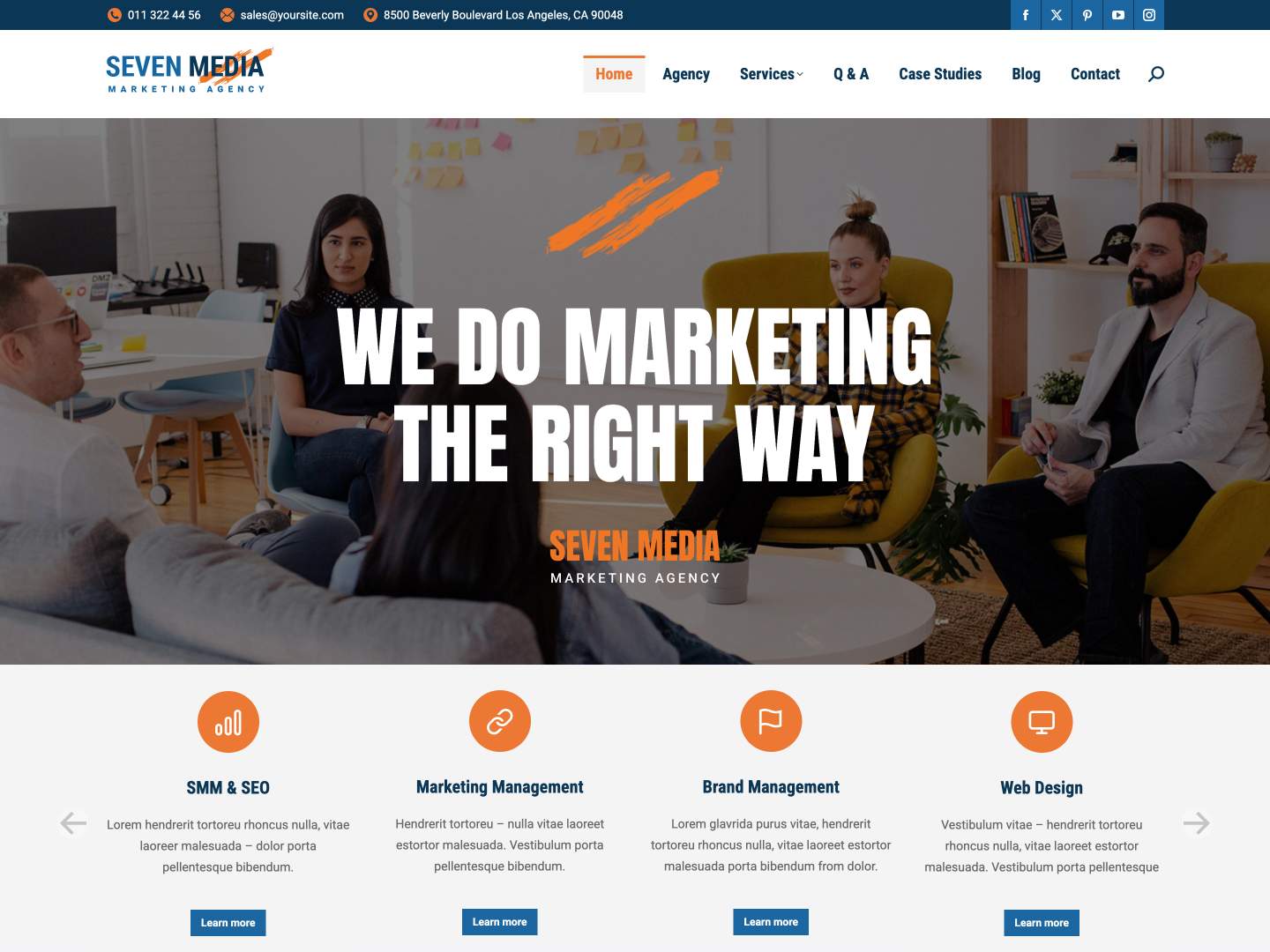

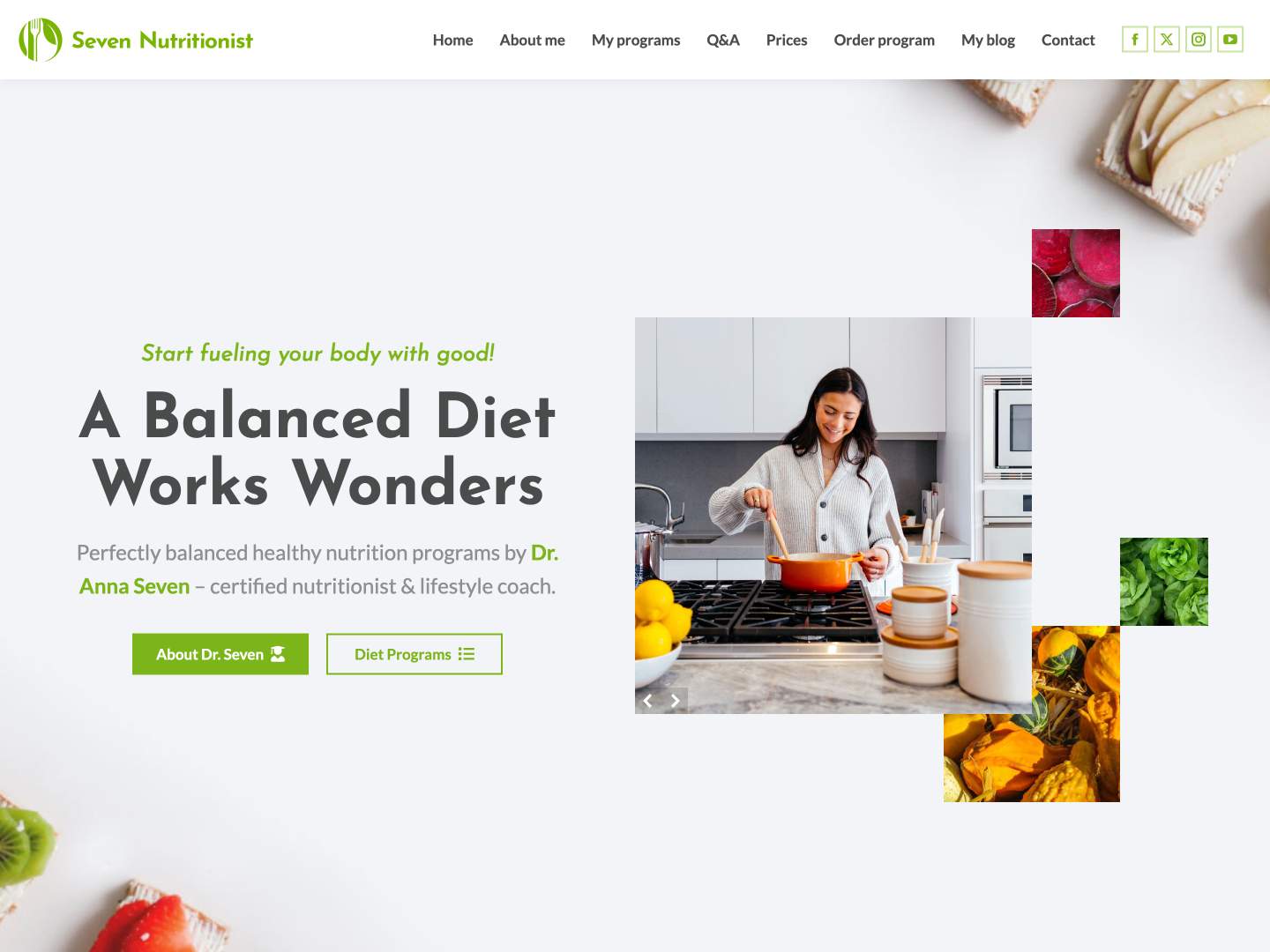

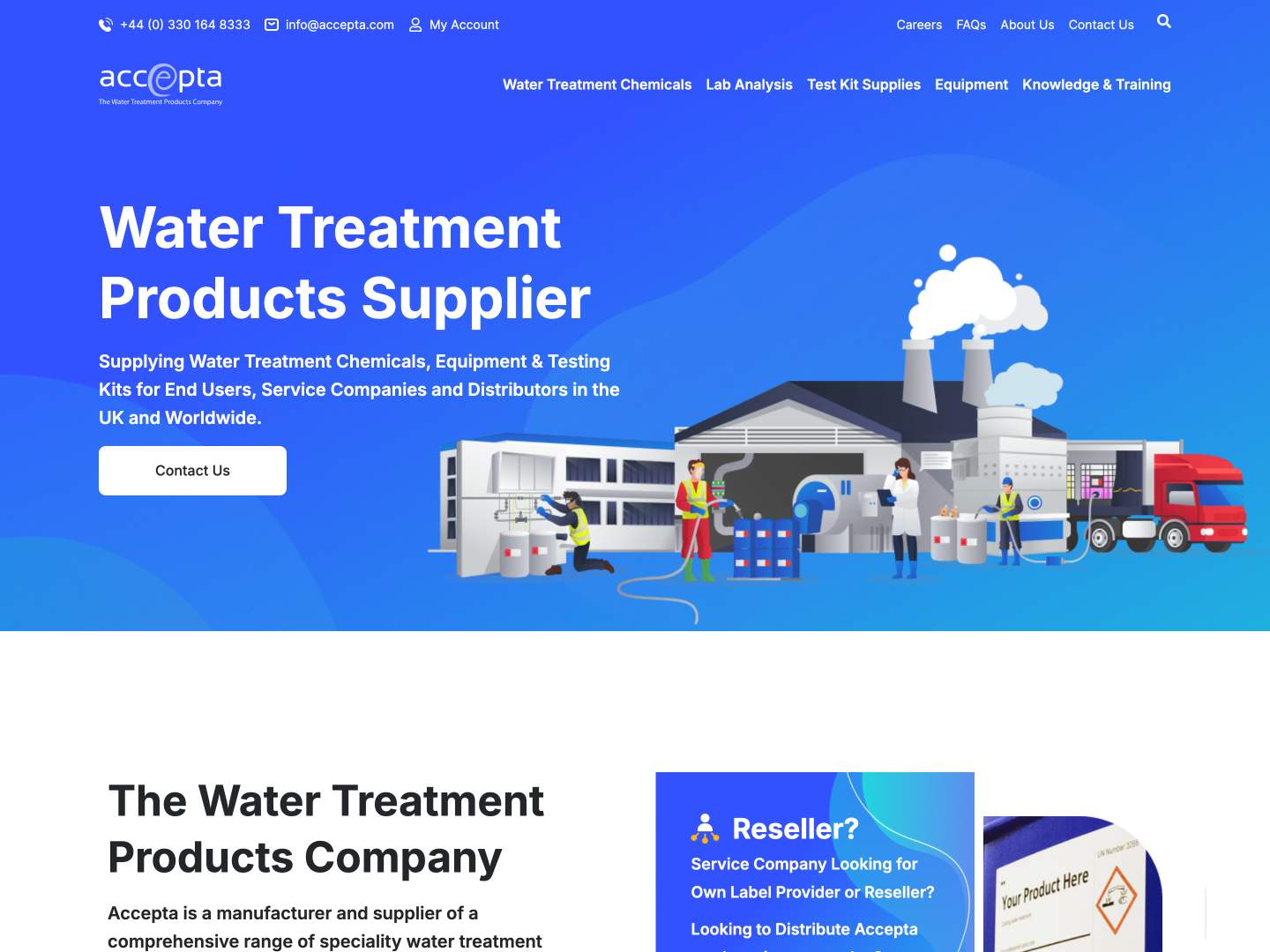

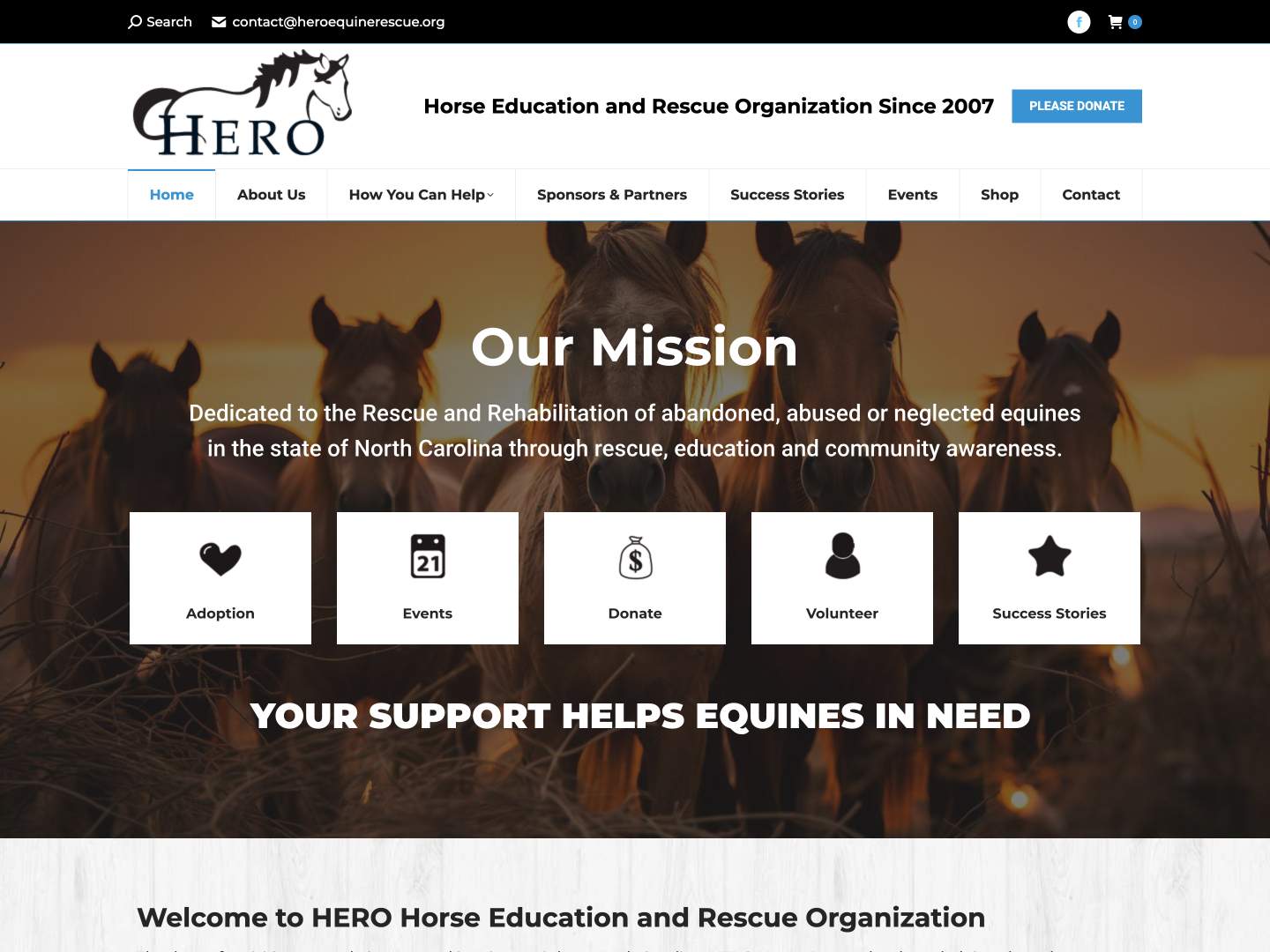

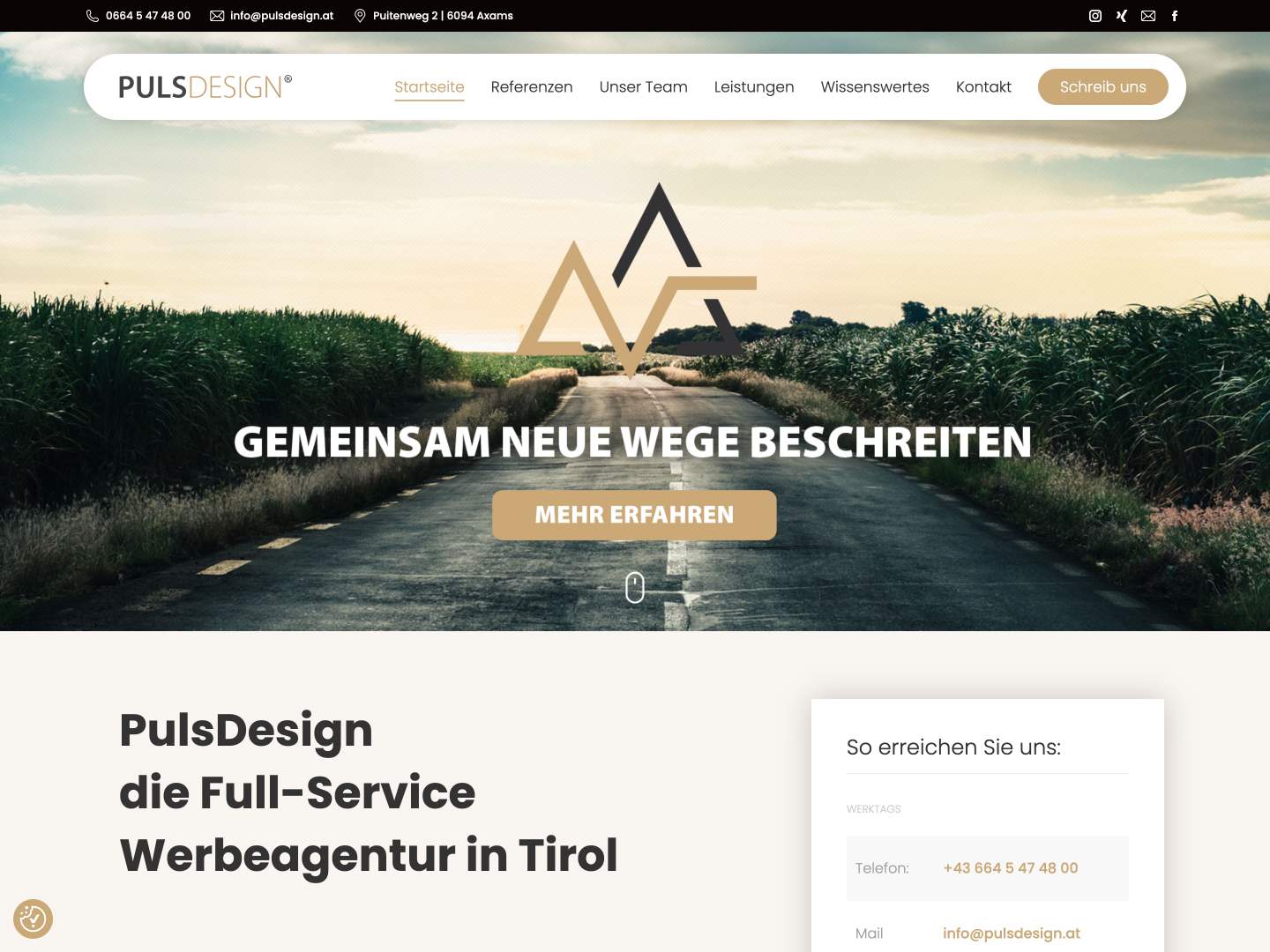

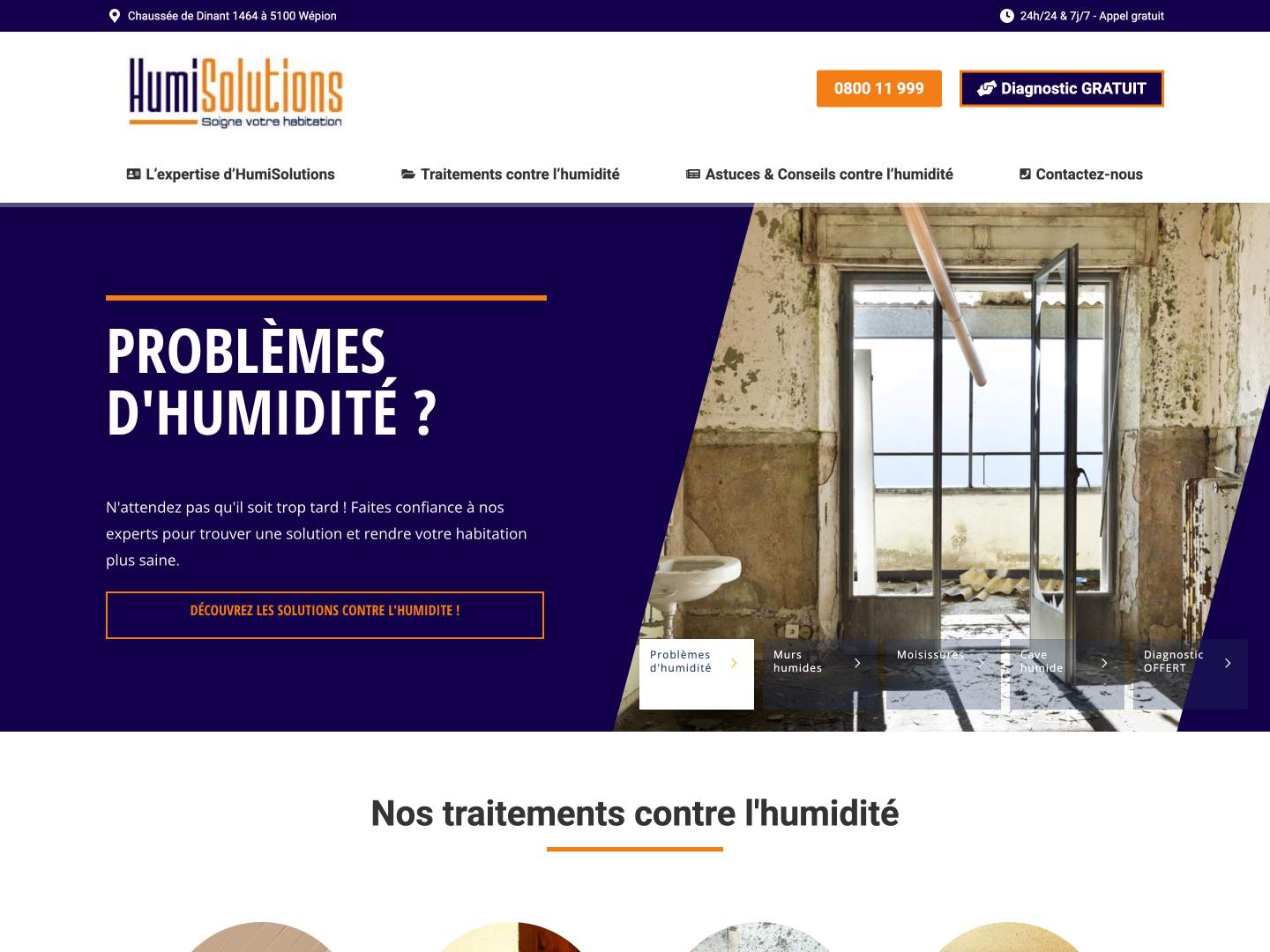

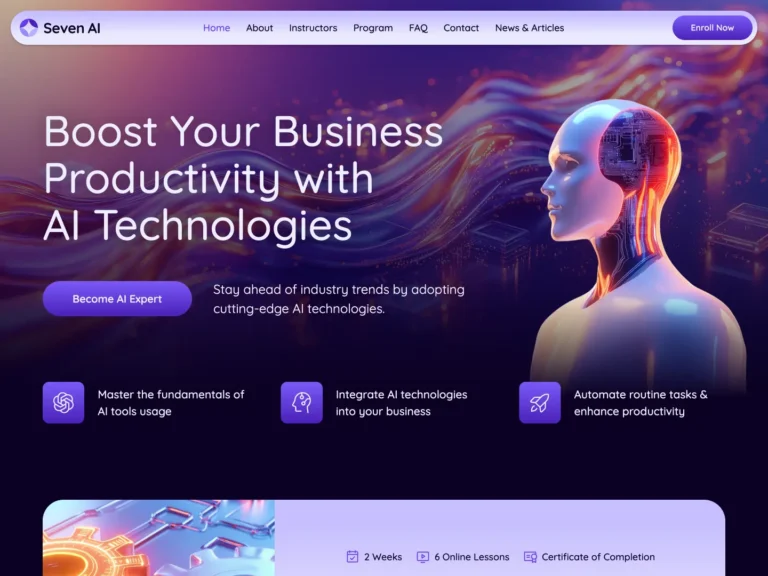

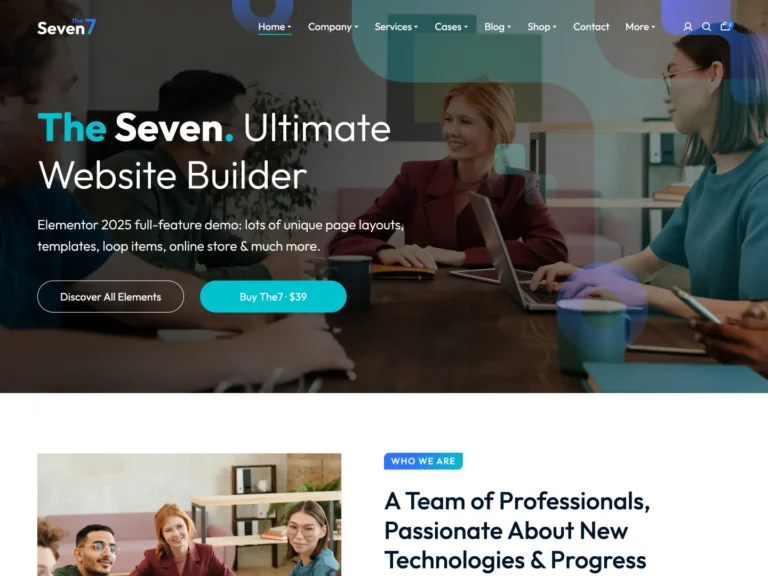

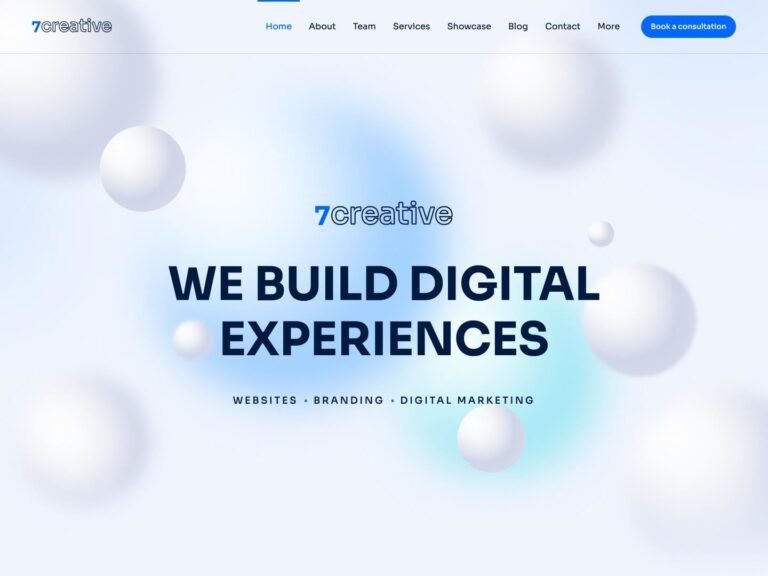

Featured Websites Powered by The7

Testimonials from The7 Users

"This is by far the most customizable without having to hack it with css code."

I’ve used a lot of WordPress theme templates over the years and this is by far the most customizable without having to hack it with css code. I’ve purchased and used this theme now on 2 totally different websites. I’ve contacted support a few times for questions and each time they’ve impressively got back to me within a day. Would definitely recommend! Thank you!

"Adaptable, powerful, great support, I have not found many things i cannot do with this theme."

So many reasons why it is SO worth getting The7.

Adaptable, powerful, great support, I have not found many things i cannot do with this theme, I use it on 4 main sites! I have one site that uses a free theme and it is so sad in comparison. Go get The7!

"The templates are incredible and the added modules are very useful. The support service is even better."

The templates are incredible and the added modules are very useful and easy to use, starting with Elementor. The support service is even better. They respond very quickly and solve your problem. I recommend the purchase and I will also buy more licenses for other clients. Thanks for your work. Great team!

"I have over 75 licenses for this theme, that's how much I love it."

As a designer, I have over 75 licenses for this theme, that’s how much I love it. I use it on all my clients’ websites because it’s so versatile, I can make it look different for each client. But the real reason I keep coming back to it over and over is the customer support. They always respond quickly and are diligent in helping me solve issues I can’t figure out on my own. Super helpful and courteous, which is much appreciated. I consider this theme and their support an integral part of my one-woman business. Thank you to Dream-Theme!

"I will continue using (The7) for every website design project I have."

I love The7 and Dream-Theme. They are just the best. The tech support and the customer service are just awesome. I will continue using them for every website design project I have. Believe me when I tell you, that I have tried other theme developers and templates, Dream-Theme developers and The7 template are the best of the best that are out there.

Buy with confidence and a piece of mind that you are well taken care of and that you are in food hands.

Cheers.

"Fantastic support. One of the most beautiful and most modern themes."

Fantastic support, they answered and solved my problem in 15 minutes, insane! About the theme: one of the most beautiful and most modern themes. I also use an other very popular Themeforest theme, and The7 is definitely faster. WP Bakery is in some way better, but some way not that good as the other theme’s own page builder.